Regal Rexnord Corp (RRX) Q1 Earnings: Adjusted EPS Aligns with Analyst Projections, Revenue ...

Adjusted Diluted EPS: Reported at $2.00, slightly above the estimated $1.99.

Net Income: GAAP net income of $20.4 million, significantly exceeding the prior year's net loss of $5.5 million but significantly below the estimated $133.58 million.

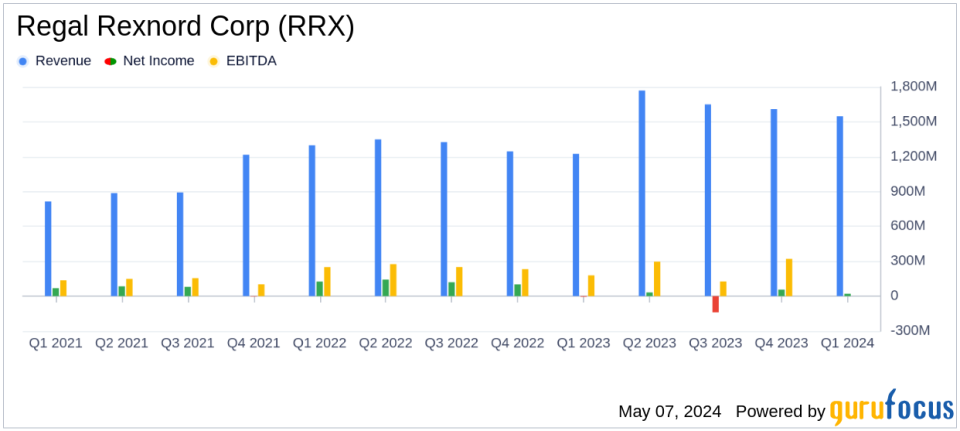

Revenue: Achieved $1,547.7 million, narrowly below the estimate of $1,560.37 million but up 26.4% year-over-year.

Gross Margin: GAAP gross margin improved to 35.7%, and adjusted gross margin reached 36.5%, showing a substantial improvement from the prior year's 33.5%.

Adjusted EBITDA: Totaled $317.4 million, with a margin increase of 100 basis points year-over-year, indicating enhanced operational efficiency.

Debt Reduction: Paid down $135.0 million of gross debt, aligning with strategic financial management objectives.

Free Cash Flow: Adjusted free cash flow reported at $64.6 million, keeping the company on track to meet the full-year outlook of $700 million.

On May 6, 2024, Regal Rexnord Corp (NYSE:RRX) released its 8-K filing, detailing the financial outcomes for the first quarter of 2024. The company reported an adjusted diluted earnings per share (EPS) of $2.00, which aligns closely with analyst estimates of $1.99. However, the reported revenue of $1,547.7 million fell slightly short of the anticipated $1,560.37 million.

Regal Rexnord, a leader in engineering and manufacturing of industrial powertrain solutions and other critical components, operates through three newly streamlined segments: Industrial Powertrain Solutions, Power Efficiency Solutions, and Automation & Motion Control. This restructuring follows the strategic sale of their Industrial Systems business, aiming to enhance focus on more profitable and sustainable market segments.

Operational Highlights and Strategic Developments

The first quarter saw Regal Rexnord achieving a GAAP net income of $20.4 million, a significant improvement from a net loss of $5.5 million in the prior year. This turnaround is attributed to enhanced operational efficiencies and successful integration of recent acquisitions, despite facing market headwinds especially in the Power Efficiency Solutions segment. The adjusted EBITDA stood at $317.4 million, slightly down from $327.1 million year-over-year, but with an EBITDA margin expansion of 100 basis points, reflecting stronger profitability.

CEO Louis Pinkham highlighted the completion of strategic mergers and acquisitions, which have not only diversified Regal Rexnord's portfolio but also positioned it towards markets with secular growth trends. The company remains focused on driving value through synergies from these integrations, targeted to reach $90 million in the current year.

Financial Position and Future Outlook

Regal Rexnord's balance sheet reflects a robust financial position with $465.3 million in cash and cash equivalents. The company has been proactive in managing its debt, evidenced by a $135 million reduction in gross debt. Looking forward, Regal Rexnord has updated its 2024 guidance, projecting GAAP diluted EPS to range between $3.97 and $4.77 and adjusted diluted EPS between $9.60 and $10.40, considering the impacts from the recent divestiture.

The company's commitment to innovation and market expansion is evident from its continued investment in research, development, and engineering, aiming to bolster its competitive edge and market share in high-growth areas such as automation, aerospace, and energy.

Analysis and Investor Implications

Regal Rexnord's Q1 results demonstrate a resilient operational model and strategic foresight in navigating market challenges. The alignment of adjusted EPS with analyst expectations and a slight revenue miss should be weighed against the backdrop of strategic divestitures and market headwinds. Investors should consider the company's robust margin improvement and debt reduction strategy as positive indicators for long-term growth and stability.

The company's forward-looking strategies and adjustments to its business operations reflect a clear path towards sustained profitability and shareholder value enhancement. As Regal Rexnord continues to execute on its strategic initiatives, it remains a noteworthy contender within the industrial sector for value-oriented investors.

Explore the complete 8-K earnings release (here) from Regal Rexnord Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance