CVR Energy Inc. (CVI) Q1 2024 Earnings: Performance Amidst Challenges

Net Income: Reported at $82 million, surpassing the estimated $13.68 million.

Earnings Per Share (EPS): Achieved $0.81 per diluted share, significantly exceeding the estimated $0.23.

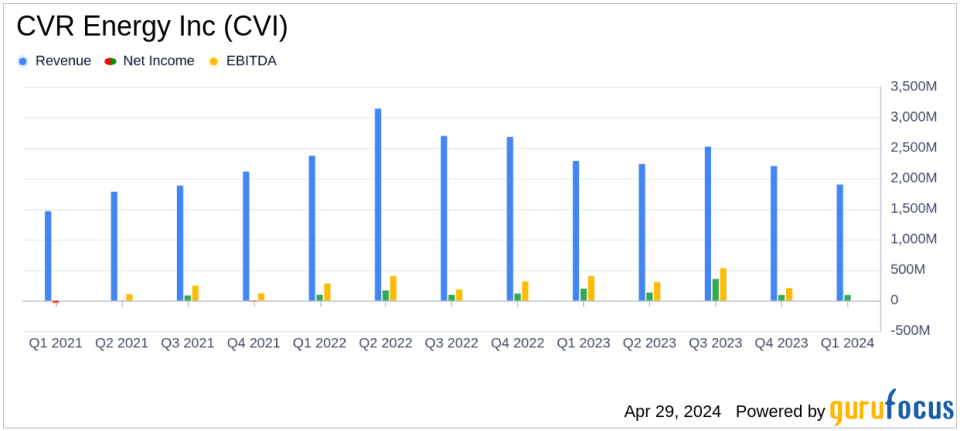

Revenue: Reached $1.9 billion, slightly below the estimated $1.962 billion.

Dividend Announcement: Declared a quarterly cash dividend of $0.50 per share.

EBITDA: Reported at $203 million for Q1 2024, showing a decrease from $401 million in Q1 2023.

Adjusted EBITDA: Posted $99 million, a decline from $334 million in the prior year's first quarter.

Refining Margin: Recorded at $290 million, or $16.29 per total throughput barrel, down from $411 million, or $23.24 per total throughput barrel in Q1 2023.

CVR Energy Inc. (NYSE:CVI) disclosed its financial results for the first quarter of 2024 on April 29, 2024, revealing a net income of $82 million, or $0.81 per diluted share, significantly below the previous year's $195 million, or $1.94 per diluted share. This performance was accompanied by net sales of $1.9 billion, a decrease from $2.3 billion in the same quarter last year. The company also announced a regular cash dividend of 50 cents per share. For a detailed view, refer to CVR Energy's 8-K filing.

Headquartered in Sugar Land, Texas, CVR Energy operates as a diversified holding company, primarily engaged in petroleum refining and nitrogen fertilizer manufacturing. The company's subsidiaries manage a complex network of full-coking crude oil refineries and a crude oil gathering system. CVR Energy's products are distributed directly to customers within close proximity and through throughput terminals.

Quarterly Performance Highlights

The first quarter of 2024 saw CVR Energy grappling with several challenges, including lower refining margins and decreased throughput due to planned maintenance at the Wynnewood refinery. Despite these hurdles, the company benefited from lower expenses related to Renewable Identification Numbers (RINs) and higher crude oil and refined product prices. The petroleum segment, however, experienced a significant drop in operating income to $118 million from $237 million in the prior year, with total throughput remaining stable at approximately 196,000 barrels per day (bpd).

The nitrogen fertilizer segment also faced difficulties, with operating income plummeting to $20 million from $109 million in the previous year, impacted by a 14-day planned downtime at the Coffeyville facility. This segment's challenges were compounded by a sharp decline in average realized gate prices for urea ammonia nitrate (UAN) and ammonia, which fell by 42% and 41%, respectively.

Financial Health and Strategic Initiatives

CVR Energy's balance sheet remains robust with an increase in cash and cash equivalents to $644 million as of March 31, 2024. The company's total debt stood at $1.6 billion. The announced dividend and a cash distribution of $1.92 per common unit by CVR Partners underline the company's commitment to returning value to shareholders.

The company's management highlighted the impact of favorable weather conditions and steady demand for nitrogen fertilizer in the spring planting season, which helped mitigate some operational challenges. Additionally, the renewable diesel unit at the Wynnewood refinery saw a decrease in vegetable oil throughput due to a catalyst change, reflecting ongoing adjustments in operations to enhance efficiency.

Outlook and Forward-Looking Statements

Looking ahead, CVR Energy remains cautious, particularly with the petroleum and renewables segments, as the full impact of a recent fire at the Wynnewood Refinery is still being assessed. The company plans to provide an updated outlook for these segments once more information becomes available.

In conclusion, while CVR Energy navigated significant challenges in the first quarter of 2024, its strategic adjustments and focus on operational efficiency are expected to stabilize its performance in the upcoming quarters. Investors and stakeholders will likely keep a close watch on how the company manages the evolving dynamics of the refining and fertilizer markets.

Explore the complete 8-K earnings release (here) from CVR Energy Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance