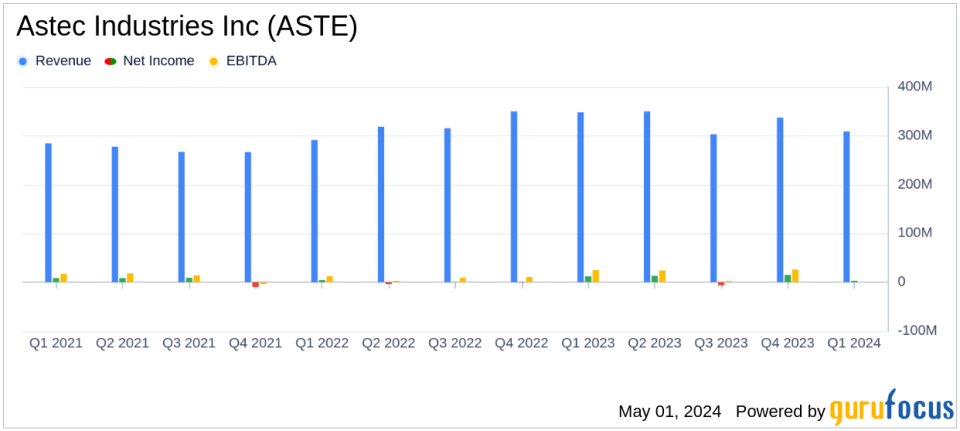

Astec Industries Inc (ASTE) Q1 2024 Earnings: Significant Miss on Revenue and EPS Projections

Revenue: Reported at $309.2 million, down 11.1% year-over-year, falling short of estimates of $343.27 million.

Net Income: Recorded at $3.4 million, a significant decrease of 71.9% from the previous year, and well below the estimated $18.10 million.

Earnings Per Share (EPS): Diluted EPS at $0.15, showing a sharp decline from $0.53 year-over-year and significantly below the estimated $0.81.

Backlog: Stood at $559.8 million, down 30% from the previous year, indicating potential future revenue challenges.

Gross Margin: Decreased by 70 basis points to 24.9%, reflecting tighter profitability.

Operating Margin: Fell to 2.0%, a decline of 310 basis points from the previous year, highlighting increased operational pressures.

Adjusted Net Income: At $7.8 million, down 62% from the previous year, reflecting ongoing operational and market challenges.

Astec Industries Inc (NASDAQ:ASTE) disclosed its first quarter results for 2024 on May 1, 2024, revealing a notable decline in performance compared to the same period last year. The company's financials fell short of analyst expectations, with net sales dropping 11.1% to $309.2 million against an estimated $343.27 million. Earnings per share (EPS) also decreased significantly, with reported EPS of $0.15 and adjusted EPS of $0.34, both well below the anticipated $0.81. For further details, refer to Astec's 8-K filing.

Astec Industries Inc, a key player in the road construction and development equipment sector, manufactures a range of products essential for building roads, from the initial mining and crushing of materials to the final road surface preparation. The company operates primarily through its Infrastructure Solutions and Materials Solutions segments, with the majority of its revenue generated within the United States.

Performance Overview and Market Challenges

The first quarter saw a sequential increase in orders by 2.4%, and the backlog approached a historical range with $559.8 million as of March 31, 2024. However, this was overshadowed by a 30% year-over-year reduction in backlog and a significant drop in net sales, primarily due to fewer conversions in the Materials Solutions segment. This segment was particularly impacted by finance capacity constraints and a challenging interest rate environment. The Infrastructure Solutions segment also faced delays due to supply chain issues but is expected to recover with shipments resuming in the second quarter.

CEO Jaco van der Merwe highlighted the ongoing challenges, particularly in the Materials Solutions segment, which are expected to persist into the first half of the year. Despite these challenges, there is optimism for recovery and growth in the latter part of the year, supported by strong demand for asphalt and concrete plants and robust federal, state, and local project activity.

Financial Health and Strategic Initiatives

The company's operating margin decreased significantly, from 5.1% to 2.0%, primarily due to a slight decrease in gross margin and increased expenses related to personnel. Despite these setbacks, Astec remains committed to enhancing its margin and improving working capital through strategic initiatives, including expanding collaborations with dealers and rolling out new products in 2024.

The adjusted financial metrics, which exclude certain incremental costs, also reflected downturns with adjusted income from operations and adjusted EBITDA decreasing by 57.9% and 46.3%, respectively. These adjustments were necessary to provide a clearer picture of the company's operating performance excluding one-time transformation program costs.

Liquidity and Capital Management

Astec reported total liquidity of $170.5 million, comprising cash and available credit facilities. The company used $47.0 million in operating activities during the quarter, mainly to support trade receivables and inventory purchases. Capital expenditures were focused on increasing capacity and improving efficiency, totaling $5.8 million for the quarter.

In conclusion, while Astec Industries Inc faces significant near-term challenges, its strategic initiatives and market position may support a recovery in the coming periods. Investors and stakeholders will likely watch closely how the company navigates these hurdles and capitalizes on potential market opportunities.

For more detailed financial information and future updates, investors are encouraged to follow Astec's filings and announcements.

Explore the complete 8-K earnings release (here) from Astec Industries Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance