Ares Management Corp (ARES) Reports Mixed Q1 2024 Results: Misses EPS Estimates, Declares Dividend

GAAP Net Income: Reported at $73.0 million for the quarter, falling short of the estimated $180.15 million.

Earnings Per Share (EPS): Achieved $0.33, below the estimated $0.92.

After-tax Realized Income: Reached $265.1 million, with a per-share figure of $0.80.

Fee-Related Earnings: Totaled $301.7 million during the quarter.

Dividend: Declared a quarterly dividend of $0.93 per share, payable on June 28, 2024.

Assets Under Management (AUM): Grew by 19% year-over-year, reaching approximately $428 billion.

Fundraising: Robust with over $17 billion raised in the quarter, reflecting strong investor confidence and strategic growth initiatives.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

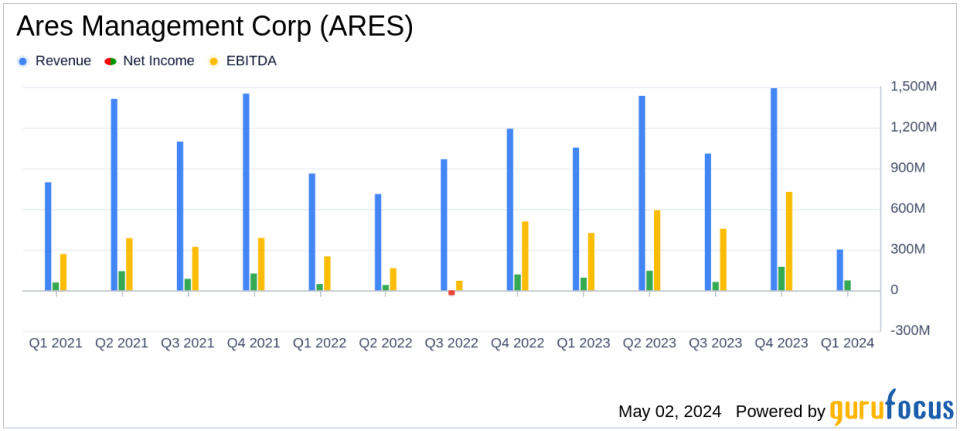

Ares Management Corporation (NYSE:ARES) disclosed its financial outcomes for the first quarter ending March 31, 2024, in its recent 8-K filing. The company reported a GAAP net income of $73.0 million, translating to earnings per share (EPS) of $0.33, which falls short of the analyst's EPS estimate of $0.92. Despite this, the company's after-tax realized income stood strong at $265.1 million, or $0.80 per share. Fee-related earnings were notably robust at $301.7 million for the quarter.

Ares Management Corp, a leading global alternative investment manager, operates through diverse segments including Credit, Private Equity, Real Assets, and Secondaries, with the Credit Group being the largest revenue contributor. As of March 31, 2024, Ares boasted approximately $428 billion in assets under management (AUM), marking a significant 19% year-over-year growth. This expansion is supported by vigorous fundraising activities exceeding $17 billion and an increase in deployment across the companys extensive global platform.

Financial Highlights and Strategic Moves

The company announced a quarterly dividend of $0.93 per share, payable on June 28, 2024, underscoring its commitment to shareholder returns. Additionally, Ares has introduced a Dividend Reinvestment Program, further enhancing shareholder value. The firm's strategic initiatives have poised it well for leveraging opportunities in a dynamic market environment, as indicated by the 28% growth in AUM not yet generating fees and nearly $115 billion in available capital.

CEO Michael Arougheti highlighted the strong performance across key financial metrics and the ongoing success in identifying compelling investment opportunities globally. CFO Jarrod Phillips expressed optimism about the company's growth capacity amid increasing transaction activities.

Operational and Market Challenges

Despite the positive developments, Ares Management Corp's earnings per share of $0.33 significantly missed the analyst expectations, which may raise concerns among investors about the firms ability to consistently translate higher AUM and capital availability into proportional earnings growth. The discrepancy between robust fee-related earnings and lower net income attributable to the corporation suggests potential areas of cost optimization or unexpected expenses impacting the bottom line.

In conclusion, Ares Management Corp's first quarter of 2024 reflects a mixed financial performance with strong operational undertakings and strategic advancements poised for future growth. However, the earnings miss highlights the challenges the firm faces in a fluctuating economic landscape. Investors and stakeholders will likely watch closely how Ares navigates these challenges in upcoming quarters.

For more detailed information, visit the Investor Resources section at www.aresmgmt.com.

Explore the complete 8-K earnings release (here) from Ares Management Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance