Sterling Infrastructure Inc (STRL) Surpasses Q1 Earnings and Revenue Estimates

Revenue: $440.4 million, up by 9% year-over-year, surpassing estimates of $412.83 million.

Net Income: $31.0 million, a 58% increase from the previous year, exceeding estimates of $24.55 million.

Earnings Per Share (EPS): $1.00 per diluted share, a significant rise of 56% year-over-year, surpassing the estimated $0.77.

Gross Margin: Improved to 17.5% from 15.3% in the prior year quarter.

Cash Flow from Operations: Reported at $49.6 million for the quarter.

Backlog: Ended the quarter with a backlog of $2.35 billion, indicating strong future revenue potential.

Guidance: Full-year revenue guidance maintained, with net income and diluted EPS expectations raised due to lower projected net interest expense and tax rate projections.

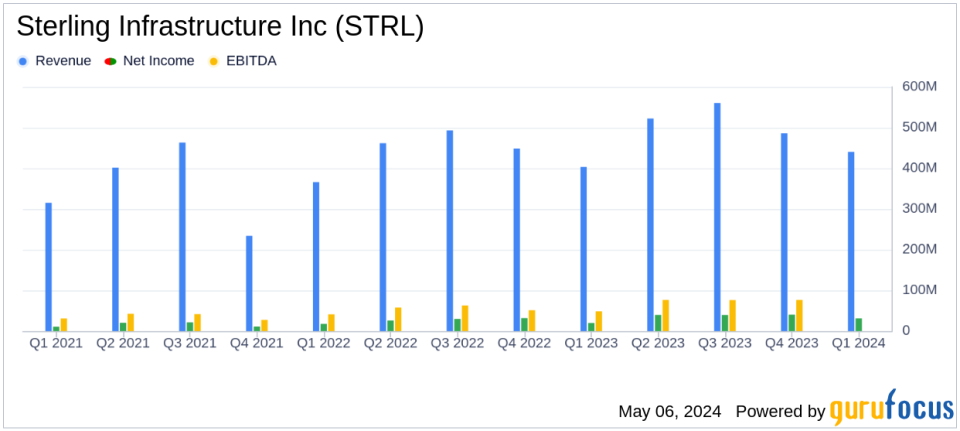

Sterling Infrastructure Inc (NASDAQ:STRL) released its 8-K filing on May 6, 2024, announcing financial results for the first quarter of 2024 that exceeded analyst expectations. The company reported a significant increase in revenues and net income, driven by strong performance across its segments despite early-year weather challenges.

Sterling Infrastructure Inc, a leader in heavy civil infrastructure construction and rehabilitation, along with residential construction projects, operates through three primary segments: Transportation Solutions, E-Infrastructure Solutions, and Building Solutions. The majority of the company's revenue is generated from its E-Infrastructure Solutions, which cater to large, blue-chip companies across various sectors.

Financial Performance Highlights

For Q1 2024, Sterling reported revenues of $440.4 million, a 9% increase from the previous year, surpassing the estimated $412.83 million. The company achieved a net income of $31.0 million, or $1.00 per diluted share, which represents a 58% increase in net income and a 56% increase in EPS year-over-year, comfortably exceeding the estimated earnings per share of $0.77.

The gross margin improved to 17.5% from 15.3% in the prior year, reflecting enhanced operational efficiency and project execution. EBITDA also saw a robust increase of 21% to $55.7 million. The company ended the quarter with a strong cash position of $480.4 million and a significant backlog of $2.35 billion, indicating healthy future revenue streams.

Segment Performance and Strategic Developments

Despite adverse weather conditions impacting the E-Infrastructure Solutions segment, which saw a revenue decline of 10%, the segment expanded its operating margins by 294 basis points and grew its operating profit by 12%. The Transportation Solutions segment experienced a 34% revenue growth and a 53% increase in operating profit, driven by broad-based demand across its markets. Building Solutions also reported a 23% increase in revenue and a 70% increase in operating profit, bolstered by the acquisition of Professional Plumbers Group (PPG).

CEO Joe Cutillo highlighted the strategic moves and operational adjustments contributing to the quarter's success. "We had a great start to the year... and we are maintaining our full year revenue and EBITDA guidance while raising our net income and diluted EPS guidance," Cutillo stated, reflecting confidence in the company's ongoing strategy and market position.

Outlook and Forward Guidance

Looking ahead, Sterling Infrastructure maintains its full-year 2024 revenue guidance at $2.125 billion to $2.215 billion and has raised its net income guidance to $160 million to $170 million, with projected diluted EPS of $5.00 to $5.30. The company's strong backlog, which includes $642 million in new awards during the quarter, supports this optimistic outlook.

The company's strategic focus on large, mission-critical projects, particularly in the data center and aviation sectors, positions it well to capitalize on the increasing demand in these high-growth areas. With a solid financial structure and a clear strategic direction, Sterling Infrastructure is poised for sustained growth in 2024 and beyond.

Investor Communication

Sterling Infrastructure plans to discuss these results and provide more detailed insights during its upcoming conference call scheduled for May 7, 2024. Investors and interested parties are encouraged to participate to gain further insights into the company's strategies and operational tactics moving forward.

For detailed financial figures and additional information, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Sterling Infrastructure Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance