Those who invested in Chart Industries (NYSE:GTLS) five years ago are up 67%

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, the Chart Industries, Inc. (NYSE:GTLS) share price is 67% higher than it was five years ago, which is more than the market average. It's also good to see that the stock is up 13% in a year.

So let's assess the underlying fundamentals over the last 5 years and see if they've moved in lock-step with shareholder returns.

Check out our latest analysis for Chart Industries

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

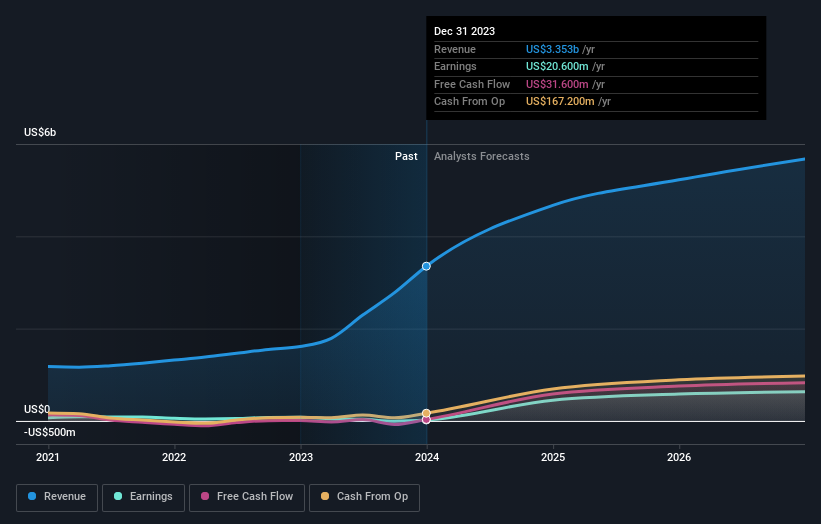

Chart Industries' earnings per share are down 14% per year, despite strong share price performance over five years.

This means it's unlikely the market is judging the company based on earnings growth. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

On the other hand, Chart Industries' revenue is growing nicely, at a compound rate of 20% over the last five years. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. You can see what analysts are predicting for Chart Industries in this interactive graph of future profit estimates.

A Different Perspective

Chart Industries shareholders are up 13% for the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 11% over half a decade This could indicate that the company is winning over new investors, as it pursues its strategy. It's always interesting to track share price performance over the longer term. But to understand Chart Industries better, we need to consider many other factors. Even so, be aware that Chart Industries is showing 3 warning signs in our investment analysis , and 1 of those can't be ignored...

Chart Industries is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance