Select Medical Holdings Corp (SEM) Surpasses Q1 Revenue and Earnings Estimates, Announces Dividend

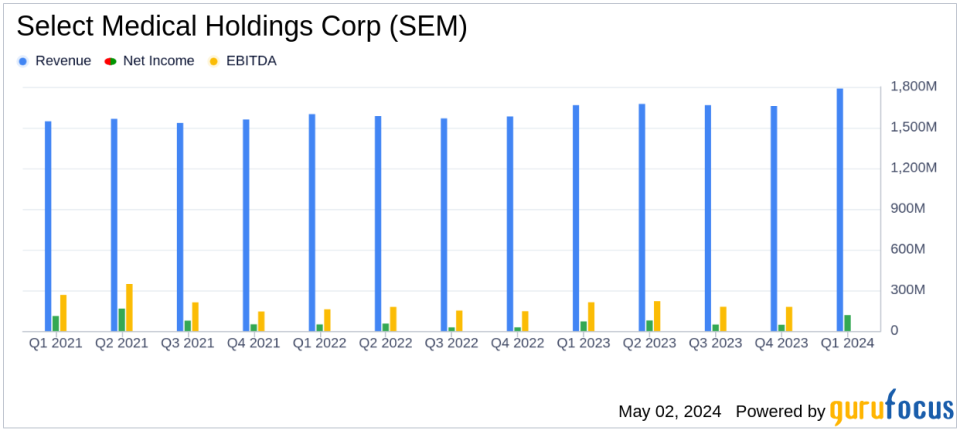

Revenue: Reached $1,788.8 million, up 7.4% year-over-year, surpassing estimates of $1,738.42 million.

Net Income: Increased to $117.2 million, a 37.4% rise from the previous year, exceeding estimates of $75.07 million.

Earnings Per Share (EPS): Grew 33.9% to $0.75, significantly above the estimated $0.58.

Adjusted EBITDA: Rose 22.4% to $261.9 million, indicating strong operational efficiency.

Dividend: Announced a cash dividend of $0.125 per share, payable on May 30, 2024, to shareholders of record as of May 16, 2024.

Stock Repurchase: Authorized a common stock repurchase program up to $1.0 billion, valid through December 31, 2025.

Business Outlook: Reaffirmed 2024 revenue expectations ranging from $6.9 billion to $7.1 billion, with adjustments to EBITDA and EPS forecasts.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Select Medical Holdings Corp (NYSE:SEM) released its 8-K filing on May 2, 2024, detailing a strong financial performance for the first quarter ended March 31, 2024. The company reported a significant 7.4% increase in revenue to $1.788 billion, surpassing the estimated $1.738 billion. Net income also saw a substantial rise of 37.4% to $117.2 million, well above the anticipated $75.07 million.

Select Medical operates across four main segments: critical illness recovery hospitals, rehabilitation hospitals, outpatient rehabilitation clinics, and Concentra institutions. This diversified business model has enabled robust segmental growth, particularly in critical illness recovery and rehabilitation hospitals, where revenue grew by 10.4% and 14.8% respectively.

Financial Highlights and Segment Performance

The company's income from operations increased by 28.1% to $194.0 million. Earnings per share (EPS) also rose significantly by 33.9% to $0.75, outperforming the analyst estimate of $0.58. This growth was underpinned by strong performance across all business segments, with notable increases in adjusted EBITDA in both the critical illness recovery and rehabilitation hospital segments, which grew 51.0% and 30.0% respectively.

The outpatient and Concentra segments experienced more modest growth. The outpatient rehabilitation segment's revenue increased by 2.5%, although its adjusted EBITDA margin declined. Meanwhile, the Concentra segment grew its revenue by 2.5% and slightly improved its adjusted EBITDA margin to 20.6%.

Strategic Initiatives and Future Outlook

Amid these financial achievements, Select Medical also declared a quarterly cash dividend of $0.125 per share, signaling confidence in its financial health and commitment to delivering shareholder value. Additionally, the Board of Directors has authorized a stock repurchase program up to $1.0 billion, set to continue until the end of 2025.

Looking forward, Select Medical has reaffirmed its 2024 revenue outlook in the range of $6.9 billion to $7.1 billion and adjusted its projections for adjusted EBITDA and EPS, reflecting ongoing optimism about its operational capabilities and market conditions.

Investor and Analyst Perspectives

Analysts might view Select Medical's robust Q1 performance and positive adjustments to its full-year outlook as indicators of strong operational execution and effective strategic management. The company's ability to exceed revenue and earnings estimates, coupled with strategic capital management initiatives such as dividends and stock repurchases, positions it favorably for sustained growth.

For detailed financial figures and future projections, interested parties can access the earnings call webcast scheduled for May 3, 2024, through Select Medicals website.

Select Medical's comprehensive performance this quarter not only demonstrates its resilience and adaptability in a challenging healthcare environment but also underscores its potential for continued growth and profitability. Investors and stakeholders may look forward to the company's sustained operational success and strategic expansions moving forward.

Explore the complete 8-K earnings release (here) from Select Medical Holdings Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance