Decoding Imperial Oil Ltd (IMO): A Strategic SWOT Insight

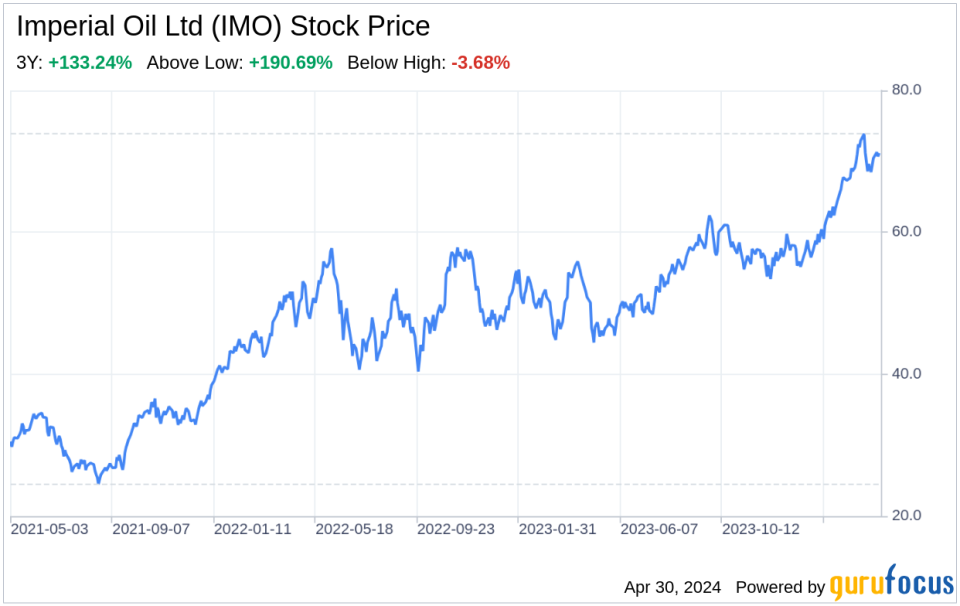

Imperial Oil Ltd showcases robust financial performance with a slight dip in net income compared to the previous year.

Strong market presence and integrated operations position Imperial Oil Ltd favorably in the competitive landscape.

Opportunities in lower-emission business ventures align with global sustainability trends.

External threats such as market volatility and environmental regulations could impact future performance.

Imperial Oil Ltd (IMO), one of Canada's leading integrated oil companies, filed its 10-Q report on April 29, 2024, providing a detailed account of its financial performance and strategic position. The company, active in exploration, production, refining, and marketing of petroleum products, reported a slight decrease in net income from CAD 1,248 million in Q1 2023 to CAD 1,195 million in Q1 2024. Despite this, the company maintained a strong balance sheet with total assets increasing from CAD 41,199 million to CAD 42,513 million in the same period. This SWOT analysis delves into the strengths, weaknesses, opportunities, and threats as revealed by the latest financial data and strategic initiatives of Imperial Oil Ltd.

Strengths

Integrated Business Model: Imperial Oil Ltd's integrated operations across the Upstream, Downstream, and Chemical segments provide a competitive edge. The company's ability to manage the entire value chain from exploration to marketing ensures operational efficiency and resilience against market fluctuations. For instance, despite a slight decrease in net income, the company's revenues increased from CAD 12,057 million to CAD 12,249 million year-over-year, demonstrating the robustness of its business model.

Financial Stability: The company's financial health is a testament to its stability and prudent management. With a solid increase in total assets and a manageable level of long-term debt, which remained relatively stable at CAD 4,006 million, Imperial Oil Ltd is well-positioned to invest in growth and innovation. The company's earnings reinvested also saw a healthy increase, indicating a strong commitment to future development.

Weaknesses

Dependence on Commodity Prices: Although Imperial Oil Ltd has a diversified portfolio, its performance is still susceptible to the volatility of commodity prices. The slight dip in net income can be partly attributed to the dynamic nature of oil and gas markets, which can impact profitability. This dependence on external market conditions remains a vulnerability that requires continuous strategic management.

Operational Risks: The nature of Imperial Oil Ltd's operations exposes it to various operational risks, including maintenance shutdowns and supply chain disruptions. For example, the company's recent minor maintenance activities led to lower refinery throughput, which could affect its Downstream segment's performance if such incidents become frequent or prolonged.

Opportunities

Transition to Low-Emission Alternatives: Imperial Oil Ltd is actively pursuing lower-emission business opportunities, such as carbon capture and storage, hydrogen, and lower-emission fuels. This strategic direction aligns with global efforts to combat climate change and positions the company to capitalize on the growing demand for sustainable energy solutions.

Market Expansion: With a strong financial base and integrated business model, Imperial Oil Ltd has the opportunity to expand its market presence. The company can leverage its expertise and financial resources to explore new markets, both geographically and within the energy sector, to drive future growth.

Threats

Regulatory and Environmental Challenges: The oil and gas industry is subject to stringent environmental regulations that can impose additional costs and operational constraints. Imperial Oil Ltd must navigate these challenges while maintaining profitability and compliance, which could impact its strategic decisions and investments.

Market Competition: The competitive landscape in the oil and gas industry is intense, with numerous players vying for market share. Imperial Oil Ltd must continue to innovate and optimize its operations to stay ahead of competitors, particularly as the industry shifts towards more sustainable energy practices.

In conclusion, Imperial Oil Ltd (IMO) presents a strong financial and strategic profile, with an integrated business model and a commitment to innovation and sustainability. While the company faces challenges from market volatility and regulatory pressures, its opportunities in low-emission ventures and potential market expansion provide a positive outlook. Investors and stakeholders can be assured of Imperial Oil Ltd's dedication to maintaining its competitive edge and driving growth in the evolving energy landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance