LPL Financial Holdings Inc. (LPLA) Q1 2024 Earnings: Aligns with EPS Projections, Surpasses ...

Net Income: Reported at $289 million, falling short of estimates of $295.81 million.

Earnings Per Share (EPS): Achieved $3.83, slightly surpassing the estimated $3.81.

Revenue: Totalled $2.83 billion, exceeding the forecast of $2.71 billion.

Gross Profit: Increased by 5% year-over-year to $1.07 billion.

Advisory Assets: Grew 28% year-over-year, reaching $793 billion.

Dividend: Announced a quarterly dividend of $0.30 per share, payable on June 4, 2024.

Acquisitions: Completed the acquisition of Crown Capital and announced agreements to acquire Atria Wealth Solutions and transition Wintrust Financial Corporation's wealth management business.

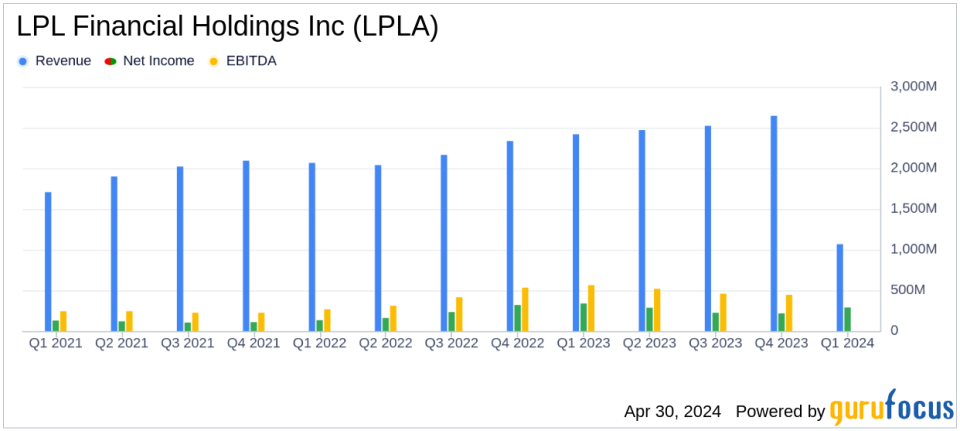

LPL Financial Holdings Inc. (NASDAQ:LPLA) disclosed its first quarter earnings for 2024 on April 30, 2024, revealing a net income of $289 million and diluted earnings per share (EPS) of $3.83. These figures align closely with analyst expectations, which projected an EPS of $3.81. Notably, the company's revenue for the quarter stood at $2,832.59 million, exceeding the estimated $2,707.60 million, showcasing a robust growth trajectory. The detailed financial outcomes can be explored in LPL Financial's recent 8-K filing.

LPL Financial Holdings operates as an independent broker/dealer, providing a comprehensive platform of proprietary technology, brokerage, and investment advisory services. As of the end of 2023, the firm supported over 20,000 advisors managing more than $1.3 trillion in client assets. This extensive network plays a crucial role in the financial advisory landscape.

Financial and Business Highlights

The first quarter saw a decrease in net income by 10% year-over-year from $339 million in Q1 2023 to $289 million. Despite this, the company achieved a 5% increase in gross profit year-over-year, totaling $1,066 million. However, challenges were evident as the adjusted EBITDA saw a 5% decline to $541 million. The firm attributes these dynamics to strategic investments and enhancements in its service offerings, which are integral to long-term growth.

On the business front, LPL Financial reported a significant 23% increase in total advisory and brokerage assets, reaching $1.44 trillion. The growth in advisory assets was particularly strong at 28% year-over-year. This increase underscores the firm's expanding influence and effectiveness in attracting and retaining advisory assets, which now constitute 55.0% of total assets, up from 52.8% a year ago.

Strategic Developments and Future Outlook

During the quarter, LPL Financial announced several strategic initiatives aimed at bolstering its market position. Notable among these is the agreement to acquire Atria Wealth Solutions, which is expected to close in the second half of 2024, and the completed acquisition of Crown Capital Securities. These moves are anticipated to enhance LPL Financial's service capabilities and market reach.

"We remain steadfast in our mission of taking care of our advisors, so they can take care of their clients," stated Dan Arnold, President and CEO of LPL Financial. He emphasized the importance of continuous investment in the company's model to drive future growth and enhance shareholder value.

Comprehensive Financial Analysis

The detailed earnings report indicates a solid performance in advisory and commission revenues, which collectively rose by 26% from the previous year. This growth is a testament to the company's robust operational framework and strategic positioning within the financial advisory sector. Furthermore, the company's balance sheet remains strong with significant increases in cash and equivalents, reflecting prudent capital management and operational efficiency.

In conclusion, LPL Financial Holdings Inc. (NASDAQ:LPLA) has demonstrated a resilient performance in the first quarter of 2024, aligning with EPS estimates and surpassing revenue expectations. The strategic acquisitions and consistent asset growth highlight the company's commitment to expanding its market presence and enhancing value for its advisors and shareholders. Moving forward, the firm looks to sustain its growth momentum through strategic initiatives and ongoing investments in its comprehensive service platform.

Explore the complete 8-K earnings release (here) from LPL Financial Holdings Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance