PETRONAS Gas Berhad's (KLSE:PETGAS) investors will be pleased with their respectable 32% return over the last three years

By buying an index fund, investors can approximate the average market return. But if you pick the right individual stocks, you could make more than that. For example, PETRONAS Gas Berhad (KLSE:PETGAS) shareholders have seen the share price rise 15% over three years, well in excess of the market return (1.2%, not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 11% in the last year , including dividends .

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for PETRONAS Gas Berhad

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

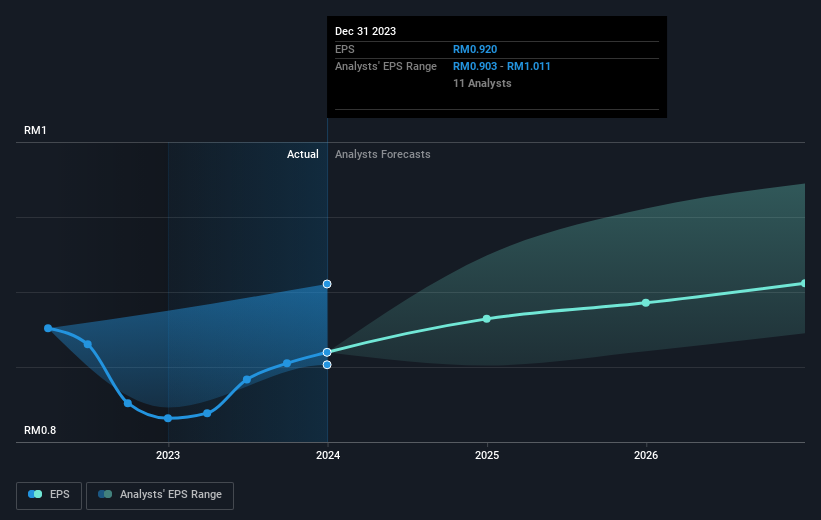

During the three years of share price growth, PETRONAS Gas Berhad actually saw its earnings per share (EPS) drop 3.3% per year.

With EPS falling, but a modestly increasing share price, it seems that the market was probably too pessimistic about the stock in the past. Having said that, if the EPS falls continue we'd be surprised to see a sustained increase in share price.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of PETRONAS Gas Berhad's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for PETRONAS Gas Berhad the TSR over the last 3 years was 32%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

PETRONAS Gas Berhad provided a TSR of 11% over the last twelve months. But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 6% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. It's always interesting to track share price performance over the longer term. But to understand PETRONAS Gas Berhad better, we need to consider many other factors. Even so, be aware that PETRONAS Gas Berhad is showing 1 warning sign in our investment analysis , you should know about...

Of course PETRONAS Gas Berhad may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Malaysian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.