Janus Henderson Q1 2024 Earnings: Surpasses EPS Estimates with Strategic Acquisitions on the Horizon

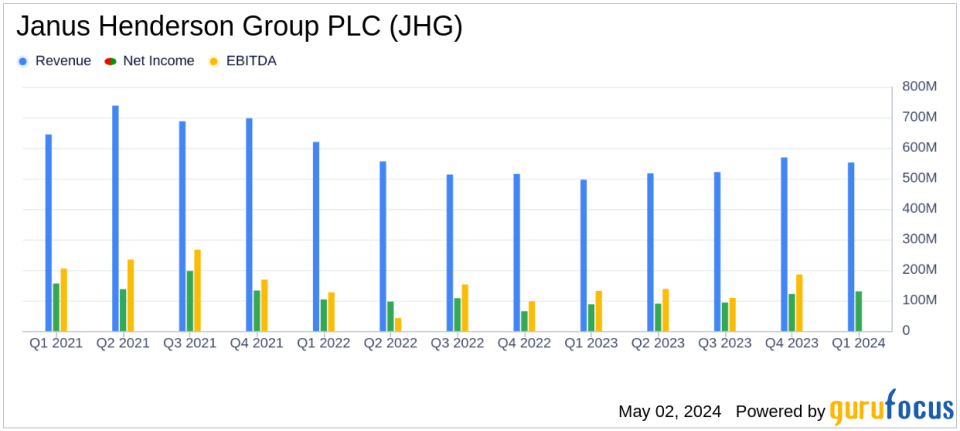

Revenue: Reported at $551.7 million for Q1 2024, surpassing the estimate of $547.21 million.

Net Income: Achieved $130.1 million, exceeding the estimated $96.55 million.

Earnings Per Share (EPS): Diluted EPS reached $0.81, significantly above the estimate of $0.62.

Operating Income: Posted at $119.2 million, showing growth from $100.4 million in Q1 2023.

Adjusted Operating Margin: Recorded at 30.0% for Q1 2024, demonstrating an improvement from 27.5% in Q1 2023.

Dividend: Declared a quarterly dividend of $0.39 per share, payable on May 29, 2024.

Share Repurchase: Announced a new $150 million share repurchase program, reflecting strong liquidity and commitment to shareholder returns.

On May 2, 2024, Janus Henderson Group PLC (NYSE:JHG) disclosed its first quarter earnings for 2024, revealing a robust performance with earnings surpassing analyst expectations. The detailed financial outcomes were published in the company's 8-K filing.

Company Overview

Janus Henderson Group is a prominent global asset manager, providing services to retail intermediaries, self-directed clients, and institutional investors. With a diverse portfolio that includes active equities, fixed-income, multi-asset, and alternative investments, Janus Henderson managed $334.9 billion in assets as of December 2023. The company has a significant presence in North America, which constitutes 59% of its managed assets, with substantial operations in Europe, the Middle East, Africa, and the Asia-Pacific region.

Financial Highlights

The first quarter of 2024 saw Janus Henderson achieving an operating income of $119.2 million, a significant rise from $100.4 million in the same quarter the previous year. The adjusted operating income also saw an increase to $128.2 million from $105.6 million year-over-year. This growth is indicative of the company's effective cost management and operational efficiency.

Notably, the diluted earnings per share (EPS) for Q1 2024 stood at $0.81, outperforming the analyst estimate of $0.62. This represents a substantial improvement from the $0.53 reported in Q1 2023. The adjusted diluted EPS was $0.71, compared to $0.55 in the previous year, reflecting a nearly 30% increase year-over-year.

Strategic Acquisitions and Partnerships

Janus Henderson announced significant strategic moves with the acquisition of NBK Capital Partners and Tabula Investment Management. These acquisitions are aimed at enhancing the firm's capabilities in emerging markets and expanding its ETF offerings in Europe, respectively. The transactions are expected to close in the second quarter of 2024, subject to regulatory approvals.

Operational and Market Performance

Janus Henderson reported a revenue of $551.7 million for the quarter, against an estimated $547.21 million, showcasing a solid top-line growth. The company's assets under management (AUM) increased to $352.6 billion by the end of March 2024, driven by positive market and foreign exchange movements.

The company also highlighted its investment performance, with a significant portion of its AUM outperforming benchmarks across most capabilities. This performance underscores Janus Henderson's strong investment management capabilities and its commitment to delivering value to its clients.

Shareholder Returns and Future Outlook

Reflecting its strong liquidity position, Janus Henderson has continued its shareholder return policy through dividends and share repurchases. A dividend of $0.39 per share was declared for Q1 2024, with a new share repurchase program of up to $150 million also announced.

CEO Ali Dibadj expressed satisfaction with the quarter's results and optimism about the strategic acquisitions, emphasizing their alignment with the company's long-term objectives. He noted, "We continue to execute our strategic objectives, and we are extraordinarily pleased to partner with the talented professionals at both NBKCP and Tabula."

In conclusion, Janus Henderson's first quarter of 2024 demonstrates a strong financial and operational performance, with strategic acquisitions set to further enhance its market position. The company remains well-positioned to capitalize on growth opportunities and deliver enhanced value to its stakeholders.

Explore the complete 8-K earnings release (here) from Janus Henderson Group PLC for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance