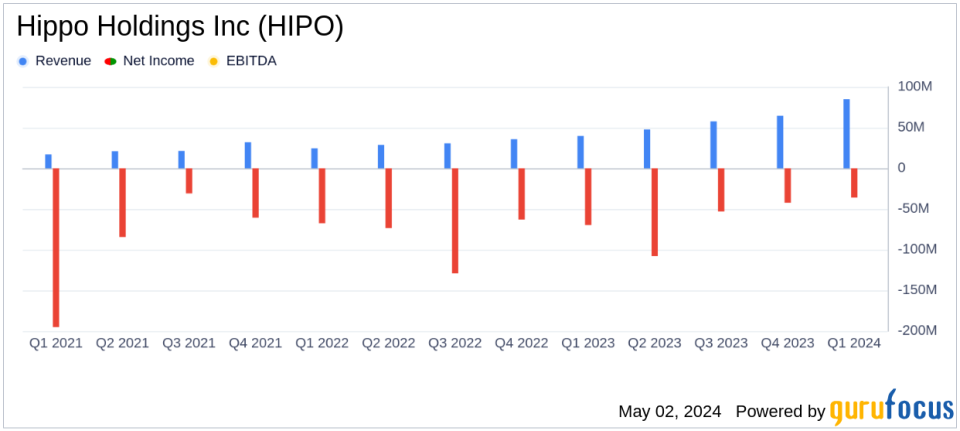

Hippo Holdings Inc (HIPO) Q1 2024 Earnings: Significant Revenue Growth and Improved Loss Ratios

Revenue: Reported a significant increase to $85 million, up 114% year-over-year, surpassing the estimated $73.04 million.

Net Loss: Decreased to $36 million, a 49% improvement from the previous year, but fell short of the estimated net loss of $30.83 million.

Earnings Per Share (EPS): Recorded at -$1.47, showing a substantial improvement from -$3.01 year-over-year, but below the estimated -$1.39.

Total Generated Premium (TGP): Grew by 20% year-over-year to $294 million, driven by growth in the Insurance-as-a-Service and third-party policy offerings.

Adjusted EBITDA: Loss reduced by 62% year-over-year to $20 million, indicating significant operational improvements and cost management.

Gross Loss Ratio: Improved by 21 percentage points year-over-year to 80% in the Hippo Home Insurance Program, reflecting better underwriting and risk management.

Operating Expenses: Decreased by 24% year-over-year, showcasing enhanced efficiency and the successful implementation of cost-reduction strategies.

Hippo Holdings Inc (NYSE:HIPO), a leading home insurance group, released its 8-K filing on May 2, 2024, showcasing substantial growth and operational improvements for the first quarter of 2024. The company reported a remarkable 114% increase in revenue year-over-year, reaching $85 million, surpassing the estimated revenue of $73.04 million. However, the net loss was $36 million, a 49% improvement from the previous year but still higher than the estimated net loss of $30.83 million.

Company Overview

Hippo Holdings Inc operates primarily through its three segments: Services, Insurance-as-a-Service (IaaS), and the Hippo Home Insurance Program (HHIP). The company has made significant strides in these areas, particularly in IaaS and Services, which now represent 80% of its Total Generated Premium (TGP), highlighting a strategic shift from higher-risk areas. This shift is part of Hippo's broader strategy to reduce exposure to catastrophic (CAT) events and improve its underwriting results.

Financial Highlights and Operational Achievements

The first quarter of 2024 was marked by several key financial achievements for Hippo. The company's TGP grew by 20% year-over-year to $294 million, driven by robust performance in the IaaS and Services segments. Notably, the HHIP segment saw a significant improvement in its gross loss ratio, which decreased by 21 percentage points year-over-year to 80%. This improvement reflects Hippo's ongoing efforts to optimize its portfolio and reduce exposure to severe weather events.

Moreover, Hippo achieved its first cash flow positive quarter, with cash and investments rising quarter-over-quarter to $511 million. This financial strength was further underscored by a surplus of $197 million from Spinnaker, up from $169 million a year ago.

Challenges and Strategic Adjustments

Despite the positive developments, Hippo faced challenges, including a large hailstorm in March 2024 that impacted Texas and Missouri. However, due to strategic adjustments in geographic exposure and policy terms, the direct losses from this event were approximately 43% lower than they would have been under last year's conditions. These proactive measures are crucial as they demonstrate Hippo's ability to manage and mitigate risks effectively.

Outlook and Forward Guidance

Looking ahead, Hippo remains committed to achieving its operational and financial goals for 2024. The company expects TGP to exceed $1.3 billion and projects revenue to grow to more than $340 million. Additionally, Hippo anticipates an adjusted EBITDA loss between $41 million and $51 million for the full year, with a positive adjusted EBITDA expected in the fourth quarter.

In conclusion, while Hippo Holdings Inc faces ongoing challenges, its strategic initiatives and operational improvements are yielding significant benefits. The company's ability to grow revenue substantially while improving its loss ratios provides a solid foundation for future profitability and operational efficiency.

Explore the complete 8-K earnings release (here) from Hippo Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance