Investors with a lot of money to spend have taken a bullish stance on Oracle (NYSE:ORCL).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ORCL, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 9 uncommon options trades for Oracle.

This isn't normal.

The overall sentiment of these big-money traders is split between 77% bullish and 11%, bearish.

Out of all of the special options we uncovered, 5 are puts, for a total amount of $430,117, and 4 are calls, for a total amount of $258,810.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $100.0 and $130.0 for Oracle, spanning the last three months.

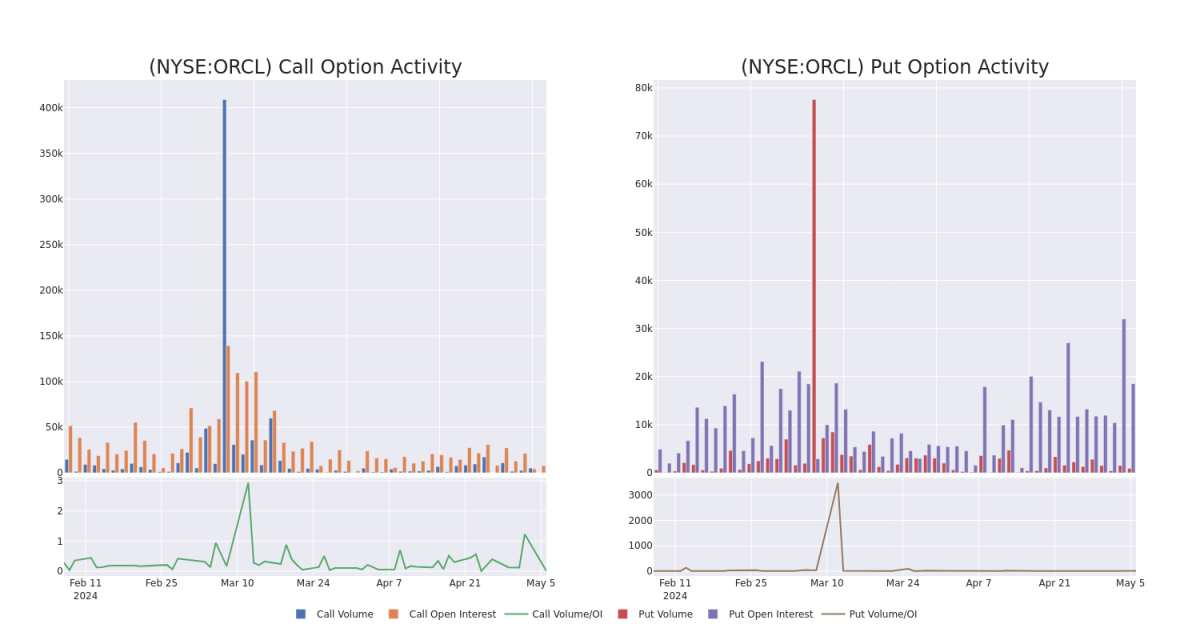

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Oracle's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Oracle's whale activity within a strike price range from $100.0 to $130.0 in the last 30 days.

Oracle Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ORCL | PUT | SWEEP | BULLISH | 09/20/24 | $9.1 | $9.0 | $9.0 | $120.00 | $225.0K | 2.7K | 254 |

| ORCL | PUT | SWEEP | NEUTRAL | 05/24/24 | $2.12 | $1.94 | $2.03 | $116.00 | $116.1K | 49 | 595 |

| ORCL | CALL | TRADE | BEARISH | 01/17/25 | $11.25 | $11.2 | $11.2 | $120.00 | $78.4K | 1.5K | 0 |

| ORCL | CALL | TRADE | BULLISH | 01/17/25 | $23.4 | $23.25 | $23.34 | $100.00 | $70.0K | 2.0K | 0 |

| ORCL | CALL | TRADE | BULLISH | 09/20/24 | $7.7 | $7.65 | $7.7 | $120.00 | $59.2K | 1.3K | 0 |

About Oracle

Oracle provides database technology and enterprise resource planning, or ERP, software to enterprises around the world. Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system. Today, Oracle has 430,000 customers in 175 countries, supported by its base of 136,000 employees.

After a thorough review of the options trading surrounding Oracle, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Oracle

- With a volume of 2,223,106, the price of ORCL is up 0.9% at $116.84.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 35 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Oracle with Benzinga Pro for real-time alerts.