nVent Electric PLC (NVT) Q1 2024 Earnings: Adjusted EPS Exceeds Estimates, Updates Full-Year ...

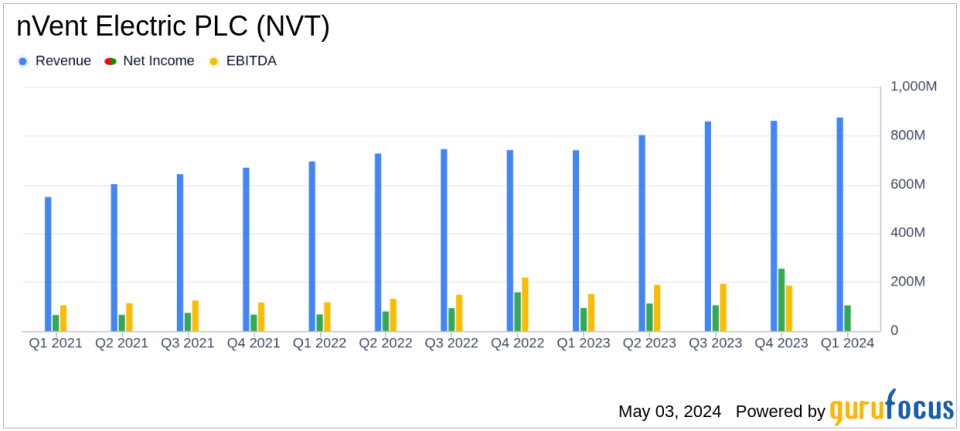

Reported Quarterly Revenue: $875 million, an 18% increase year-over-year, surpassing estimates of $864.35 million.

Adjusted EPS: $0.77, a 15% increase from the previous year, exceeding estimates of $0.74.

Net Income: $105.1 million, up from $93.8 million year-over-year, below the estimated $123.5 million.

Free Cash Flow: Increased by 41% to $74 million, indicating strong cash generation capabilities.

Operating Income: Rose 28% to $159 million, reflecting improved operational efficiency.

Full-Year EPS Guidance: Updated to $2.74 to $2.82 on a GAAP basis and $3.22 to $3.30 on an adjusted basis, indicating positive future expectations.

Organic Sales Growth: Reported at 5% for the quarter, demonstrating solid core business growth.

nVent Electric PLC (NYSE:NVT), a prominent provider of electrical connection and protection solutions, unveiled its financial results for the first quarter of 2024 on May 3, 2024. The company reported a robust start to the year with significant growth in sales and earnings per share (EPS). The detailed financial outcomes can be reviewed in their 8-K filing.

nVent operates through three main segments: Enclosures, Thermal Management, and Electrical and Fastening Solutions. The company is known for its innovative solutions in managing heat and ensuring safety in electrical systems. It primarily serves industries such as Commercial and Residential, Energy, and Industrial Solutions, with the majority of its revenue generated from North America.

Financial Highlights and Performance

For Q1 2024, nVent reported an 18% increase in sales, reaching $875 million, with an organic growth of 5%. This performance surpasses the estimated revenue of $864.35 million. The adjusted EPS was $0.77, also exceeding the analysts' expectation of $0.74. This represents a 15% increase compared to the previous year. The reported EPS saw an 11% rise, standing at $0.62.

The company's operating income surged by 28% to $159 million, compared to $124 million in the first quarter of 2023. Adjusted for specific financial measures, the segment income reached $192 million, marking a 30% increase from the previous year. This financial strength is reflected in the company's robust cash flow, with cash flows from operations up by 30% to $90 million and free cash flow increasing by 41% to $74 million.

Strategic Developments and Market Positioning

nVent's CEO, Beth Wozniak, highlighted the company's strategic advancements, particularly in Data Solutions which is thriving due to the acceleration of AI and high-performance computing. The company's focus on electrification, sustainability, and digitalization aligns with current market trends, positioning nVent for continued growth. In response to their strong Q1 performance, nVent has updated its full-year adjusted EPS guidance to $3.22 to $3.30.

The company's segments showed varied performance, with the Enclosures segment growing 13% to $440 million and the Electrical & Fastening Solutions segment soaring by 42% to $292 million. However, the Thermal Management segment experienced a slight decline.

Looking Ahead: Guidance and Expectations

For the full year of 2024, nVent anticipates reported sales growth of 8 to 10% and organic sales growth of 3 to 5%. The EPS forecast has been adjusted to $2.74 to $2.82 on a GAAP basis. For the second quarter of 2024, the company expects reported sales growth of 10 to 12% and an adjusted EPS of $0.81 to $0.83.

nVent's strategic initiatives and robust financial performance underscore its resilience and adaptability in a dynamic market. The company's updated guidance reflects confidence in its operational capabilities and market positioning, promising continued growth and shareholder value.

Investors and stakeholders can look forward to the earnings conference call, which will provide further insights into the companys strategies and outlook for the coming quarters.

Explore the complete 8-K earnings release (here) from nVent Electric PLC for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance