3 Top French Dividend Stocks Offering Up To 6.5% Yield

Amid a backdrop of economic recovery and moderating inflation within the Eurozone, French markets have experienced some volatility, with the CAC 40 Index reflecting broader European market trends by closing lower. In such an environment, dividend stocks can be particularly appealing to investors looking for potential income streams and relative stability in their portfolios.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Rubis (ENXTPA:RUI) | 6.04% | ★★★★★★ |

Samse (ENXTPA:SAMS) | 8.84% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.47% | ★★★★★★ |

Métropole Télévision (ENXTPA:MMT) | 9.56% | ★★★★★☆ |

Teleperformance (ENXTPA:TEP) | 3.87% | ★★★★★☆ |

Sanofi (ENXTPA:SAN) | 4.13% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 3.57% | ★★★★★☆ |

Carrefour (ENXTPA:CA) | 5.53% | ★★★★★☆ |

Jacquet Metals (ENXTPA:JCQ) | 5.32% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 7.25% | ★★★★★☆ |

Click here to see the full list of 29 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

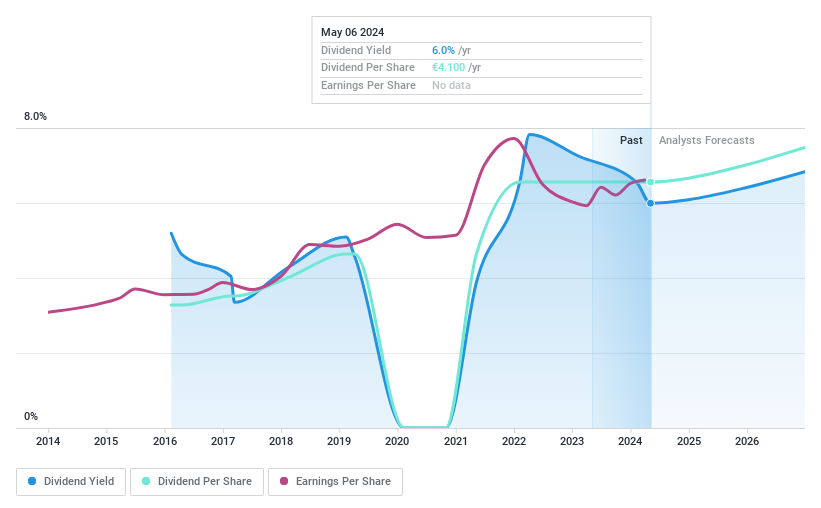

Amundi

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amundi is a publicly owned investment manager with a market capitalization of approximately €13.91 billion, specializing in asset management services.

Operations: Amundi generates €6.03 billion from its asset management services.

Dividend Yield: 6%

Amundi's recent financial performance shows a steady increase in revenue and net income, with Q1 2024 revenue at €824 million and net income at €318 million. The company maintains a dividend of €4.10 per share, consistent with the previous year, supported by a payout ratio of 71.9% from earnings and 56% from cash flows, indicating sustainable dividend payments despite its less stable historical track record. New leadership under Barry Glavin may influence future strategic directions enhancing its equity investment platform.

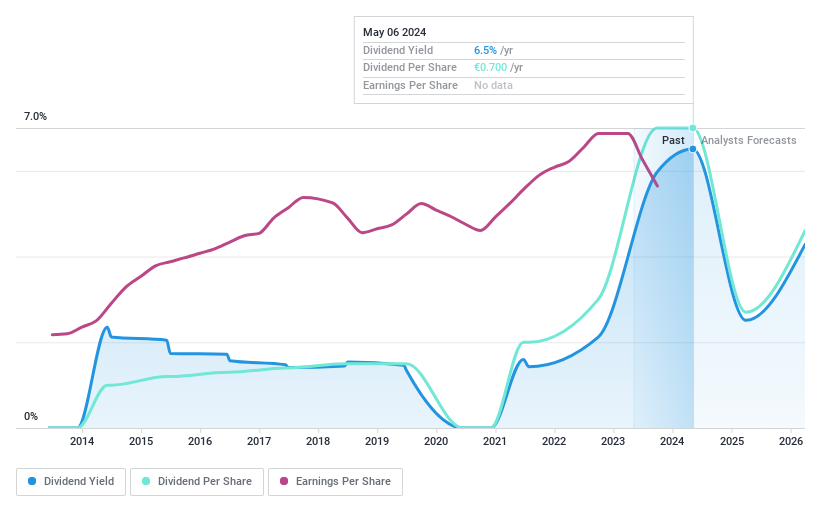

Oeneo

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Oeneo SA is a global company specializing in the wine industry with a market capitalization of approximately €695.43 million.

Operations: Oeneo SA generates its revenue primarily through two segments: Aging (€103.16 million) and Corking (€226.21 million).

Dividend Yield: 6.5%

Oeneo has demonstrated inconsistent dividend reliability over the past decade, with significant annual fluctuations exceeding 20%. Despite a reasonable payout ratio of 66.8%, indicating that earnings cover the dividends, the high cash payout ratio of 302.4% suggests that these are not well supported by free cash flow. Additionally, while Oeneo's dividends have increased over this period, a forecasted modest earnings growth of 3.35% per year may challenge future sustainability and growth of dividend payments.

Navigate through the intricacies of Oeneo with our comprehensive dividend report here.

Our valuation report unveils the possibility Oeneo's shares may be trading at a premium.

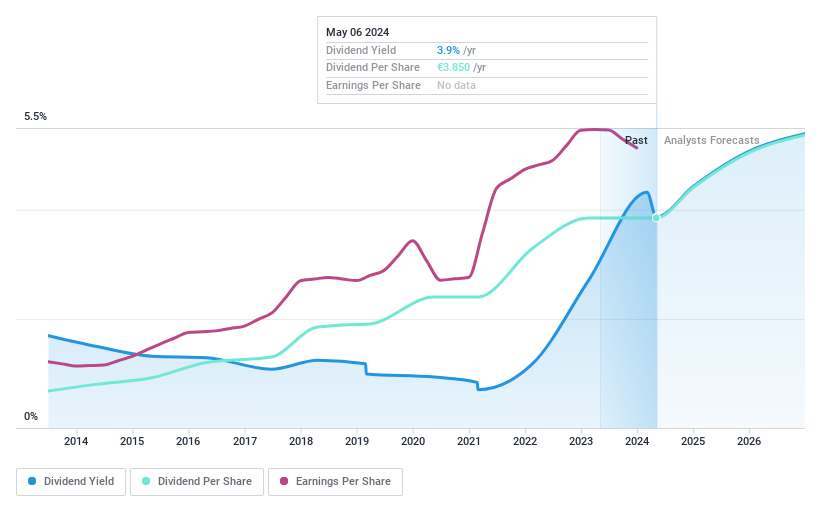

Teleperformance

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Teleperformance SE operates globally, providing customer consultancy services, with a market capitalization of approximately €6.05 billion.

Operations: Teleperformance SE generates revenue through various segments, including Specialized Services at €1.36 billion, Core Services & D.I.B.S across LATAM at €1.57 billion, North America & Asia-Pacific at €2.53 billion, and Europe, Middle East & Africa (EMEA) at €2.54 billion.

Dividend Yield: 3.9%

Teleperformance SE maintains a stable dividend, with a recent affirmation of a €3.85 per share payout for 2023, reflecting a 38% payout ratio. The company's dividends are well-supported by both earnings and cash flows, with low payout ratios of 37.5% and 20.5%, respectively. Despite this stability, its dividend yield of 3.87% falls below the French market's top quartile at 5.27%. Additionally, shareholders face high volatility in share price and increasing debt levels, alongside modest projected revenue growth of +2% to +4% for 2024.

Click here to discover the nuances of Teleperformance with our detailed analytical dividend report.

Our valuation report here indicates Teleperformance may be undervalued.

Taking Advantage

Get an in-depth perspective on all 29 Top Dividend Stocks by using our screener here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:AMUNENXTPA:SBT and ENXTPA:TEP

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance