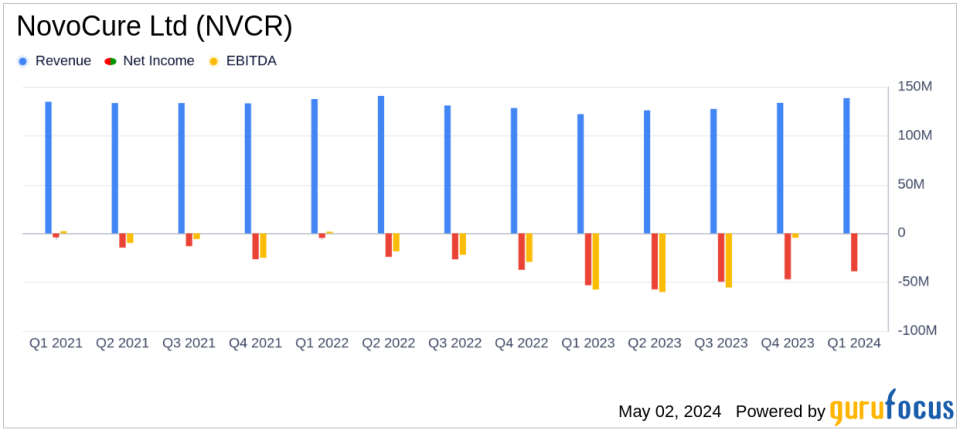

NovoCure Ltd (NVCR) Q1 2024 Earnings: Revenue Surpasses Estimates, Narrower Net Loss Reported

Revenue: $138.5 million, up 13% year-over-year, exceeding estimates of $131.45 million.

Net Loss: $38.8 million, an improvement from the previous year, exceeding estimates of $45.15 million.

Earnings Per Share: Loss of $0.36, better than the estimated loss of $0.42 per share.

Gross Margin: Reported at 76% for the quarter.

Research and Development Expenses: $51.6 million, down 14% from the same period last year.

Sales and Marketing Expenses: Increased by 8% to $55.2 million, reflecting expanded sales force and marketing activities.

Cash Position: Strong with $870.1 million in cash, cash equivalents, and short-term investments as of March 31, 2024.

On May 2, 2024, NovoCure Ltd (NASDAQ:NVCR) announced its financial results for the first quarter ended March 31, 2024, revealing a revenue that exceeded analyst expectations and a reduced net loss compared to the previous year. The details were disclosed in their recent 8-K filing.

Company Overview

Headquartered in Root, Switzerland, NovoCure Ltd operates in the healthcare sector, primarily focusing on the development, manufacture, and commercialization of Tumor Treating Fields (TTFields) devices. These devices, including Optune Gio and Optune Lua, are used for treating solid tumor cancers such as glioblastoma and non-small cell lung cancer. The company generates the majority of its revenue from the United States, with significant contributions from Germany, Japan, and other markets.

Financial Highlights

NovoCure reported quarterly net revenues of $138.5 million, a 13% increase from $122.2 million in the same period last year, surpassing the estimated revenue of $131.45 million. This growth was driven by a successful launch in France and improved U.S. approval rates. The U.S., Germany, and Japan were significant contributors to the revenue, with respective earnings of $90.5 million, $15.7 million, and $7.8 million.

The company also reported a net loss of $38.8 million, or $0.36 per share, which is an improvement over the previous year's net loss of $53.1 million, or $0.50 per share. This performance is better than the anticipated net loss of $45.15 million and earnings per share of -$0.42.

Operational and Clinical Developments

During the quarter, NovoCure achieved several operational milestones. The company received 1,643 new prescriptions, marking a 10% increase year-over-year. As of March 31, 2024, there were 3,845 active patients on therapy. Notably, the Phase 3 METIS trial in brain metastases from non-small cell lung cancer met its primary endpoint, a significant clinical achievement that will be presented at the ASCO 2024.

Additionally, the company met with the U.S. FDA for a Day-100 meeting concerning the PMA application for Optune Lua in treating non-small cell lung cancer, anticipating a decision in the second half of 2024.

Financial Condition and Future Outlook

NovoCure's financial position remains robust with cash, cash equivalents, and short-term investments totaling $870.1 million as of March 31, 2024. The company also secured a new five-year senior secured credit facility agreement potentially worth $400 million, enhancing its financial flexibility for future investments.

Looking forward, NovoCure is poised for continued growth with several clinical milestones anticipated in 2024, including top-line data from the phase 3 PANOVA-3 clinical trial in locally advanced pancreatic cancer.

Conclusion

NovoCure's Q1 2024 results reflect a solid financial and operational performance, underscored by revenue growth and clinical advancements. With strategic initiatives in place and a strong pipeline of clinical trials, NovoCure is well-positioned to maintain its trajectory in the competitive oncology sector.

For further details, investors and interested parties are encouraged to access the webcast and conference call hosted by NovoCure, available through their Investor Relations page.

Explore the complete 8-K earnings release (here) from NovoCure Ltd for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance