Atmus Filtration Technologies Inc. (ATMU) Q1 Earnings: Aligns with Analyst EPS Projections, ...

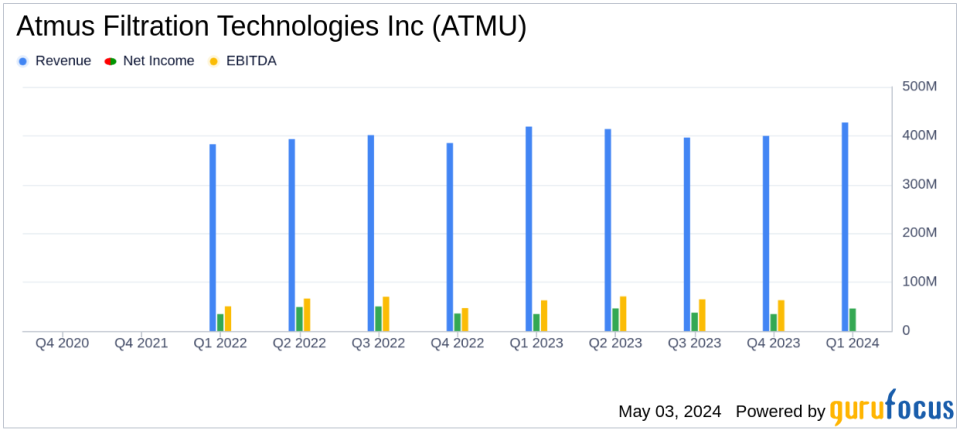

Revenue: Reported $427 million, an increase of approximately 2% year-over-year, exceeding the estimate of $416.24 million.

Net Income: Achieved $46 million, slightly above the estimate of $44.55 million.

Earnings Per Share (EPS): Recorded at $0.54, falling short of the estimated $0.55.

Adjusted Earnings Per Share: Posted at $0.60, compared to $0.67 in the same quarter last year, indicating a decrease.

Adjusted EBITDA: Reached $80 million with a consistent margin of 18.8% year-over-year.

Gross Margin: Slightly increased to $112 million from $110 million in the previous year, maintaining a margin of 26.2%.

Adjusted Free Cash Flow: Reported a negative $13 million, a significant drop compared to $37 million in the prior year's first quarter.

On May 3, 2024, Atmus Filtration Technologies Inc. (NYSE: ATMU) disclosed its financial outcomes for the first quarter ended March 31, 2024, through its 8-K filing. The company, a global leader in filtration and media solutions, reported net sales of $427 million, surpassing analyst expectations of $416.24 million, and achieving a net income of $46 million against projections of $44.55 million. However, the diluted earnings per share (EPS) stood at $0.54, aligning closely with the estimated $0.55.

About Atmus Filtration Technologies Inc.

Atmus Filtration Technologies, headquartered in Nashville, Tennessee, specializes in designing and manufacturing advanced filtration products under the Fleetguard brand. With a focus on lower emissions and asset protection, the company serves a global clientele across various sectors including truck, bus, agriculture, construction, and mining. Atmus offers a comprehensive range of products for both OEM and aftermarket applications, employing approximately 4,500 people worldwide.

Q1 Financial Highlights and Operational Challenges

The company's revenue increase was primarily driven by strategic pricing adjustments and favorable currency impacts, although partially offset by a slight decrease in volume. The gross margin remained stable at 26.2%, identical to the previous year, despite the challenges of higher manufacturing costs and reduced volumes. Adjusted EBITDA stood at $80 million with a margin of 18.8%, consistent with the prior year, excluding $6 million related to one-time costs from the separation from Cummins.

Atmus faced heightened interest expenses due to debt incurred from its May 2023 IPO, impacting its net income which saw a decline from the previous year's $53 million to $46 million. The company also experienced a significant shift in cash flow, using $8 million in operating activities compared to generating $43 million in the prior year, primarily due to increased working capital requirements and incentive compensation payments.

Strategic Moves and Market Outlook

CEO Steph Disher expressed confidence in Atmus's growth strategy following its successful separation from Cummins. The company has reaffirmed its 2024 revenue guidance to be between $1,610 million and $1,675 million, with an adjusted EBITDA margin forecast ranging from 18.25% to 19.25%. Adjusted EPS is projected to be between $2.10 and $2.35.

The completion of the share exchange with Cummins in March 2024 marked a significant milestone, making Atmus a fully independent entity. This strategic move is expected to enhance operational efficiencies and market responsiveness.

Investor and Analyst Perspectives

Despite the challenges, Atmus's ability to exceed revenue forecasts and align closely with EPS expectations suggests a resilient operational model. The company's strategic pricing and market adaptation strategies are pivotal in navigating the current economic landscape. Investors and analysts might view the reaffirmed financial guidance and successful corporate restructuring as positive indicators of the company's potential for sustainable growth.

For detailed financial figures and future projections, interested parties are encouraged to attend the upcoming webcast on the Atmus investor relations website or consult the full earnings report.

Explore the complete 8-K earnings release (here) from Atmus Filtration Technologies Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance