National Storage Affiliates Trust Surpasses Q1 Earnings Projections with Significant Net Income ...

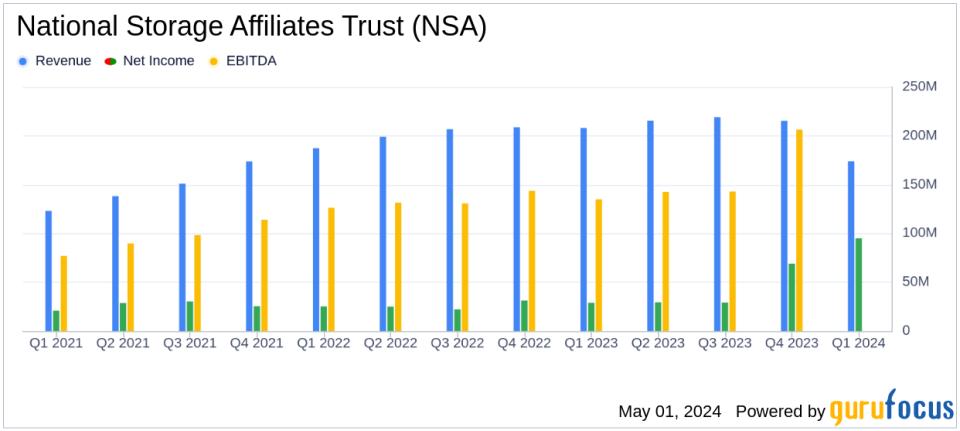

Net Income: Reported $95.1 million, a significant increase of 135.4% from the previous year, far exceeding the estimated $35.02 million.

Earnings Per Share (EPS): Diluted EPS reached $0.65, surpassing the estimated $0.32, marking a substantial growth from $0.24 year-over-year.

Revenue: Total revenue amounted to $196.1 million, slightly above the estimate of $191.02 million.

Same-Store Net Operating Income (NOI): Experienced a decline of 3.7% due to a decrease in occupancy and increased operating expenses.

Share Repurchase: Repurchased approximately 5.49 million shares for $203.5 million, demonstrating strong capital return to shareholders.

Property Sales: Completed the sale of 71 self-storage properties for approximately $540 million, enhancing liquidity and capital allocation efficiency.

Joint Venture: Formed a new joint venture contributing 56 properties valued at approximately $346.5 million, indicating strategic portfolio management and investment.

On May 1, 2024, National Storage Affiliates Trust (NYSE:NSA) released its first quarter results for 2024, showcasing a substantial increase in net income and a strategic expansion in operations. The detailed financial outcomes are accessible through NSA's 8-K filing.

National Storage Affiliates Trust, a prominent real estate investment trust, focuses on acquiring, owning, and managing self-storage properties across the United States. Operating under brands such as iStorage, SecurCare, Northwest, and Move It, NSA leverages a robust property management platform to optimize the performance of its extensive portfolio.

Financial Highlights and Performance Metrics

For Q1 2024, NSA reported a remarkable net income of $95.1 million, a 135.4% increase from Q1 2023's $40.4 million, significantly outpacing analyst estimates of $35.02 million. This surge was primarily fueled by gains from the sale of 39 self-storage properties and contributions to a new joint venture. Diluted earnings per share also saw a substantial rise to $0.65, up from $0.24 in the same quarter last year, exceeding the expected $0.32.

Despite these gains, NSA experienced a 9.1% decline in Core Funds from Operations (Core FFO) per share, now at $0.60, reflecting challenges in same-store net operating income (NOI) which decreased by 3.7%. This was attributed to a 1.5% drop in same-store total revenues and a 4.5% increase in same-store property operating expenses. The same-store period-end occupancy also declined to 85.9%, a decrease of 350 basis points.

The company's strategic activities included the repurchase of 5,491,925 shares for approximately $203.5 million and the formation of a new joint venture, contributing 56 properties valued at approximately $346.5 million. These moves are part of NSAs broader strategy to optimize its portfolio and shareholder value amidst fluctuating market conditions.

Operational and Strategic Developments

NSA's operational strategy in the challenging market involved significant asset rotation, including the sale of 71 properties and the strategic formation of a joint venture, which collectively aim to streamline operations and focus on high-potential markets. The company's proactive management of expenses and strategic dispositions are geared towards sustaining profitability and competitiveness.

David Cramer, President and CEO of NSA, emphasized the strategic milestones achieved during the quarter, stating:

We completed a handful of strategic milestones during the first quarter, which places NSA in a position to thrive as business fundamentals and capital markets improve. Were excited about the medium- and long-term outlook for both NSA and the self-storage sector in general.

He also highlighted the operational challenges, adding:

Our team performed well in what remains a challenging operating environment characterized by continued pressure on street rates and significant competition to attract new customers. Rental volume and occupancy are increasing from the seasonal trough in February, but the next few months will be key determinants of full-year performance.

Future Outlook and Guidance

Looking ahead, NSA reaffirms its Core FFO guidance for 2024, projecting a range of $2.40 to $2.56 per share. The company anticipates variations in same-store revenue growth and property operating expenses, reflecting ongoing market adjustments and operational optimization efforts.

Overall, NSA's first quarter results reflect a robust strategic response to a dynamic market, underscored by significant income growth and proactive portfolio management. As the company continues to navigate market challenges, its strategic initiatives are expected to bolster long-term growth and shareholder value.

For further details on NSAs financial performance and strategic initiatives, investors and interested parties are encouraged to view the full earnings release and supplemental financial information available on NSAs investor relations website.

Explore the complete 8-K earnings release (here) from National Storage Affiliates Trust for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance