Newpark Resources Inc (NR) Q1 2024 Earnings: Surpasses EPS Estimates, Faces Revenue Decline

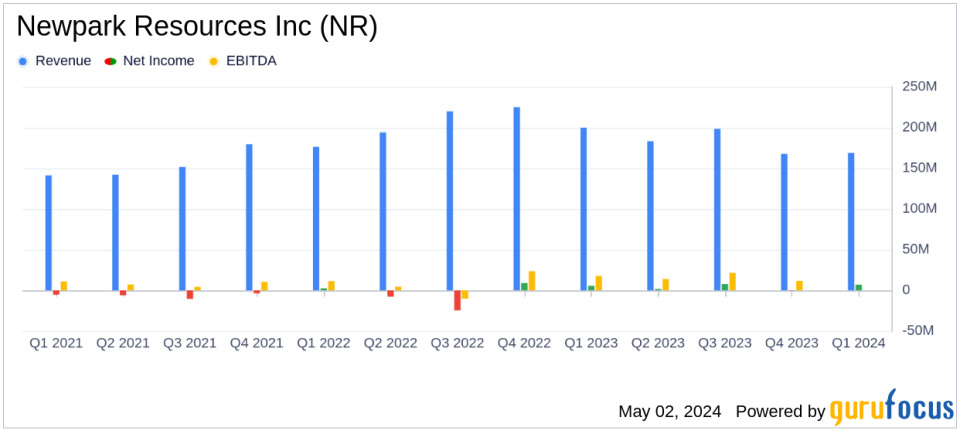

Net Income: Reported $7.3 million, up 30% year-over-year, surpassing the estimated $4.90 million.

Earnings Per Share (EPS): Achieved $0.08 per diluted share, exceeding the estimated $0.06.

Revenue: Totaled $169.1 million, falling short of the estimated $170.79 million.

Adjusted EBITDA: Increased slightly to $21.3 million, with a margin improvement to 12.6%, up 210 basis points year-over-year.

Free Cash Flow: Reported a negative $0.8 million, a significant decline from $23.2 million in the prior year.

Debt Levels: Ended the quarter with Net Debt of $40 million, maintaining a low Net Leverage ratio of 0.5x.

Capital Expenditure: Invested $13 million primarily in expanding the composite matting rental fleet.

Newpark Resources Inc (NYSE:NR) released its 8-K filing on May 2, 2024, revealing a mixed financial performance for the first quarter ended March 31, 2024. The company reported a net income of $7.3 million, translating to $0.08 per diluted share, which notably surpasses the analyst's EPS estimate of $0.06. However, revenue fell to $169.1 million from $200.0 million in the prior year, missing the estimated $170.79 million.

Newpark Resources Inc is a key player in the oil and gas industry, providing environmentally-sensitive products and services across multiple sectors. The company operates through two main segments: Industrial Solutions and Fluids Systems, with the latter being the primary revenue generator. Despite a global presence, the majority of its revenue is derived from the United States.

Performance Highlights and Strategic Focus

The first quarter saw a 30% increase in net income year-over-year, bolstered by significant margin expansions in both business segments. Adjusted EBITDA slightly increased to $21.3 million from $21.0 million in the previous year, with the Adjusted EBITDA margin improving by 210 basis points to 12.6%. This improvement is attributed to enhanced operational efficiency and strategic cost management.

President and CEO Matthew Lanigan emphasized the company's ongoing transformation into a specialty rental business, focusing on high-margin, worksite access solutions. This strategic pivot is expected to enhance Newpark's market positioning and financial robustness. The Fluids Systems segment, in particular, is under strategic review, with expectations to conclude by mid-2024.

Financial and Operational Challenges

Despite the positive earnings per share, Newpark faced a significant revenue decline of 15.5% year-over-year. This drop was primarily due to decreased activity levels in the Fluids Systems segment, which saw a revenue decrease of $24.1 million. The Industrial Solutions segment also experienced a revenue decline, albeit at a lower rate, impacted by the timing of product sales and project support.

The company's balance sheet remains solid with a total net debt of $40 million, maintaining a net leverage ratio of 0.5x. The liquidity position is supported by $38 million in cash and $58 million available under its credit facility. However, the free cash flow was negative at $0.8 million, compared to a positive $23.2 million in the prior year, reflecting higher capital expenditures primarily for expanding the rental fleet.

Looking Forward

For the full year 2024, Newpark anticipates Industrial Solutions segment revenue between $230 million and $240 million, with Adjusted EBITDA expected to range from $80 million to $85 million. The company plans to continue its focus on strategic investments and operational efficiencies to navigate the current market dynamics effectively.

The strategic review of the Fluids Systems segment and the continued expansion in high-margin rental solutions are pivotal to Newpark's future growth trajectory. Investors and stakeholders will be watching closely as the company progresses with its transformation plans and capitalizes on emerging market opportunities.

For more detailed information and to join the upcoming earnings call on May 3, 2024, please visit Newpark's website.

Explore the complete 8-K earnings release (here) from Newpark Resources Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance