Whales with a lot of money to spend have taken a noticeably bearish stance on FedEx.

Looking at options history for FedEx (NYSE:FDX) we detected 12 trades.

If we consider the specifics of each trade, it is accurate to state that 41% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 8 are puts, for a total amount of $305,995 and 4, calls, for a total amount of $154,569.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $260.0 to $310.0 for FedEx over the recent three months.

Volume & Open Interest Trends

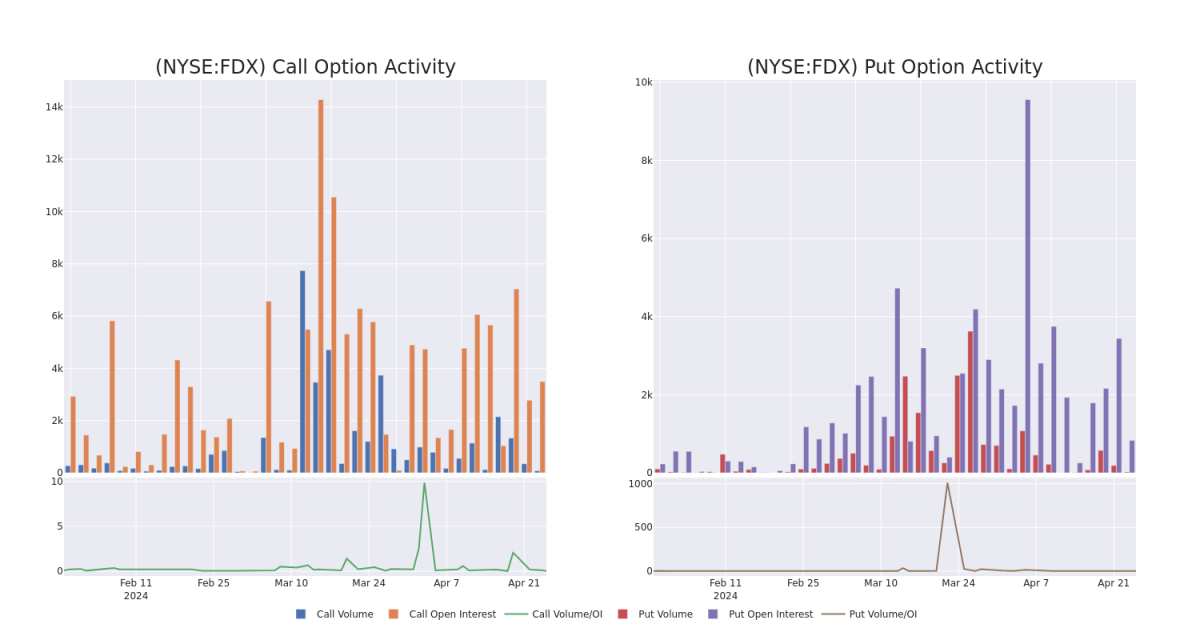

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for FedEx's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of FedEx's whale activity within a strike price range from $260.0 to $310.0 in the last 30 days.

FedEx Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FDX | PUT | SWEEP | BEARISH | 09/20/24 | $23.45 | $23.3 | $23.45 | $280.00 | $51.6K | 281 | 43 |

| FDX | PUT | SWEEP | BEARISH | 07/19/24 | $9.2 | $9.05 | $9.2 | $260.00 | $47.8K | 663 | 71 |

| FDX | CALL | SWEEP | BEARISH | 09/20/24 | $4.6 | $4.45 | $4.5 | $310.00 | $45.0K | 100 | 100 |

| FDX | PUT | TRADE | BULLISH | 05/03/24 | $16.65 | $15.25 | $15.75 | $282.50 | $44.1K | 0 | 28 |

| FDX | CALL | SWEEP | BEARISH | 05/17/24 | $3.75 | $3.6 | $3.6 | $270.00 | $43.2K | 870 | 137 |

About FedEx

FedEx pioneered overnight delivery in 1973 and remains the world's largest express package provider. In its fiscal 2023, which ended May 2023, FedEx derived 47% of revenue from its express division, 37% from ground, and 11% from freight, its asset-based less-than-truckload shipping segment. The remainder comes from other services, including FedEx Office, which provides document production/shipping, and FedEx Logistics, which provides global forwarding. FedEx acquired Dutch parcel delivery firm TNT Express in 2016. TNT was previously the fourth-largest global parcel delivery provider.

FedEx's Current Market Status

- With a volume of 676,250, the price of FDX is up 0.33% at $266.39.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 53 days.

Professional Analyst Ratings for FedEx

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $321.5.

- An analyst from B of A Securities persists with their Buy rating on FedEx, maintaining a target price of $340.

- An analyst from Stifel has decided to maintain their Buy rating on FedEx, which currently sits at a price target of $303.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest FedEx options trades with real-time alerts from Benzinga Pro.