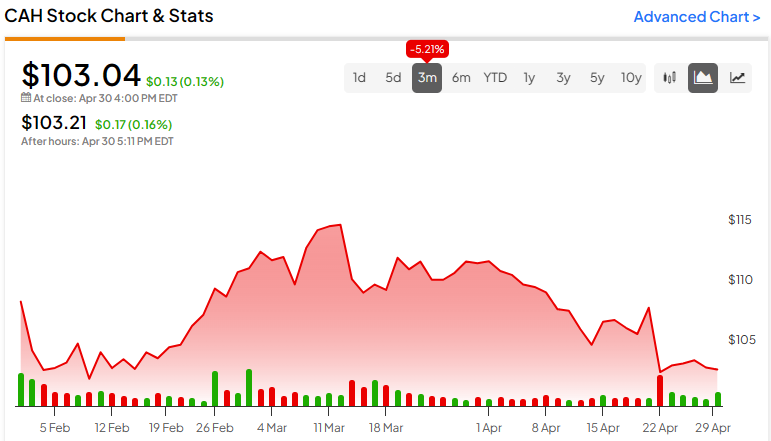

Cardinal Health (NYSE:CAH) stock has given back some of its gains in recent weeks, and I believe that has created a buying opportunity. The stock trades at an attractive 14.2x forward earnings and has a price-to-earnings-to-growth (PEG) ratio of 0.98x, indicating that it’s undervalued when factoring in growth expectations. It’s also a behemoth in its industry and deserves to trade at a premium, given its dominant market positioning. Therefore, I am bullish on the stock for the long term.

Cardinal Health Is a Behemoth

Cardinal Health is a major American healthcare product and service distributor, focusing on distributing pharmaceuticals and medical supplies to a huge network of over 48,000 partners and clients. Cardinal Health also manufactures some medical and pharmaceutical products.

The Dublin, Ohio-based company is one of the so-called Big Three, with Cardinal, Cencora (NYSE:COR), and McKesson Corporation (NYSE:MCK) accounting for over 90% of wholesale drug distribution in the U.S. It’s got scale and is the 13th largest U.S.-listed stock by revenue. Notably, with revenues over $215 billion, the company’s forward price-to-sales ratio ratio is just 0.12x.

In addition to its sheer size, part of the stock’s allure relates to the resilience and long-term growth within the sectors it serves. Its business spans pharmaceuticals, surgical products, and procedure kits, but subsectors like surgical consumables represent huge repeat markets. For context, according to a 2017 study from the National Library of Medicine, 64 million surgeries are undertaken in the U.S. every year. That’s a huge market and a steady sales pipeline for everything from gowns to clippers.

Moreover, its size does allow it to benefit from economies of scale, and with 21,000 SKUs and approximately 1,200 varied manufacturers, Cardinal Health can negotiate to pay less for products it buys, increasing its margins. In 2014, it also started a joint venture with CVS Health (NYSE:CVS), creating one of the biggest generics purchasing arrangements in the U.S., capturing a third of the market by volume.

It’s this scale and the stability of its operations that have allowed Cardinal Health to pay a dividend for 29 consecutive years. However, it’s worth noting that CAH’s dividend yield of 1.93% isn’t much to write home about. It is, nonetheless, covered more than three times by earnings. It’s a very safe-looking dividend.

Is Cardinal Health Stock Undervalued?

There is a long-term driver behind most investments in healthcare, and that’s the fact that Western populations are aging. We’re living longer on average — with the exception of a blip during the pandemic years — and treatment and drugs are part of the reasons for this. It’s certainly not because of our diets. All of this means that demand for healthcare products is likely to rise. I’d also suggest that advances in healthcare technology may allow Cardinal Health to increase its offering over the long run, too.

From a growth perspective, earnings per share are expected to grow at 14.4% over the medium term — that’s the next three to five years. Clearly, this is a rather strong forecast and is seemingly reflective of the long-term drivers in its favor.

Currently, Cardinal Health is trading at 14.2x forward earnings, which actually puts it at a significant discount to both Cencora and McKesson Corporation, which trade at 17.6x and 19.2x, respectively. Cardinal’s forward price-to-earnings (P/E) ratio also falls as we move forward, given the expected growth rate. The stock is trading at 13.2x projected earnings for 2025 and 12.1x forecasted earnings for 2026.

Finally, coming to the all-important PEG ratio, which is calculated by dividing the forward P/E ratio by the expected growth rate for the medium term. Currently, we can see that Cardinal Health has a PEG ratio of 0.98x, inferring that the stock is undervalued.

Traditionally, a PEG ratio under 1.0x suggests a company is undervalued, but it can be challenging to find stocks with PEG ratios this low in the current market. It’s also worth remembering that the PEG ratio doesn’t take into account returns in the form of dividends.

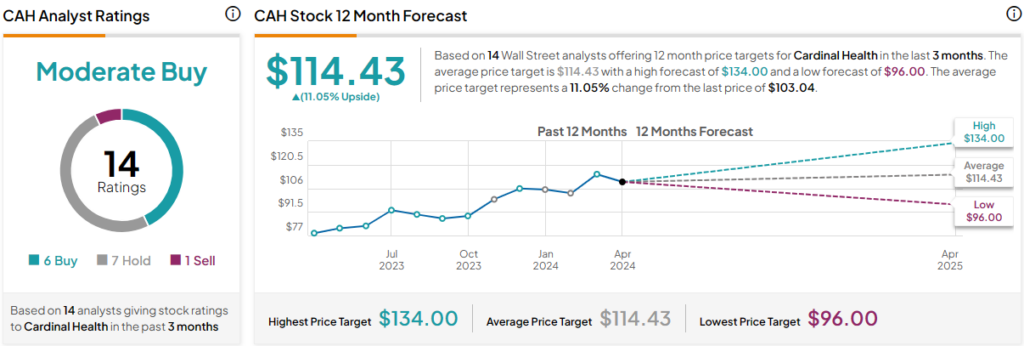

Is Cardinal Health Stock a Buy, According to Analysts?

Cardinal Health stock is rated a Moderate Buy on TipRanks based on six Buys, seven Holds, and one Sell rating assigned by analysts in the past three months. The average CAH stock price target is $114.43, implying 11.05% upside potential, with a high forecast of $134.00 and a low forecast of $96.00. It’s reassuring to see that the lowest price target only represents a small downside from the current position.

The Bottom Line on Cardinal Health Stock

Cardinal Health shares have returned some of their gains in recent weeks, but this may represent a strong buying opportunity. The company is a steady behemoth of the healthcare world, with a huge network and extensive reach. The stock is also trading at an attractive valuation, representing a discount versus its Big Three peers, and offers a PEG ratio under 1.0x. But buying Cardinal Health stock is also about the long run. Aging populations and healthcare advances represent long-term drivers that will fuel demand over the next 10 to 20 years.