Vanguard Health Care Fund's Strategic Moves in Q1 2024: A Focus on Pfizer Inc

Insight into the Fund's Latest Investment Decisions and Stock Adjustments

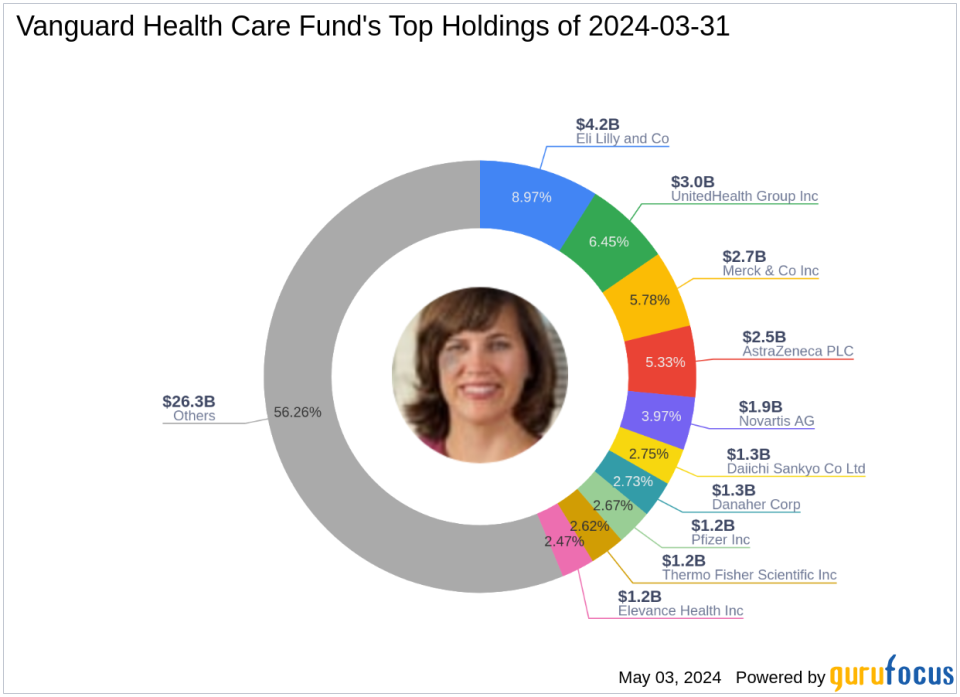

Vanguard Health Care Fund (Trades, Portfolio), managed by Wellington Management Company since 1984, continues to target long-term capital appreciation by investing in a diverse range of health care stocks. Under the leadership of Jean M. Hynes, CFA, the fund emphasizes investments in high-quality companies with strong management teams and innovative products. This approach is evident in their latest N-PORT filing for the first quarter of 2024, which reveals significant transactions including new buys, position increases, and some strategic exits.

New Additions to the Portfolio

In the first quarter of 2024, Vanguard Health Care Fund (Trades, Portfolio) expanded its portfolio by adding eight new stocks. Noteworthy among these was the purchase of 601,225 shares of Intuitive Surgical Inc (NASDAQ:ISRG), which now represents 0.51% of the portfolio with a total value of $239.94 million. Other significant additions included Galderma Group AG (XSWX:GALD) with 2,268,938 shares valued at CHF 159.38 million, and ConvaTec Group PLC (LSE:CTEC) with 15,436,613 shares worth 55.77 million.

Significant Increases in Existing Positions

The fund also aggressively increased its stakes in several key holdings. A notable increase was in Novo Nordisk A/S (NYSE:NVO), where the fund added 2,818,786 shares, bringing the total to 6,205,664 shares. This adjustment marked an 83.23% increase in share count and had a 0.77% impact on the current portfolio, totaling $796.02 million. Another major increase was in GSK PLC (LSE:GSK), with an additional 11,712,501 shares, bringing the total to 27,447,667 shares valued at 589.31 million.

Complete Exits from Certain Holdings

The first quarter also saw Vanguard Health Care Fund (Trades, Portfolio) exiting completely from five holdings. This included selling all 796,328 shares of Karuna Therapeutics Inc (KRTX), which had a -0.55% impact on the portfolio, and liquidating 9,572,139 shares of Roivant Sciences Ltd (NASDAQ:ROIV), impacting the portfolio by -0.23%.

Reductions in Key Positions

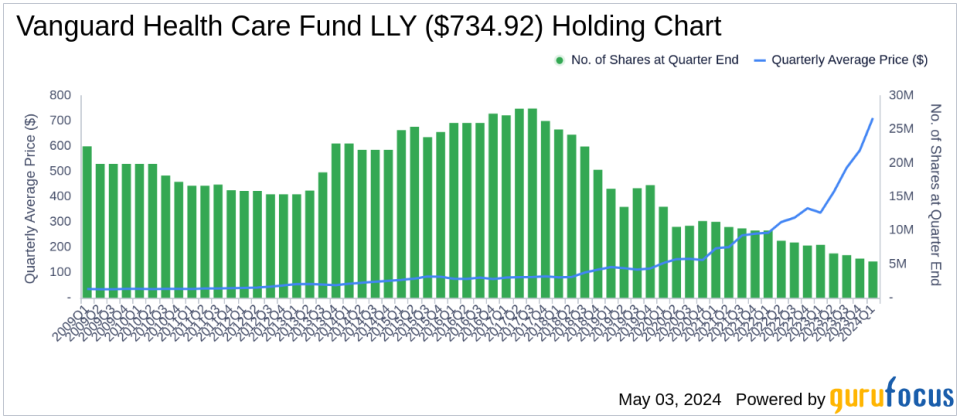

Conversely, the fund reduced its position in several stocks, including a significant reduction in Pfizer Inc (NYSE:PFE) by 14,576,889 shares, resulting in a -24.46% decrease in shares and a -0.92% impact on the portfolio. Pfizer traded at an average price of $27.75 during the quarter. Similarly, Abbott Laboratories (NYSE:ABT) saw a reduction of 2,876,011 shares, marking a -25.1% decrease and a -0.69% portfolio impact.

Portfolio Overview and Sector Concentration

As of the first quarter of 2024, Vanguard Health Care Fund (Trades, Portfolio)'s portfolio included 98 stocks. The top holdings were 8.97% in Eli Lilly and Co (NYSE:LLY), 6.45% in UnitedHealth Group Inc (NYSE:UNH), 5.78% in Merck & Co Inc (NYSE:MRK), 5.33% in AstraZeneca PLC (LSE:AZN), and 3.97% in Novartis AG (XSWX:NOVN). The holdings are predominantly concentrated in the Healthcare, Consumer Defensive, and Financial Services sectors, reflecting the fund's strategic focus.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance