Tenable Holdings Inc (TENB) Surpasses Revenue Estimates in Q1 2024, Showcases Robust Growth

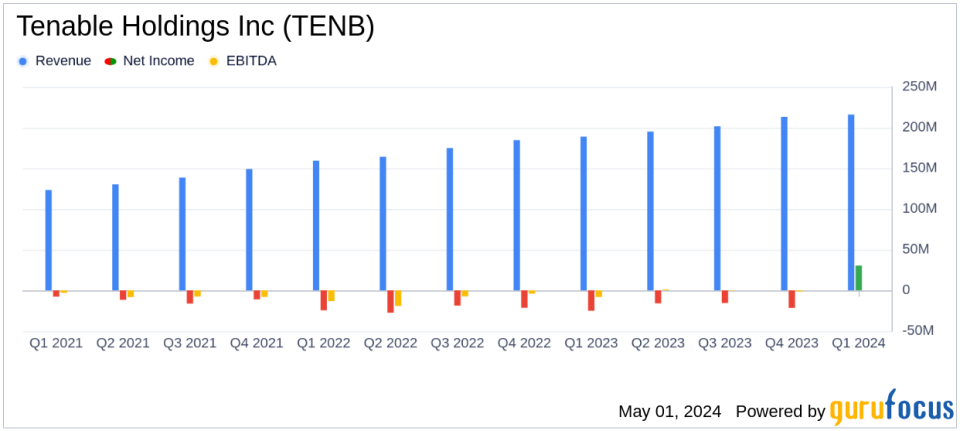

Revenue: Reported $216.0 million, up 14% year-over-year, surpassing estimates of $213.57 million.

Net Income: Non-GAAP net income reached $30.4 million, significantly exceeding the estimated $21.56 million.

Earnings Per Share: Non-GAAP diluted EPS was $0.25, surpassing the estimated $0.18.

Operating Margin: Non-GAAP operating margin improved to 17%, demonstrating strong operational efficiency.

Free Cash Flow: Unlevered free cash flow was $54.7 million, indicating robust cash generation capabilities.

Customer Growth: Added 410 new enterprise platform customers, highlighting expanding market penetration.

Stock Repurchase: Repurchased 0.5 million shares for $25.0 million, reflecting confidence in the company's financial health and future prospects.

On May 1, 2024, Tenable Holdings Inc (NASDAQ:TENB) released its 8-K filing, announcing the financial results for the first quarter ended March 31, 2024. The cybersecurity leader reported a revenue of $216.0 million, marking a 14% increase year-over-year and surpassing the estimated $213.57 million. This growth is attributed to the strong performance of its exposure management solutions, including Tenable One and Cloud Native Application Protection Platform.

Founded in 2002, Maryland-based Tenable is renowned for its vulnerability management solutions, initially through its Nessus software. Over the years, the company has expanded its offerings to include a comprehensive range of exposure management modules, catering to diverse cybersecurity needs across cloud security, compliance, and operational technology.

Financial Highlights and Operational Achievements

The first quarter saw Tenable achieve a non-GAAP net income of $30.4 million, significantly up from $13.1 million in the previous year, with a non-GAAP diluted earnings per share of $0.25, which exceeded the analyst estimate of $0.18. This performance underscores the company's effective operational execution and growth strategy. The GAAP net loss improved to $14.4 million from $25.1 million year-over-year, reflecting stringent cost management and operational efficiency.

Tenable's calculated current billings stood at $197.8 million, a 12% increase from the previous year, driven by robust customer acquisition and retention strategies. The company added 410 new enterprise platform customers, although it noted a slight decrease in net new six-figure customers. The financial period also highlighted a strong cash position, with net cash provided by operating activities reaching $50.3 million and unlevered free cash flow at $54.7 million.

Strategic Developments and Market Position

The quarter was marked by significant strategic developments, including the launch of Tenable One for OT/IoT Security, enhancing the company's leadership in exposure management across IT and operational technologies. Tenable's market position was further solidified by Moodys and S&Ps credit rating upgrades, reflecting improved financial stability and market confidence.

CEO Amit Yoran emphasized the traction in Tenable's unified platform and the resonance of their solutions with customers, aiming for a unified view of risks in interconnected environments. This strategic focus is expected to continue driving growth and customer engagement in upcoming quarters.

Looking Forward

For Q2 2024, Tenable projects revenue between $217.0 million and $219.0 million and non-GAAP net income between $28.0 million and $30.0 million. The full-year outlook anticipates revenue in the range of $900.0 million to $908.0 million and non-GAAP net income between $135.0 million and $140.0 million. These projections reflect Tenable's confidence in its operational strategies and market demand for its comprehensive exposure management solutions.

In conclusion, Tenable Holdings Inc's Q1 2024 results not only surpassed revenue expectations but also demonstrated significant profitability improvements and strategic advancements in cybersecurity solutions. The company's robust financial health and strategic initiatives position it well for sustained growth in the competitive cybersecurity market.

Explore the complete 8-K earnings release (here) from Tenable Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance