American Assets Trust Inc Surpasses Analyst Net Income Forecasts and Aligns with EPS ...

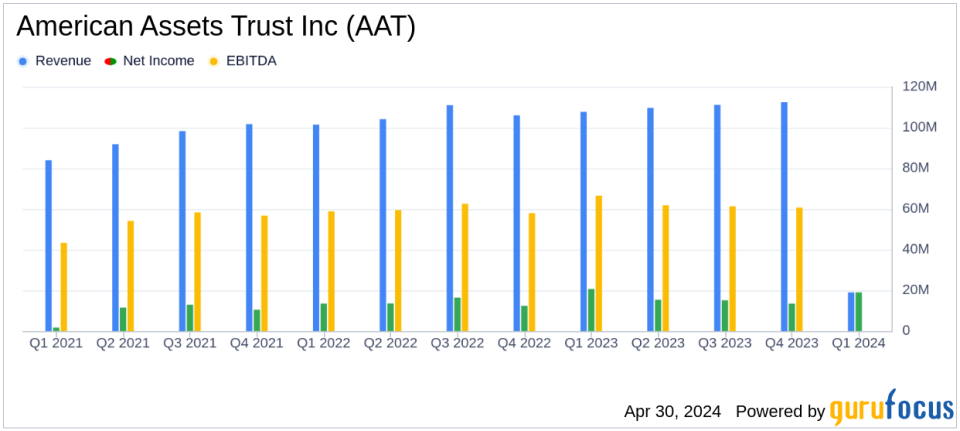

Net Income: Reported at $19.3 million for Q1 2024, surpassing the estimated $18.21 million.

Earnings Per Share (EPS): Achieved $0.32 per diluted share, exceeding the estimated $0.26.

Funds from Operations (FFO) Per Diluted Share: Increased to $0.71, up 8% year-over-year.

Revenue: Specific revenue figures for Q1 2024 were not disclosed, comparison to the estimated $110.51 million cannot be made.

Same-Store Cash Net Operating Income (NOI): Grew by 1.5% year-over-year; adjusted for non-recurring costs, the increase was 2.3%.

Guidance for 2024 FFO Per Diluted Share: Raised to a range of $2.24 to $2.34, marking a 1% increase from prior midpoint estimates.

Leasing Activity: Notable increases in leased square footage with office and retail spaces showing average rent increases of 11% and 22% on a straight-line basis, respectively.

On April 30, 2024, American Assets Trust Inc (NYSE:AAT), a prominent real estate investment trust, announced its financial results for the first quarter ended March 31, 2024, through its 8-K filing. The company reported a net income of $19.3 million, or $0.32 per diluted share, surpassing the analyst's estimated net income of $18.21 million and aligning closely with the estimated earnings per share of $0.26. This performance indicates a robust operational stance amidst varying market conditions.

Company Overview

American Assets Trust Inc is a self-administered real estate investment trust based in the United States, focusing on acquiring, operating, and developing retail, office, residential, and mixed-use properties primarily in high-demand markets of Southern California, Northern California, Oregon, Washington, and Hawaii. The company operates through four segments: retail; office; mixed-use, which includes retail and hotel components; and multifamily, encompassing its apartment properties.

Financial Highlights and Operational Performance

The first quarter saw an increase in Funds from Operations (FFO) per diluted share by 8% year-over-year to $0.71. This growth is attributed to a $10 million settlement payment related to building specifications at one of its office projects and higher annualized base rents in its office segment. However, these gains were partially offset by a $6.3 million net settlement payment and increased net interest expenses.

The company also revised its 2024 FFO per diluted share guidance upwards to a range of $2.24 to $2.34, reflecting a 1% increase from prior projections. This adjustment suggests management's confidence in the company's ongoing financial health and market position.

Leasing and Portfolio Management

During the quarter, American Assets Trust signed 48 leases covering approximately 234,000 square feet of office and retail space, and 326 multifamily apartment leases. Notably, the office and retail segments saw average rent increases on a straight-line basis of 10.9% and 22.3%, respectively, indicating strong leasing momentum and effective portfolio management.

As of March 31, 2024, the total portfolio occupancy rates showed improvement across most segments, with retail properties at 94.4% and multifamily units at 92.8%. These figures represent a stable operational framework capable of sustaining revenue growth.

Balance Sheet Strength

The company's balance sheet as of March 31, 2024, remains robust, with gross real estate assets valued at $3.8 billion and liquidity of $498.6 million. This financial stability is critical for future growth initiatives and operational flexibility.

Dividends and Forward Guidance

Reflecting its solid financial position, American Assets Trust declared a dividend of $0.335 per share for the first quarter, paid on March 21, 2024, with a similar dividend announced for the second quarter to be paid on June 20, 2024. The increase in FFO guidance for 2024 underscores the company's optimistic outlook and commitment to delivering shareholder value.

Conclusion

American Assets Trust Inc's first quarter results demonstrate a strong financial and operational position. The company's ability to exceed net income expectations and align closely with EPS estimates, combined with strategic portfolio management and upward revisions in FFO guidance, positions it well for sustained growth in the competitive real estate market. Investors and stakeholders may look forward to continued robust performance as the company leverages its market expertise and strategic asset base.

Investor and Media Contact

For further details, investors and interested parties are encouraged to contact Robert F. Barton, Executive Vice President and Chief Financial Officer, at 858-350-2607.

Explore the complete 8-K earnings release (here) from American Assets Trust Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance