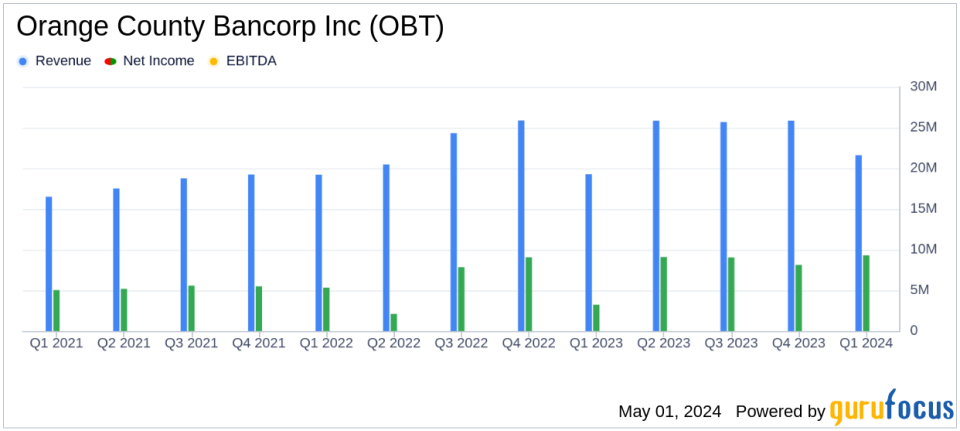

Orange County Bancorp Inc (OBT) Surpasses Analyst Earnings Projections in Q1 2024

Net Income: Reported at $9.3 million, an increase of 187.6% from $3.2 million in the previous year, surpassing estimates of $7.55 million.

Earnings Per Share (EPS): Achieved $1.65, exceeding the estimated $1.35 per share.

Revenue: Total interest income rose to $31.1 million, reflecting a 17.9% increase year-over-year, contributing to a robust financial performance.

Provision for Credit Losses: Recorded a net credit of $1.6 million due to a recovery, compared to a provision of $6.4 million in the prior year, indicating improved credit conditions.

Non-Interest Income: Increased by 16.3% to $3.7 million, driven by higher fee income across various categories.

Deposits: Grew by $110.7 million, or 5.4%, reaching $2.2 billion, primarily due to an increase in lower-cost core deposits.

Wealth Management: Trust and investment advisory income rose by 21.6% to $2.9 million, signaling growth in asset and client acquisition as well as market performance.

Orange County Bancorp Inc (NASDAQ:OBT) announced a significant increase in its first-quarter earnings for 2024, with net income reaching $9.3 million, or $1.65 per share, substantially surpassing the analyst estimates of $1.35 per share and $7.55 million in net income. This performance marks a robust 187.6% increase compared to the same quarter last year. The company released these figures in its 8-K filing on May 1, 2024, reflecting a successful period of growth and strategic financial management.

Orange County Bancorp Inc, headquartered in Middletown, NY, operates primarily through its subsidiaries, Orange Bank & Trust Co. and Hudson Valley Investment Advisors, Inc. The company offers a comprehensive range of banking and wealth management services, focusing on personal and business banking solutions as well as trust and investment services.

Financial Highlights and Strategic Achievements

The first quarter of 2024 saw Orange County Bancorp Inc not only increase its net income but also enhance its net interest income, which rose by $462 thousand or 2.2%, totaling $21.6 million. This growth was supported by a $4.7 million increase in total interest income, reflecting a 17.9% improvement year-over-year. The bank also reported a significant reduction in expenses related to credit losses, including a $1.9 million recovery from previously written-off subordinated debt from Signature Bank.

Non-interest income also showed a healthy increase of 16.3%, amounting to $3.7 million, driven by higher fee income across various categories. This diversification of income streams underscores the bank's strategic focus on broadening its revenue base.

Challenges and Operational Focus

Despite the positive earnings report, Orange County Bancorp Inc faces ongoing challenges due to the current high-interest rate environment, which continues to pressure deposit rates and margins. Nevertheless, the bank's management strategies have effectively mitigated these issues, as evidenced by only a minor decrease in net interest margin, which stood at 3.64% for the quarter.

Deposit growth was another area of strength, with total deposits rising by $110.7 million, or 5.4%, driven largely by an increase in lower-cost core deposits. This growth helped the bank reduce its more expensive FHLBNY credit line significantly, from $224.5 million at the end of 2023 to $28 million at the end of the first quarter of 2024.

Looking Ahead

Michael Gilfeather, President and CEO of Orange Bank, expressed optimism about the future, citing the bank's conservative financial posture and readiness to adapt to potential shifts in the interest rate landscape. The bank's strategic initiatives, focusing on relationship banking and tight management of net interest margin, are expected to sustain its industry-leading performance.

As Orange County Bancorp Inc continues to navigate a complex economic environment, its strong Q1 performance and strategic management provide a solid foundation for future growth and stability, reinforcing its commitment to delivering value to clients, shareholders, and the communities it serves.

Explore the complete 8-K earnings release (here) from Orange County Bancorp Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance