Ares Capital Corp (ARCC) Q1 2024 Earnings: Surpasses Analyst EPS Forecasts with Strong ...

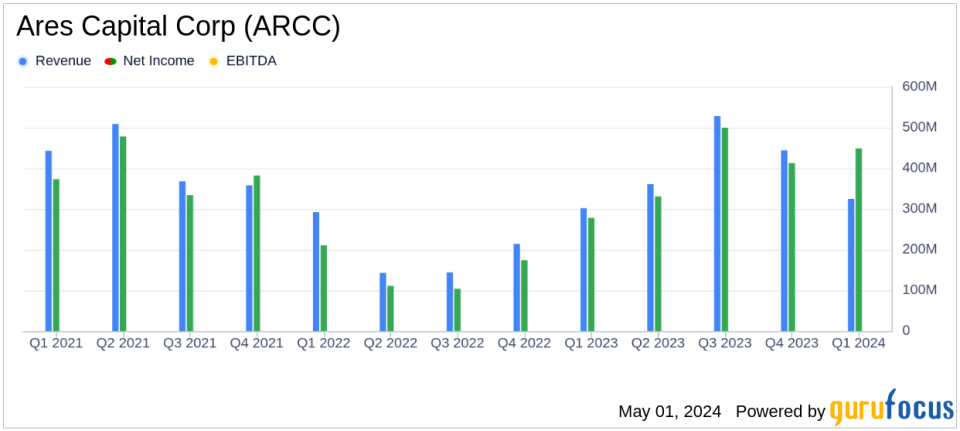

GAAP Net Income: Reported at $449 million for Q1 2024, significantly exceeding the estimated $346.08 million.

Earnings Per Share (EPS): GAAP EPS stood at $0.76, surpassing the estimated $0.60.

Revenue: Total investment income reached $701 million, exceeding the forecast of $700.13 million.

Dividend: Declared a Q2 2024 dividend of $0.48 per share, consistent with the previous quarter.

Portfolio Growth: Portfolio investments at fair value increased to $23,124 million as of March 31, 2024, from $22,874 million at the end of 2023.

Debt to Equity Ratio: Improved to 0.99x from 1.07x at the end of the previous quarter, indicating better financial leverage.

Net Asset Value: Increased to $19.53 per share from $19.24 at the end of December 2023.

Ares Capital Corp (NASDAQ:ARCC) released its 8-K filing on May 1, 2024, revealing a robust financial performance for the first quarter ended March 31, 2024. The company reported a GAAP net income per share of $0.76, significantly surpassing the analyst estimate of $0.60 per share. This performance underscores ARCC's effective investment strategies and operational efficiency in a dynamic market environment.

About Ares Capital Corp (NASDAQ:ARCC)

Ares Capital Corp, a leading specialty finance company in the United States, focuses on direct loans and other investments in private middle-market companies. With an investment objective aimed at generating both current income and capital appreciation, ARCC predominantly invests in first and second lien senior secured loans and mezzanine debt, which may include equity components. The company's portfolio is diversified across various industries and sectors, emphasizing its role in fostering business growth and employment in the middle market segment.

Financial Highlights and Portfolio Performance

For Q1 2024, ARCC reported net investment income of $325 million, or $0.55 per share, which aligns closely with the previous year's performance. The company's portfolio investments at fair value stood at $23.124 billion as of March 31, 2024, showing a slight increase from $22.874 billion at the end of 2023. This growth is attributed to new investment commitments totaling approximately $3.6 billion during the quarter, highlighting ARCC's aggressive strategy in capital deployment and portfolio expansion.

The company's balance sheet remains robust with total assets amounting to $24.256 billion and stockholders' equity at $11.872 billion, translating to a net asset value per share of $19.53. The debt-to-equity ratio improved to 0.99x from 1.07x at the end of 2023, reflecting prudent leverage management and a strong capital structure.

Strategic Developments and Market Positioning

ARCC's management, led by CEO Kipp deVeer and CFO Scott Lem, emphasized the company's strong start to the year, driven by healthy earnings levels and strategic financing activities. Over $7 billion of financing was issued, amended, or renewed during the quarter, enhancing ARCC's capital base and supporting further investment activities. The company's competitive advantages in the middle market lending space, coupled with a nearly 20-year track record, position it well for continued success and attractive investment returns.

Furthermore, ARCC declared a second quarter 2024 dividend of $0.48 per share, consistent with the previous quarter, underscoring its commitment to delivering shareholder value through regular dividend payments.

Operational Challenges and Outlook

Despite the positive outcomes, ARCC faces challenges such as market volatility and competitive pressures in the middle market lending space. However, the company's diversified investment approach and strong risk management practices are expected to navigate these challenges effectively. Looking ahead, ARCC is well-positioned to capitalize on growth opportunities with over $6 billion of available capital and leverage levels below 1.0x, providing flexibility to support its investment strategies in the current market environment.

In conclusion, Ares Capital Corp's Q1 2024 performance not only exceeded earnings expectations but also demonstrated strategic foresight in portfolio management and capital deployment. As the company continues to leverage its robust platform and market coverage, it remains a compelling choice for investors seeking exposure to middle-market credit opportunities.

Explore the complete 8-K earnings release (here) from Ares Capital Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance