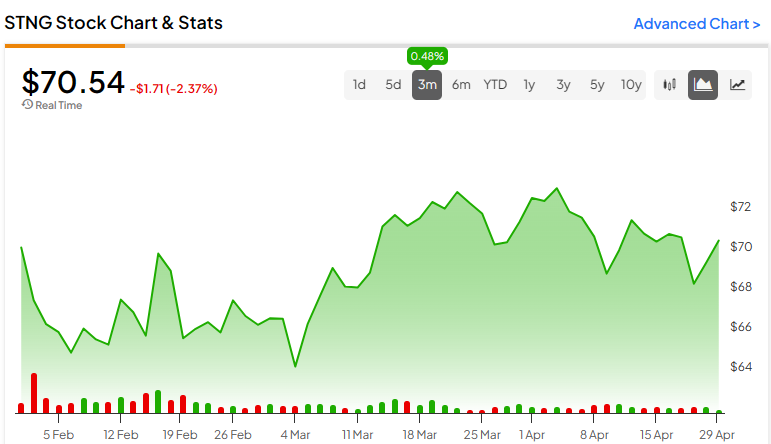

The tanker industry is booming, but Scorpio Tankers (NYSE:STNG) stock, along with many of its peers, has remained pretty flat in recent months. However, while the share price is flattening, the tailwinds that propelled this crude oil and petroleum transporter (and the industry as a whole) to where we are today are continuing. Day rates (leasing rates) remain elevated, and the industry appears to be at the start of a multi-year supercycle whereby supply can’t keep up with demand. Thus, I’m bullish on Scorpio Tankers.

Scorpio Tankers and the Multi-Year Supercycle

Experts had been warning for several years that the tanker industry was building too few vessels. Just two new supertankers are set to join the global fleet in 2024. That’s the fewest additions in nearly 40 years and around 90% below the yearly average this millennium.

One reason for this is the pandemic. The disruption caused by the virus, the associated lockdowns, and shifting demand dynamics created uncertainty within the tanker industry. New orders were put on hold while many shipyards closed — some permanently. In fact, the number of shipyards has fallen from ~700 in 2007 to ~300 by 2022.

With fewer vessels and fewer shipyards, supply is lagging behind demand. This was largely kept in check in the early part of last year as OPEC kept oil off the market, thus reducing near-term demand for tankers. Coupled with a less optimistic long-term outlook on the tanker industry — as the global economy transitions to greener energy — tanker stocks didn’t pick up until Q2 of 2023.

However, many analysts now think we’re moving toward a supercycle in the sector. Demand is robust due to a resurgent global economy, and supply isn’t catching up. After all, it can take between two and four years to build a new tanker.

Scorpio Tankers’ Short-Term Tailwinds

Several factors have contributed to supply becoming tighter. This was noted by management during the Q4 earnings call in February: “We’ve seen low water levels in the Panama Canal, attacks in the Red Sea and sanctions on Russia, which had led to the rerouting of vessels. This has made the fleet more inefficient and further tightened supply against a strong demand curve.”

These events have served to push day rates higher. For example, since November, when Houthi attacks began on ships transiting the Bab-el-Mandeb strait — which aptly translates as the Gate of Grief — the price of leasing Suezmax tankers has consistently been above $40,000 per day. Leasing rates for Suexmax tankers (the largest vessels that can fit through the Suez Canal) were less than half this during the summer of 2022.

Of course, the reason these attacks have influenced day rates so significantly is that many vessels are still being rerouted around Southern Africa rather than through the Red Sea and the Suez Canal. This has compounded the low transit numbers through the Panama Canal. Meanwhile, sanctions on Russia have meant that oil products once destined for Europe are now being shipped to Asia.

Scorpio Tankers Offers Good Value

Scorpio Tankers currently trades at 5.7x forward earnings. That’s attractive even for an industry with traditionally low multiples due to its cyclical nature and debt burdens. However, the consensus estimate suggests that earnings will fall in 2025 and 2026. Thus, the stock is currently trading at 6.7x projected earnings for 2025 and 7.5x earnings for 2026.

My feeling is that these estimates are a little conservative. However, the earnings forecasts are determined by realized day rates, and this is, in part, dependent on geopolitical events. At this moment, there’s no obvious end in sight to Russia’s war in Ukraine or hostilities in the Middle East. Coupled with the low levels of new supply, it makes me want to be more bullish than these estimates.

It’s also worth highlighting that the current tailwinds are allowing Scorpio to reduce debt levels. “In the first quarter of 2024, we will repay $316 million in debt. And today our net debt stands at just a shade below $1.1 billion and we feel very well positioned at these levels,” management said in the Q4 earnings call.

Personally, I think the market is waiting for more news. All eyes should be on earnings data on May 9, where we will see exactly how strong the aforementioned tailwinds are.

Is Scorpio Tankers Stock a Buy, According to Analysts?

Scorpio Tankers stock is rated a Strong Buy on TipRanks. This is based on six Buys and one Hold rating from analysts in the last three months. The average Scorpio Tankers stock price target is $81.00, implying 14.7% upside potential.

The Bottom Line on Scorpio Tankers Stock

Scorpio Tankers is benefiting from a host of tailwinds, including a shortage of supply and geopolitical factors that have contributed to rising day rates. This booming period is allowing Scorpio to pay down debt and prepare for the future. At 5.7x forward earnings, I certainly don’t think the stock is expensive, and I’m bullish on its medium-term outlook, given supply-side constraints.