The April employment report delivered a mixed bag of results. Job creation fell short of expectations, unemployment figures rose, and wage growth remained subdued. This data sets a potentially dovish tone for the upcoming statements from key Federal Reserve officials. The expectation of a softer stance on monetary policy could give US dollar bears a reason to rally. However, the currency might see some consolidation in the short term, especially with pivotal US inflation data on the horizon next week. Furthermore, unexpected currency movements in Asia and evolving market sentiments are shaping a complex backdrop for the dollar.

The fundamentals impacting the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory. This development has led investors to expect a potentially dovish pivot from the Federal Reserve. If the Fed adopts a more cautious approach, it could reduce the likelihood of near-term interest rate hikes, thereby pressuring the dollar downwards.

Moreover, international factors also play a crucial role. The surprising underperformance of the Yuan, despite China's efforts to curb excessive currency weakness and promote growth through supportive policies, reflects the complex interplay of global economic forces. This situation illustrates the nuanced dynamics influencing the dollar. The market's response to these developments, including a recalibration of rate-cut expectations previously priced in, underscores the sensitivity of the US dollar to domestic economic shifts and international monetary flows.

Technical outlook

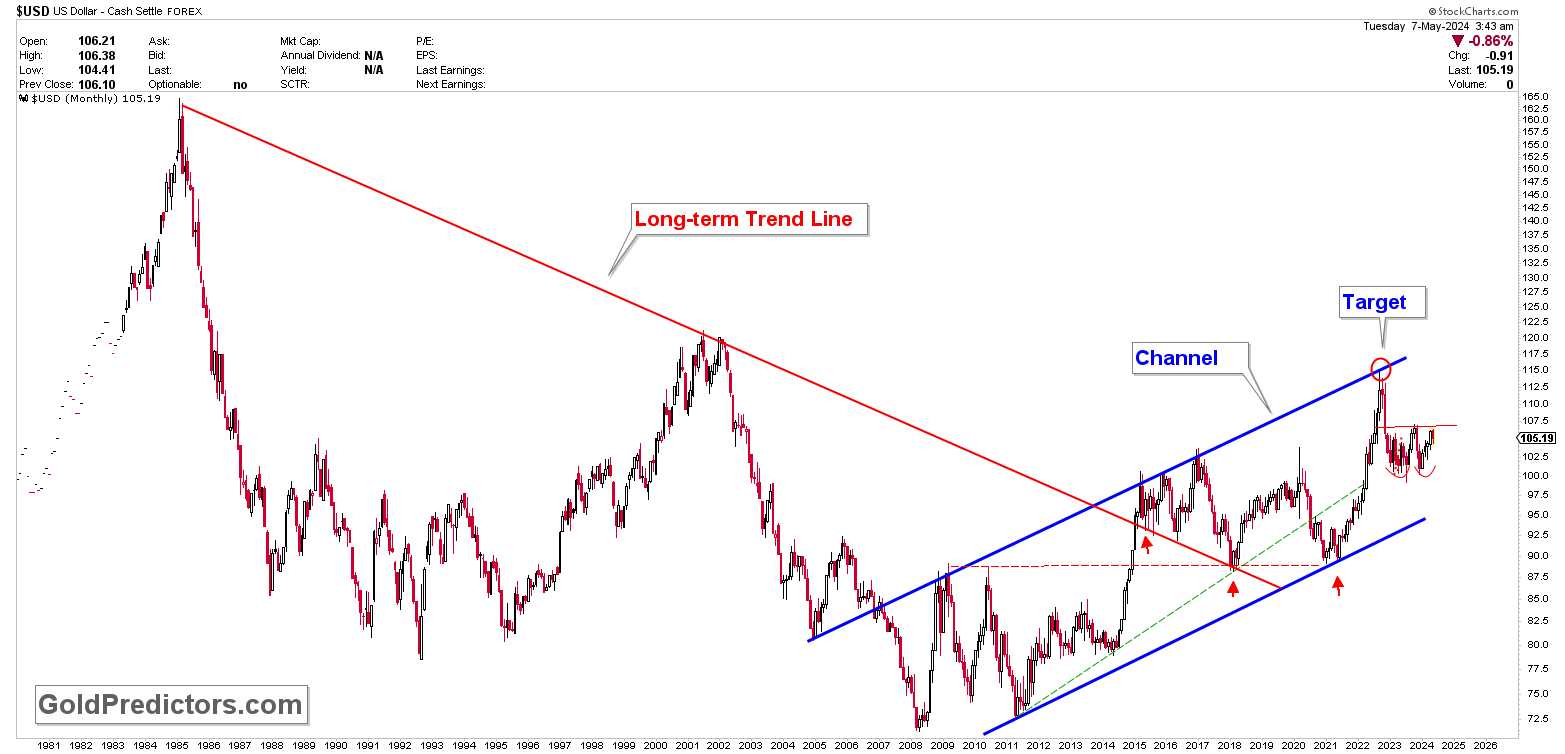

From a technical perspective, the US dollar presents an interesting scenario. Analysis of the monthly chart indicates that the dollar is trending upward within a defined channel, suggesting a continuation of its recent ascent. Despite breaking a long-term bearish trend line, the currency's trajectory points to sustained growth until a clear top formation is confirmed. Last week's drop, aligning with the neckline of a double-bottom pattern, appears to be a normal retracement within a larger bullish context. This pattern suggests that while the dollar may face short-term pullbacks, its fundamental upward trend is likely to persist in the medium term, barring significant economic upheavals.

Conclusion

In summary, while the US dollar faces potential headwinds from a softer Federal Reserve stance and mixed economic signals at home and abroad, the technical indicators suggest a continuing upward movement. The interplay of dovish policy expectations, influenced by domestic labor market trends, and international currency dynamics will be crucial in shaping the dollar's path forward. Investors and market watchers may stay alert to unfolding economic data and the Fed's communicative cues, which will be instrumental in setting the market tone for the coming months. As the landscape evolves, the dollar's journey remains a focal point of interest amidst a backdrop of global economic uncertainty.

Articles/Trading signals/Newsletters distributed by GoldPredictors.com have no regard to the specific investment objectives, financial situation, or the particular needs of any visitor or subscriber. Any material distributed or published by GoldPredictors.com or its affiliates is solely for informational and educational purposes and is not to be construed as a solicitation or an offer to buy or sell any financial instrument, commodity, or related securities. Plan the strategy that is most suitable for your investment. No one knows tomorrow’s price or circumstance. The intention of the writer is only to mention his thoughts and ideas that may be used as a tool for the reader. Trading Options and futures have large potential rewards, but also large potential risks.

Recommended Content

Editors’ Picks

AUD/USD: Bears could not breach 0.6600

After a brief drop to the sub-0.6600 region, AUD/USD gathered traction and eventually ended Thursday’s session with marked gains in response to the renewed selling pressure hurting the Greenback.

EUR/USD hamstrung in the midrange ahead of Friday full of key data

EUR/USD dipped to 1.0790 on Thursday before a broad-market recovery forced the Greenback lower across the board. US GDP growth eased in-line with market expectations, and rate-cut-hopeful investors are taking a cautious step forward ahead of Friday’s key data prints.

Gold prices increase but stay under $2,350 ahead of key PCE data

Gold prices trimmed some of Wednesday’s losses and rose 0.41% on Thursday after the US Gross Domestic Product showed the economy is slowing, reigniting hopes that the US Federal Reserve may cut rates later in the year.

Ethereum maintains horizontal trend following BlackRock's updated S-1 filing

Ethereum (ETH) price shows neutrality despite positive updates of BlackRock's spot ETH ETF updated S-1 application and the Securities & Exchange Commission’s (SEC) engagement with issuers.

Dow Jones Industrial Average tumbles once again, but pumps brakes on declines

The Dow Jones Industrial Average kicked off Thursday with another bearish gap after overnight trading dragged key securities steeply lower. However, market action in the US session is finding a floor in prices as investors dare to hope for signs of further easing in the US economy.