WestRock Co (WRK) Q2 Fiscal 2024 Earnings: Misses Revenue Estimates, Reports Modest Profit

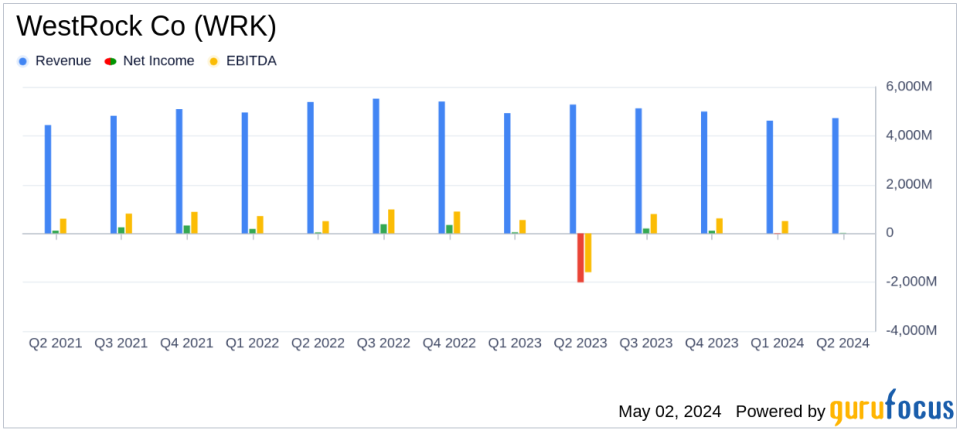

Revenue: Reported at $4,726.7 million for the quarter, falling short of the estimated $4,750.15 million.

Net Income: Achieved $15.5 million, comparing favorably against the estimated $74.43 million loss.

Earnings Per Share (EPS): Recorded at $0.06, below the estimated $0.23.

Consolidated Adjusted EBITDA: Declined by 21.6% year-over-year to $618.3 million.

Net Cash from Operating Activities: Decreased significantly to $37 million from $284 million in the prior year's quarter.

Capital Expenditures: Invested $301 million during the quarter, with $78 million returned to shareholders in dividends.

Total Debt: Stood at $9.0 billion as of March 31, 2024, with adjusted net debt at $8.4 billion.

On May 2, 2024, WestRock Co (NYSE:WRK), a leader in sustainable paper and packaging solutions, disclosed its financial results for the second quarter of fiscal year 2024, which ended on March 31, 2024. The company released its 8-K filing showing a slight recovery in net income but a decline in revenue compared to the same period last year. WestRock, known for its extensive range of corrugated and consumer packaging products, reported a net income of $15.5 million, contrasting sharply with a loss of $2,006.1 million in the prior year, primarily due to a substantial non-cash goodwill impairment recorded in 2023.

Despite the positive turn in net income, the company's revenue for the quarter stood at $4,726.7 million, down from $5,277.6 million in the previous year, marking an 8.7% decrease. This figure falls short of the analyst expectations which estimated revenue to be around $4,750.15 million. The earnings per share (EPS) for the quarter was $0.06, significantly lower than the analyst forecast of $0.23 per share.

Operational Highlights and Segment Performance

CEO David B. Sewell highlighted the company's robust cost-saving measures, which have already surpassed their mid-year target for fiscal 2024. Sewell emphasized the strategic positioning of WestRock to leverage its scale and innovative solutions to capture market share and drive long-term growth. Despite these efforts, all major segments of WestRock reported a decline in sales and adjusted EBITDA, attributed mainly to lower selling prices and reduced volumes, which were slightly offset by cost savings and favorable foreign exchange impacts.

The Corrugated Packaging segment saw sales decrease by approximately 8.7%, with a corresponding drop in adjusted EBITDA by 21.9%. The Consumer Packaging and Global Paper segments also experienced declines in both sales and adjusted EBITDA, driven by similar market challenges.

Financial Position and Future Outlook

WestRock's total debt as of March 31, 2024, was reported at $9.0 billion, with adjusted net debt slightly lower at $8.4 billion. The company maintained about $3.0 billion in available liquidity through various credit facilities and cash reserves. Notably, the company invested $301 million in capital expenditures and returned $78 million to shareholders in dividends during the quarter.

Looking forward, WestRock did not provide specific financial guidance for upcoming quarters, citing ongoing preparations for its proposed business combination with Smurfit Kappa Group plc, aimed at creating a global leader in sustainable packaging. The transaction is expected to close in early July 2024.

Challenges and Market Dynamics

The decline in revenue across all segments underscores the challenges WestRock faces in a competitive and fluctuating market, influenced by pricing pressures and changes in consumer demand. The company's ability to continue its cost efficiency programs will be crucial in mitigating these impacts and strengthening its market position.

For more detailed financial information and to view the full earnings release, please visit WestRock's investor relations page at ir.westrock.com.

Explore the complete 8-K earnings release (here) from WestRock Co for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance