Ichor Holdings Ltd (ICHR) Q1 2024 Earnings: Misses Analyst Revenue Forecasts with Challenges Ahead

Revenue: Reported $201 million, slightly above the estimate of $199.99 million.

Gross Margin: Achieved 11.4% on a GAAP basis and 12.2% on a non-GAAP basis.

Earnings Per Share (EPS): Recorded GAAP EPS of $(0.30) and non-GAAP EPS of $(0.09), both below the estimated EPS of $0.00.

Net Loss: Posted a net loss of $9 million on a GAAP basis and $2.7 million on a non-GAAP basis, both below from an estimated net income of $0.00 million.

Debt Reduction: Reduced total debt by $117 million at the end of the quarter.

Cash Position: Ended the quarter with $102.1 million in cash and cash equivalents, reflecting a $22.2 million increase from the prior year-end.

Future Outlook: Expects Q2 2024 revenue to be between $190 million and $205 million, with GAAP diluted EPS ranging from $(0.22) to $(0.10) and non-GAAP diluted EPS from $(0.03) to $0.09.

On May 7, 2024, Ichor Holdings Ltd (NASDAQ:ICHR), a pivotal player in the semiconductor equipment sector, disclosed its financial results for the first quarter of 2024 through its 8-K filing. The company reported revenues of $201 million, falling short of the analyst estimates of $199.99 million, and posted a significant net loss, highlighting ongoing challenges in the semiconductor industry.

Ichor Holdings Ltd, headquartered in Fremont, California, specializes in designing, engineering, and manufacturing critical fluid delivery subsystems for semiconductor capital equipment. The company's products are integral to the manufacturing of semiconductor devices, with operations spread across the United States, the United Kingdom, Singapore, Malaysia, Korea, and Mexico, with a significant portion of its revenue generated from Singapore.

Financial Performance Overview

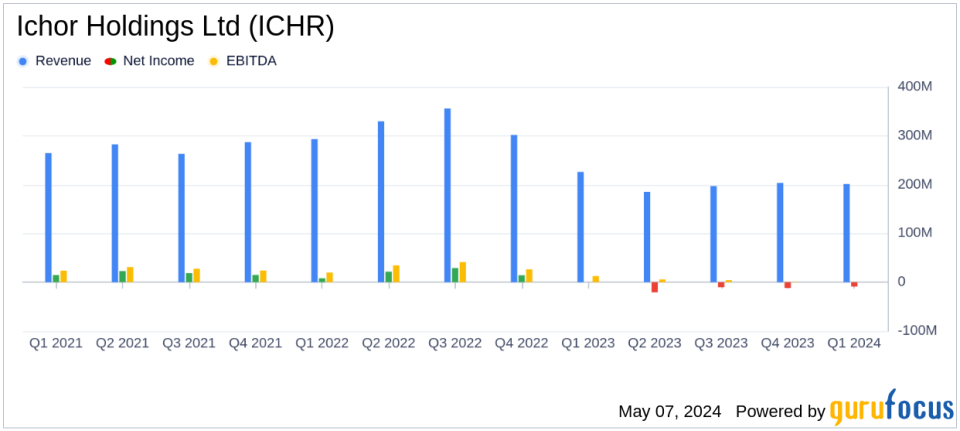

The first quarter of 2024 saw Ichor achieving a revenue of $201 million, a slight decrease from $203.5 million in Q4 2023 and a more noticeable drop from $225.9 million in Q1 2023. The company's gross margin also reflected a decline, registering at 11.4% on a GAAP basis and 12.2% on a non-GAAP basis, compared to 14.7% in the same quarter the previous year.

The net loss deepened to $8.989 million, a stark contrast to the negligible loss of $5 in Q1 2023. Earnings per share (EPS) on a GAAP basis plummeted to $(0.30), down from $0.00 in the year-ago quarter. On a non-GAAP basis, the EPS was $(0.09), indicating continued profitability pressures.

Operational Challenges and Strategic Initiatives

CEO Jeff Andreson commented on the quarter's performance, noting the stable yet challenging demand environment within the wafer fab equipment market. Despite these challenges, Ichor is focusing on expanding its penetration of proprietary products and diversifying its customer base, which is crucial for future revenue growth as the industry anticipates a recovery in 2025.

"With expectations for industry demand in 2024 remaining relatively consistent year to date, we likewise have witnessed a stabilization in our revenue run rate around these levels. We remain optimistic for an improvement in second half revenue volumes as the demand profile begins to build in advance of a stronger 2025 spending environment," said Jeff Andreson.

Financial Outlook and Projections

Looking ahead to the second quarter of 2024, Ichor forecasts revenue to be in the range of $190 million to $205 million. The projected GAAP diluted EPS ranges from $(0.22) to $(0.10), and non-GAAP diluted EPS is expected to be between $(0.03) and $0.09. These projections reflect the company's cautious optimism about a gradual recovery in the semiconductor sector.

Conclusion

While Ichor Holdings Ltd faces significant challenges, including a competitive market and a complex global economic environment, its strategic initiatives aimed at product diversification and customer base expansion are steps in the right direction. Investors and stakeholders will be watching closely to see if these efforts can translate into improved financial performance in the latter half of 2024 and beyond.

Explore the complete 8-K earnings release (here) from Ichor Holdings Ltd for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance