Global Business Travel Group Inc (GBTG) Q1 2024 Earnings: Aligns with Analyst Revenue Projections

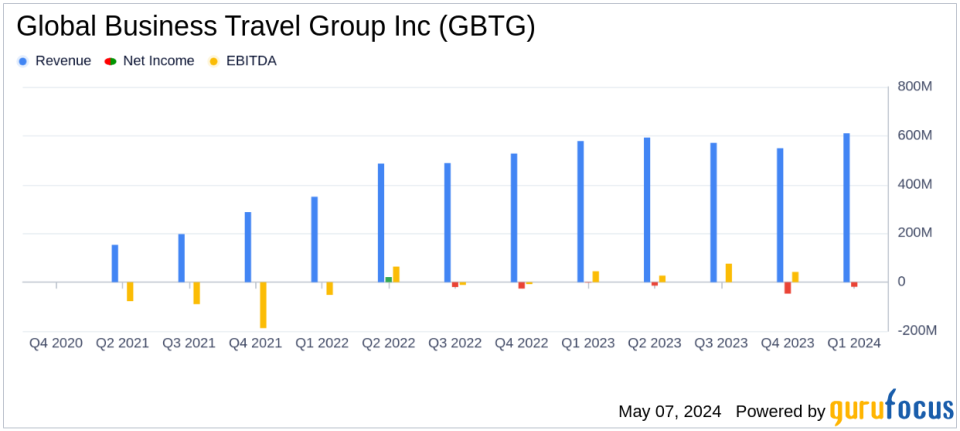

Revenue: Reported at $610 million, marking a 6% increase year-over-year, slightly below the estimated $624.28 million.

Net Loss: Improved to $19 million from a previous $27 million, indicating a reduction in losses year-over-year.

Earnings Per Share (EPS): Recorded at -$0.04, below the estimated $0.04.

Adjusted EBITDA: Grew by 24% to $123 million, demonstrating significant operational efficiency and margin expansion.

Free Cash Flow: Achieved a positive $24 million, a substantial improvement from a negative $109 million in the prior year.

Leverage Ratio: Decreased to 2.2x, down from 4.5x year-over-year, reflecting effective debt management and deleveraging.

Full-Year Guidance: Reiterated, with expectations for revenue growth of 6% to 9% and Adjusted EBITDA growth of 18% to 32%.

On May 7, 2024, Global Business Travel Group Inc (NYSE:GBTG) disclosed its first-quarter earnings for the year, revealing figures that closely aligned with analyst expectations on revenue while showcasing significant operational achievements. The details of the report can be accessed through the company's 8-K filing.

As a prominent B2B software and services provider in the travel and expense sector, GBTG operates a comprehensive platform designed to manage corporate travel, expenses, and meetings. The company generates revenue through transaction fees and services provided to clients and travel suppliers.

Financial Performance Overview

For Q1 2024, GBTG reported a revenue of $610 million, a 6% increase year-over-year, which aligns with the estimated revenue of $624.28 million projected by analysts. This growth was primarily driven by a 9% increase in Total Transaction Value (TTV) and notable gains in both travel revenue and product and professional services revenue.

The company achieved a record first-quarter Adjusted EBITDA of $123 million, up 24% from the previous year, highlighting effective cost management and operational efficiency. The Adjusted EBITDA margin expanded by 300 basis points to 20%, reflecting robust operating leverage.

Despite these gains, GBTG reported a net loss of $19 million for the quarter, an improvement from a $27 million loss in the same period last year. This loss includes the impacts of various non-operational items such as fair value movements on earnout derivative liabilities and a higher provision for income taxes.

Strategic Developments and Future Outlook

GBTG's strategic maneuvers include the definitive agreement to acquire CWT, a global business travel and meetings solutions provider, for $570 million. This acquisition is expected to be break-even to earnings per share in the first year post-closure and accretive thereafter. The company has also reiterated its full-year 2024 guidance, expecting revenue between $2.43 billion and $2.50 billion and an Adjusted EBITDA between $450 million and $500 million.

CEO Paul Abbott expressed confidence in the company's trajectory, citing strong financial results, share gains, and significant margin expansion as indicators of sustained growth and shareholder value enhancement.

Challenges and Operational Highlights

While GBTG has demonstrated financial resilience, it faces challenges such as managing integration costs and navigating the complexities of international expansion, particularly with the pending CWT acquisition. However, the company's strong customer retention rate of 96% and continued investment in technology and content development position it well to overcome these hurdles.

In conclusion, Global Business Travel Group Inc's Q1 2024 performance reflects a stable financial position with strategic initiatives poised to foster long-term growth. The alignment of its quarterly revenue with analyst expectations, coupled with proactive management and strategic acquisitions, underscores its potential for sustained success in the evolving B2B travel industry.

Explore the complete 8-K earnings release (here) from Global Business Travel Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance