FAT Brands Inc. Posts Mixed Q1 2024 Results: Revenue Surges but Net Loss Widens

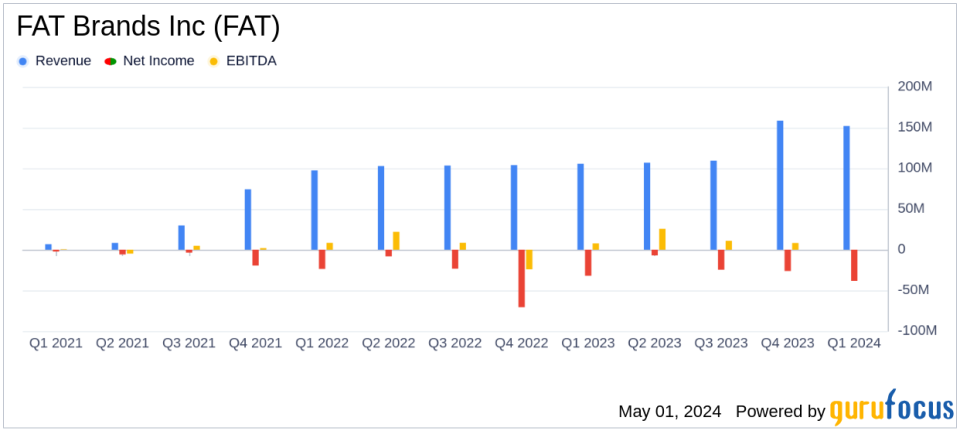

Revenue: Reached $152.0 million, marking a 43.8% increase year-over-year, and short of the estimate of $157.68 million.

Net Loss: Reported at $38.3 million, or $2.37 per diluted share, which is above the estimated net loss of $19.15 million and estimated EPS of -$1.15.

Store Openings: Added 16 new store locations during the quarter, contributing to an expanded global presence.

Same-Store Sales: Experienced a decline of 4.0% in same-store sales compared to the previous year.

Adjusted EBITDA: Recorded at $18.2 million, slightly below the previous year's $19.2 million.

Strategic Developments: Signed over 150 development deals, boosting the pipeline to more than 1,200 locations and initiated a strategic deal for 40 co-branded locations.

Debt and Financing: Interest expenses increased due to new debt offerings, totaling $34.0 million for the quarter.

FAT Brands Inc. (NASDAQ:FAT) disclosed its financial outcomes for the first quarter of 2024 on May 1, 2024, revealing a significant revenue increase but a deeper net loss than anticipated. The details were released in their recent 8-K filing.

FAT Brands Inc., a prominent multi-brand restaurant franchising company, operates globally with a portfolio that includes Round Table Pizza, Fatburger, Johnny Rockets, and Twin Peaks among others. The company primarily earns through franchising, charging initial fees and ongoing royalties, while also managing some direct restaurant operations.

Financial Performance Overview

The first quarter of 2024 saw FAT Brands' total revenue jump to $152.0 million, up 43.8% from $105.7 million in the same quarter the previous year, primarily driven by the acquisition of Smokey Bones. However, this was slightly below the analyst expectations of $157.68 million. The net loss widened to $38.3 million, or $2.37 per diluted share, from $32.1 million, or $2.05 per diluted share, year-over-year, surpassing the anticipated loss of $19.15 million.

Despite the revenue growth, the company faced challenges with increased costs and expenses, which rose by 45.6% to $153.3 million, primarily due to the Smokey Bones acquisition and higher operating costs at company-owned locations. This escalation in expenses contributed to the widening of the net loss.

Operational Highlights and Strategic Moves

During the quarter, FAT Brands continued to expand its global footprint, opening 16 new stores and signing over 150 development deals, increasing its pipeline to over 1,200 locations. This expansion includes strategic plans for the Twin Peaks brand, with three new lodges opened and 15-20 more expected by the end of 2024.

Rob Rosen, Co-Chief Executive Officer of FAT Brands, highlighted the abundance of opportunities in 2024, focusing on organic expansion, strategic acquisitions, and value creation through strategic divestments to manage debt and enhance stakeholder value.

Key Financial Metrics and Adjustments

The adjusted EBITDA for the quarter stood at $18.2 million, a slight decrease from $19.2 million in the prior year. The company also reported an adjusted net loss of $32.9 million, or $2.05 per diluted share, compared to an adjusted net loss of $23.5 million, or $1.53 per diluted share, in the first quarter of 2023.

These financial adjustments reflect FAT Brands' efforts to provide a clearer picture of its operating performance by excluding non-recurring costs and benefits that do not directly reflect ongoing operations.

Looking Ahead

While FAT Brands faces challenges with increasing costs and a widening net loss, its aggressive expansion strategy and the integration of new acquisitions like Smokey Bones may set the stage for improved performance in the upcoming quarters. However, the company will need to carefully manage its expenses and operational efficiencies to return to profitability and meet stakeholder expectations.

Investors and stakeholders will likely keep a close eye on how FAT Brands balances growth initiatives with cost management in a bid to improve its bottom line in a competitive and ever-evolving restaurant industry landscape.

Explore the complete 8-K earnings release (here) from FAT Brands Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance