3 Tech Stocks Suited for Dividend-Focused Investors

Other than tech stocks, investors also love dividends, as they can provide a nice buffer against drawdowns in other positions and a passive income stream.

And interestingly enough, several tech stocks – Microsoft MSFT, Dell Technologies DELL, and Qualcomm QCOM – reward their shareholders with quarterly payouts.

Let’s take a closer look at each.

Microsoft

Tech heavyweight Microsoft is coming off a recent double beat, with the company exceeding the Zacks Consensus EPS estimate by nearly 5% and posting sales 2% ahead of expectations. Both items saw considerable growth from the year-ago period, with shares seeing buying pressure post-earnings.

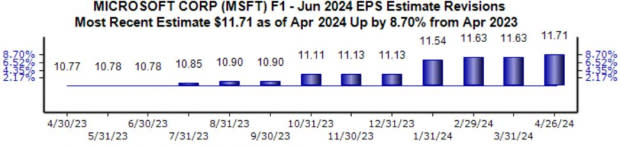

Analysts have positively revised their earnings expectations across the board, with the trend notably bullish for its current fiscal year, up nearly 9% to $11.71 over the last year.

Image Source: Zacks Investment Research

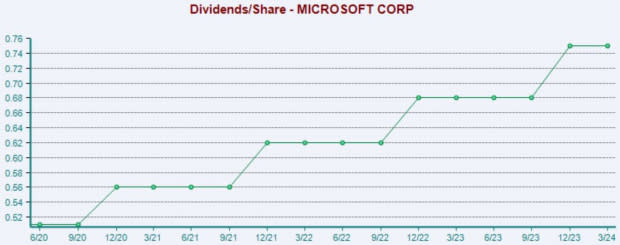

The company has increasingly rewarded its shareholders, boasting a sizable 10.5% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Dell Technologies

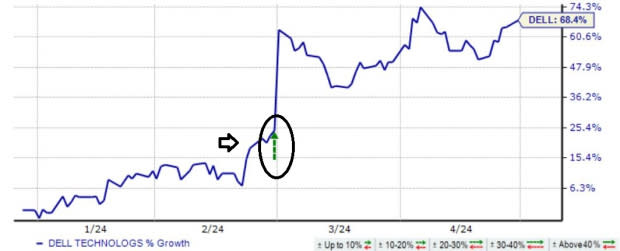

DELL shares have been considerably strong year-to-date, up more than 60% and crushing the S&P 500’s performance. Positive quarterly results have led the surge, with shares melting higher following its latest quarterly release.

Image Source: Zacks Investment Research

Shares currently yield 1.4% annually, nicely above that of the Zacks Computer & Technology sector average. It’s worth noting that shares have become more expensive amid hopes of growth tailwinds from AI, currently trading at a 15.7X forward 12-month earnings multiple.

Image Source: Zacks Investment Research

Qualcomm

Qualcomm, a current Zacks Rank #2 (Buy), has seen its shares perform nicely year-to-date, up 17% compared to the S&P 500’s 8% gain.

Image Source: Zacks Investment Research

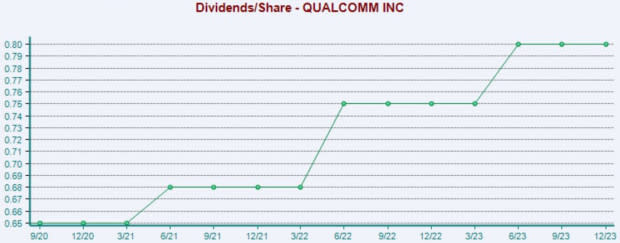

QCOM shares pay investors nicely, currently yielding 1.9% annually. The company has shown a commitment to increasingly rewarding shareholders, as reflected by its 6.3% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Bottom Line

Dividend-paying stocks don’t always have to be ‘boring,’ as many exciting companies from the technology sector also reward their shareholders with payouts.

And for those interested in gaining exposure to the sector paired with quarterly payouts, all three stocks above – Microsoft MSFT, Dell Technologies DELL, and Qualcomm QCOM – fit the criteria nicely.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance