DMC Global Inc (BOOM) Q1 Earnings: Misses Revenue and EPS Estimates Amid Market Challenges

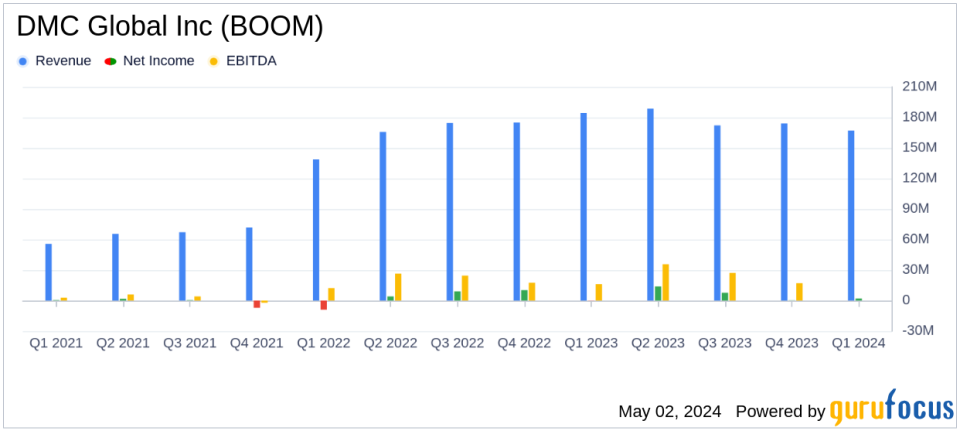

Revenue: Reported $166.9 million, a decrease of 9% year-over-year, falling short of estimates of $172.77 million.

Net Income: Achieved $2.3 million, significantly below the estimated $5.1 million.

Earnings Per Share (EPS): Adjusted diluted EPS was $0.21, slightly above the estimate of $0.20.

Free Cash Flow: Generated $10.5 million, more than doubling from $4.8 million in the same quarter last year.

Gross Margin: Gross profit percentage decreased to 25.4% from 28.3% year-over-year.

Adjusted EBITDA: Totalled $16.7 million, a decline of 17% compared to the first quarter of the previous year.

Debt Management: Reduced total debt to $90 million and improved debt-to-adjusted EBITDA leverage ratio to 1.00x from 1.25x at the end of the previous quarter.

On May 2, 2024, DMC Global Inc (NASDAQ:BOOM) disclosed its first-quarter financial results through an 8-K filing. The company reported a revenue of $166.9 million, a 9% decrease compared to the same period last year, falling short of the estimated $172.77 million. Adjusted earnings per share (EPS) for the quarter was $0.21, also below the analyst expectation of $0.20. This performance reflects significant challenges across its industrial manufacturing segments due to varying market conditions.

DMC Global operates through three primary segments: Arcadia Products, DynaEnergetics, and NobelClad. These divisions serve a diverse range of markets including energy, industrial, and infrastructure sectors. The company's broad portfolio includes everything from architectural building products to specialized materials for industrial processing equipment.

Segment Performance and Market Conditions

The company's Arcadia Products segment saw a significant downturn, with sales dropping 23% to $61.9 million. This decline was attributed to a slowdown in commercial construction activities and a decrease in high-end residential sales. Conversely, DynaEnergetics reported a slight increase in sales, up 4% sequentially, though down 5% year-over-year, totaling $78.1 million. This segment faced pricing pressures in North America but achieved record unit sales of its DynaStage perforating systems. NobelClad, the composite metals business, outperformed with a 22% increase in sales to $26.8 million, driven by strong demand in industrial markets and a significant $19 million order post-quarter.

Financial Health and Operational Highlights

Despite the revenue shortfall, DMC Global managed to improve its financial position by more than doubling its first-quarter free cash flow to $10.5 million, compared to $4.8 million in the previous year. The company also reduced its total debt to $90 million and lowered its debt-to-adjusted EBITDA leverage ratio to 1.00x from 1.25x at the end of the fourth quarter. These indicators suggest a strengthening balance sheet and better liquidity management.

Strategic Moves and Future Outlook

Looking ahead, DMC Global's management remains focused on navigating the current market challenges while exploring strategic alternatives for its NobelClad and DynaEnergetics segments. The company anticipates these reviews to be a crucial step in enhancing shareholder value. For the second quarter of 2024, DMC Global expects consolidated sales to range between $161 million and $171 million, with adjusted EBITDA projections set between $14 million and $17 million.

In conclusion, DMC Global Inc faces a tough market environment that has impacted its first-quarter performance. However, strategic initiatives and a strong order backlog, particularly in the NobelClad segment, provide a basis for cautious optimism. Investors and stakeholders will be watching closely to see how the company's strategic reviews and market strategies unfold in the coming months.

Explore the complete 8-K earnings release (here) from DMC Global Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance