The Wendy's Co (WEN) Q1 2024 Earnings: Modest Revenue Growth and EPS Alignment with Analyst ...

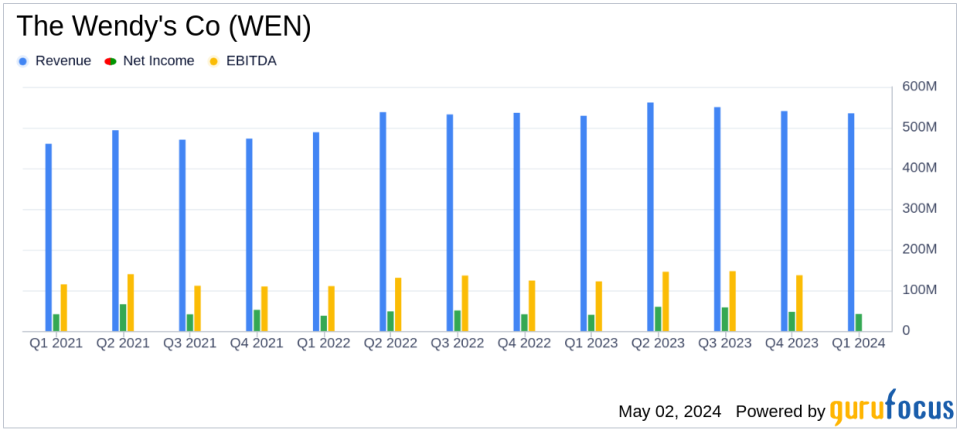

Reported Revenue: $534.8 million in Q1 2024, a slight increase of 1.1% year-over-year,

marginally surpassingmarginally below the estimated $540.97 million.Net Income: Rose to $42.0 million, up by 5.5% compared to the previous year,

exceedingbelow the estimated $43.62 million.Earnings Per Share (EPS): Reported at $0.20, up 5.3% year-over-year, below the estimated $0.21.

Adjusted Earnings Per Share: Increased to $0.23, a 9.5% rise, surpassing the estimated $0.21.

Operating Profit: Decreased to $81.2 million, down by 3.9% year-over-year, impacted by higher investments in breakfast advertising and operational costs.

Free Cash Flow: Decreased to $60.8 million, a 4.6% drop, primarily due to increased capital expenditures related to advertising investments.

Global Restaurant Count: Expanded to 7,248 locations, up from 7,095 in the previous year, reflecting continued growth in international markets.

On May 2, 2024, The Wendy's Co (NASDAQ:WEN) disclosed its financial results for the first quarter ended March 31, 2024, through its 8-K filing. The company reported a slight revenue increase and earnings per share that aligned closely with analyst expectations, reflecting a stable performance amidst challenging market conditions.

The Wendy's Company, a major player in the quick-service restaurant sector in the United States, continues to drive growth through strategic initiatives focused on digital sales and breakfast offerings. With a total of 7,248 restaurants globally, Wendy's maintains a significant presence in the industry, supported by a strong franchise model.

Financial Performance Highlights

For Q1 2024, Wendy's posted revenues of $534.8 million, a 1.1% increase from the $528.8 million recorded in the same quarter the previous year, slightly surpassing the estimated $540.97 million. This growth was primarily fueled by higher franchise royalty revenue and advertising funds revenue, attributable to net new restaurant development and robust same-restaurant sales.

The company's net income for the quarter stood at $42.0 million, up 5.5% from $39.8 million in Q1 2023, aligning with the analyst's expectation of $43.62 million. Earnings per share (EPS) rose to $0.20, compared to $0.19 in the prior year, closely meeting the estimated EPS of $0.21.

Adjusted EBITDA saw a modest rise of 1.8%, reaching $127.8 million, driven by higher franchise royalty revenue and an improved U.S. company-operated restaurant margin, which expanded by 60 basis points to 15.3%. This margin improvement reflects the benefits of a higher average check, despite challenges such as customer count declines and rising labor costs.

Operational and Strategic Developments

Wendy's operational strategy in the quarter included a focus on digital sales, which constituted nearly 17% of global sales, and a significant push in the U.S. breakfast segment, which saw high-single-digit growth year-over-year. The company also continued its global restaurant expansion, adding a net of 8 new locations, bringing the total to 7,248.

The company's commitment to reimagining its stores is on track, with 87% of global stores completed by the end of Q1 2024. This initiative is part of Wendy's strategy to enhance customer experience and operational efficiency.

Challenges and Forward-Looking Statements

Despite positive growth indicators, Wendy's faces challenges including increased investments in breakfast advertising and higher general and administrative expenses, which have impacted operating profits, down 3.9% to $81.2 million. The company also noted potential headwinds such as labor cost increases and economic conditions that could affect consumer spending.

Looking ahead, Wendy's remains focused on executing its growth strategies, particularly in digital expansion and menu innovation, to drive long-term shareholder value. The company's forward-looking statements suggest cautious optimism, with plans to continue leveraging its brand strength and operational initiatives to navigate the competitive landscape.

In conclusion, The Wendy's Co's first-quarter results for 2024 reflect a resilient business model capable of generating steady growth amidst market challenges. With strategic investments in key growth areas and a strong focus on operational efficiency, Wendy's is well-positioned to maintain its trajectory and deliver value to its stakeholders.

Explore the complete 8-K earnings release (here) from The Wendy's Co for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance