Star Group LP (SGU) Fiscal 2024 Q2 Earnings: Revenue Declines Amid Lower Volume Sales

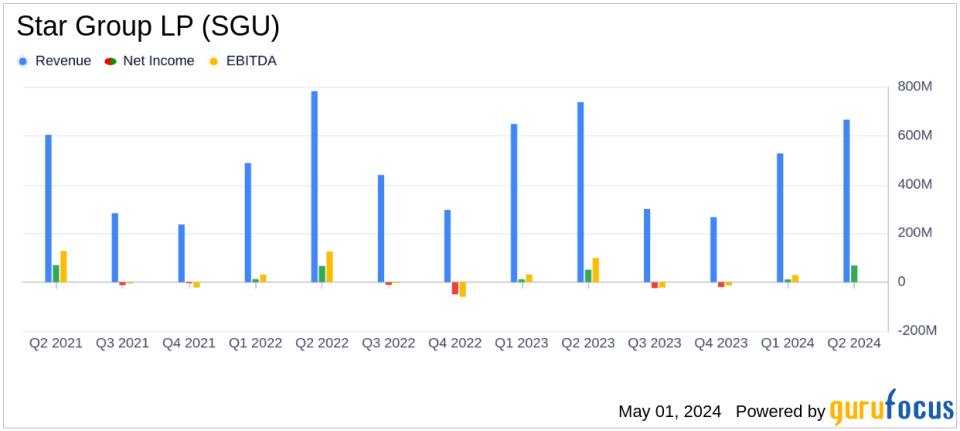

Total Revenue: $666.0M for Q2 2024, a decrease of 9.7% from $737.6M in Q2 2023.

Net Income: Increased by $6.3M to $68.4M in Q2 2024 compared to $62.1M in the previous year.

Adjusted EBITDA: Reported at $96.3M in Q2 2024, down from $102.2M in Q2 2023.

Volume Sold: Home heating oil and propane sales volume decreased by 4.0 million gallons, or 3.3%, to 117.1 million gallons in Q2 2024.

Selling Prices: Decreased by $0.3775 per gallon, or 12.5%, mainly due to lower wholesale product costs.

Interest Expense: Decreased by $1.2M to $3.8M in Q2 2024, contributing to net income growth.

Income Tax Expense: Increased by $3.6M to $27.9M in Q2 2024.

On May 1, 2024, Star Group LP (NYSE:SGU), a leading home energy distributor and services provider, disclosed its financial results for the second quarter of fiscal year 2024, which ended on March 31, 2024. The company reported a decrease in total revenue by 9.7% to $666.0 million from $737.6 million in the same quarter the previous year. This decline was primarily attributed to a decrease in volume sold and lower selling prices for petroleum products. Despite the revenue drop, SGU saw an increase in net income to $68.4 million, up from $62.0 million a year earlier, largely due to favorable changes in the fair value of derivative instruments. The detailed financial outcomes are available in SGU's 8-K filing.

Company Overview

Star Group LP is a prominent provider in the U.S. specializing in the sale of home heating products and services to both residential and commercial customers. The company's offerings include heating and air conditioning equipment, home security, and plumbing services. Additionally, Star Group sells diesel fuel, gasoline, and home heating oil, positioning itself as the nation's largest retail distributor of home heating oil based on sales volume.

Quarterly Performance Insights

The fiscal second quarter saw a 3.3% reduction in the volume of home heating oil and propane sold, totaling 117.1 million gallons. This volume decrease was slightly mitigated by colder weather conditions and recent acquisitions. However, net customer attrition and other factors overshadowed these gains. The average selling prices for petroleum products fell by 12.5%, reflecting a decline in wholesale product costs.

Adjusted EBITDA for the quarter was $96.3 million, a decrease from $102.2 million in the prior year, influenced by the reduced volume sold and a lower weather hedge benefit. Jeff Woosnam, President and CEO of Star Group, commented on the challenges and strategic actions taken during the quarter:

"Temperatures in the second quarter were 15.2 percent warmer than normal throughout Stars footprint. While slightly colder than the same period last year, it was unfortunately not enough to drive higher delivery volumes. However, we were able to mute the impact on adjusted EBITDA, even with a lower weather hedge benefit and some ongoing inflationary pressures, by improving per gallon margins and employing solid expense control."

Woosnam also highlighted the completion of two strategic acquisitions in February and the company's readiness to leverage opportunities in the upcoming summer months.

Financial Position and Future Outlook

As of March 31, 2024, Star Group reported total assets of $939.8 million, with current liabilities amounting to $375.5 million. The company's financial health remains stable with a robust strategy to manage operational challenges and capitalize on market opportunities.

Looking ahead, Star Group is focused on enhancing its service offerings, improving customer retention, and executing strategic acquisitions to bolster its market position. The management will discuss these results and future strategies in more detail during their webcast and conference call scheduled for May 2, 2024.

This earnings report reflects a resilient performance by Star Group LP amidst challenging market conditions, highlighting its ability to adapt and strategically navigate through cyclical industry dynamics.

Explore the complete 8-K earnings release (here) from Star Group LP for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance