Schrodinger Inc (SDGR) Misses Revenue Expectations in Q1 2024

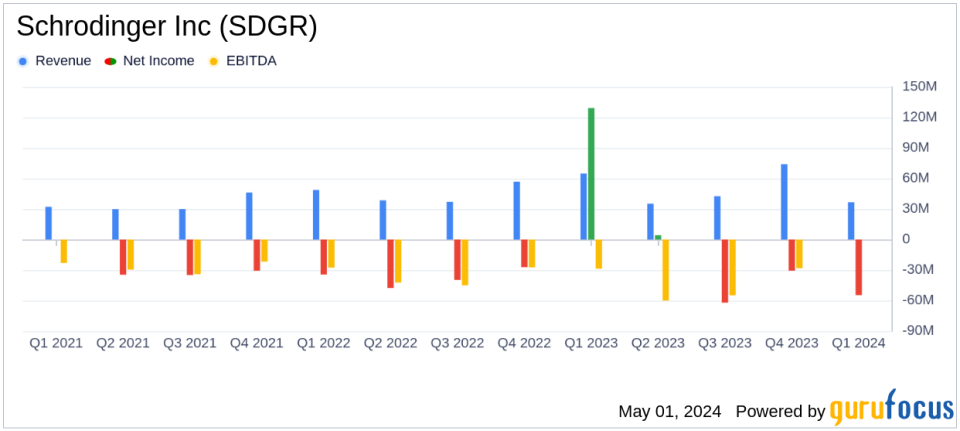

Total Revenue: Reported $36.6 million, a decrease of 44% year-over-year, falling short of estimates of $41.97 million.

Net Loss: Recorded at $54.7 million, compared to net income of $129.1 million in the prior year, and worse than the estimated net loss of $55.94 million.

Earnings Per Share (EPS): Reported a loss of $0.76 per share, slightly worse than the estimated loss of $0.75 per share.

Software Revenue: Increased by 3.7% to $33.4 million, reflecting a growing contribution from hosted licenses.

Drug Discovery Revenue: Drastically reduced to $3.2 million from $32.6 million in the prior year, due to the absence of large collaboration milestone payments.

Operating Expenses: Rose to $86.3 million, up 13% from $76.2 million in the prior year, primarily due to higher R&D expenses.

Cash Reserves: Ended the quarter with $435.7 million in cash, cash equivalents, restricted cash, and marketable securities, down from $468.8 million at the end of the previous quarter.

Schrodinger Inc (NASDAQ:SDGR) released its 8-K filing on May 1, 2024, revealing a challenging first quarter with total revenue falling significantly year-over-year, missing analyst expectations. The company, known for its computational platform aimed at transforming therapeutics and materials discovery, reported a total revenue of $36.6 million, a sharp decline from $64.8 million in the same period last year.

Schrodinger Inc operates through two segments: Software and Drug Discovery. The Software segment, despite the overall revenue dip, saw a modest increase of 3.7%, generating $33.4 million, primarily from hosted licenses. However, the Drug Discovery segment experienced a significant drop, earning just $3.2 million compared to $32.6 million in Q1 2023, attributed to the absence of large collaboration milestone payments received last year.

Financial Performance and Market Challenges

The company's operating expenses surged to $86.3 million from $76.2 million, driven by increased R&D expenditures. This escalation in spending, alongside reduced milestone payments, contributed to a net loss of $54.7 million, a stark contrast to the net income of $129.1 million reported in the prior year's first quarter. The software gross margin also slightly decreased to 76% from 78%, impacted by higher technology costs.

CEO Ramy Farid highlighted the growing interest in computational drug discovery and the company's efforts to enhance customer adoption and revenue growth. Despite the setbacks, Schrodinger remains optimistic about its proprietary pipeline, including the FDA clearance of its IND application for SGR-3515, a novel Wee1/Myt1 inhibitor expected to enter Phase 1 clinical trials this year.

Strategic Developments and Future Outlook

Amid these financial fluctuations, Schrodinger continues to innovate, as demonstrated by the launch of LiveDesign Biologics and advancements in its drug discovery pipeline. The company maintains its financial guidance for 2024, projecting a software revenue growth between 6% to 13% and drug discovery revenue ranging from $30 million to $35 million.

Furthermore, Schrodinger's balance sheet remains robust with approximately $435.7 million in cash, cash equivalents, and marketable securities, ensuring ample resources to support ongoing research and development activities.

Analysis and Investor Implications

While the first quarter of 2024 posed challenges, particularly in drug discovery revenue, Schrodinger's sustained investment in R&D and strategic initiatives like the LiveDesign platform may bolster long-term growth. Investors should consider the potential volatility from fluctuating milestone payments and the outcomes of upcoming clinical trials which could significantly impact future performance.

As Schrodinger navigates through these challenges, the company's ability to leverage its computational platform and expand its software segment will be critical in achieving sustained growth and profitability.

Explore the complete 8-K earnings release (here) from Schrodinger Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance