What's in the Cards for Amgen (AMGN) This Earnings Season?

Amgen AMGN will report first-quarter 2024 results on May 2, before market open. In the last reported quarter, the company beat earnings expectations by 1.07%.

Factors to Consider

Amgen’s product sales are expected to be the lowest in the first quarter per historical trends due to the impact of benefit plan changes, insurance re-verification and increased co-pay expenses as U.S. patients work through deductibles. First-quarter 2024 total revenues are expected to grow roughly 20% year over year. The Zacks Consensus Estimate for total revenues is $7.38 billion.

Amgen’s product sales are expected to have been driven by strong volume growth of products like Evenity, Repatha, Prolia, and Blincyto, among others. However, prices of most products are expected to have declined.

The Zacks Consensus Estimate for Prolia, Repatha, Evenity and Blincyto sales are pegged at $1.0 billion, $452.3 million, $334.0 million and $240.0 million, respectively.

Our estimates for Prolia, Repatha, Evenity and Blincyto sales are pegged at $997 million, $448.0 million, $330.8 million and $227.1 million, respectively.

In addition, higher volumes of newer drugs like Tezspire and Tavneos are expected to have contributed to top-line growth driven by new patient volume growth. Sales of both Tezspire and Tavneos improved sequentially in the last two quarters, a trend expected to have continued in the first quarter. Like the previous quarters, Tezspire volumes are likely to have benefitted from the launch of a self-administered, pre-filled, single-use pen formulation of the drug. The pen formulation helped expand coverage with major pharmacy benefit managers, which led to higher new patient growth in 2023.

Our estimates for Tezspire and Tavneos are pegged at $192 million and $53.5 million, respectively.

However, lower revenues from oncology biosimilars (Kanjinti and Mvasi) and legacy established products are expected to have hurt the top line.

Sales of Otezla and Enbrel are expected to have been lower in the first quarter of 2024 per historical trends due to the impact of benefit plan changes, insurance re-verification and increased co-pay expenses as U.S. patients work through deductibles.

On the fourth-quarter conference call, Amgen said that it has been seeing a reduced impact of the free drug programs launched by new competitors in the United States, which had hurt Otezla’s sales in the past few quarters. It remains to be seen if there was any improvement in sales of Otezla in the first quarter.

The Zacks Consensus Estimate for Otezla is $434.0 million, while our estimate is $403.8 million.

The Zacks Consensus Estimate for Enbrel is $591.0 million, while our estimate is $527.1 million.

Adjusted operating margin is expected to be roughly 43% in the first quarter, which is less than the full-year expectation of 48%. Management expects margins to increase each subsequent quarter following the first.

Amgen closed the acquisition of Horizon Therapeutics for $27.8 billion on Oct 6, 2023, which added several rare disease drugs like Tepezza, Krystexxa and Uplizna to AMGN’s portfolio. Amgen's first-quarter results will include the full-quarter sales of all these drugs.

Earnings Surprise History

This large biotech’s performance has been strong, with earnings beating estimates in all the trailing four quarters. The company delivered a four-quarter earnings surprise of 6.0%, on average.

Amgen Inc. Price and EPS Surprise

Amgen Inc. price-eps-surprise | Amgen Inc. Quote

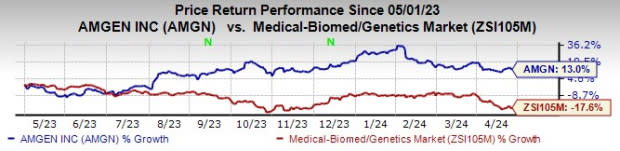

Amgen’s stock has risen 13.0% in the past year against a decrease of 17.6% for the industry.

Image Source: Zacks Investment Research

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Amgen this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that is not the case here.

Earnings ESP: Amgen’s Earnings ESP is -1.47%. The Zacks Consensus Estimate is pegged at $3.76 per share, while the Most Accurate Estimate is pegged at $3.70 per share. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Amgen has a Zacks Rank #3.

Stocks to Consider

Here are some large drug/biotech stocks that have the right combination of elements to beat on earnings this time around:

Alnylam Pharmaceuticals ALNY has an Earnings ESP of +5.87% and a Zacks Rank #3.

Alnylam’s stock has declined 29% in the past year. Alnylam topped earnings estimates in three of the last four quarters while missing in one. ALNY delivered a four-quarter earnings surprise of 45.05%, on average. Alnylam is scheduled to release its first-quarter results on May 2.

Novavax NVAX has an Earnings ESP of +15.06% and a Zacks Rank #3.

Novavax’s stock has declined 47% in the past year. Novavax beat earnings estimates in two of the last four quarters while missing in the other two. NVAX has a four-quarter negative earnings surprise of 4.31%, on average.

Exelixis EXEL has an Earnings ESP of +9.11% and a Zacks Rank #3.

Exelixis’ stock has risen 25.9% in the past year. Exelixis beat earnings estimates in two of the last four quarters while missing in the other two. EXEL has a four-quarter negative earnings surprise of 6.06%, on average. Exelixis is scheduled to release its first-quarter results on Apr 30.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alnylam Pharmaceuticals, Inc. (ALNY) : Free Stock Analysis Report

Amgen Inc. (AMGN) : Free Stock Analysis Report

Exelixis, Inc. (EXEL) : Free Stock Analysis Report

Novavax, Inc. (NVAX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance