Normally, approval from the Food and Drug Administration (FDA) is good news for a biotech stock, and for Pfizer (NYSE:PFE), it should have been no exception. Yet, Pfizer shares are only up fractionally in Friday afternoon’s trading thanks to a new approval on a market-first treatment for a disturbing and rare disease.

The drug, which will be known as Beqvez, is geared toward treating “moderate to severe hemophilia B” in adults, a rare bleeding disorder that is passed down genetically. Beqvez is a market first, the first gene therapy that Pfizer has ever won clearance on in the United States. Meanwhile, the price tag is a downright disaster; before insurance and similar rebates get involved, a dose of Beqvez will run a whopping $3.5 million.

Given that there are about 7,000 people in the United States with hemophilia B, it’s clear that the drug had to be somewhat pricey to recoup its development costs because sales would likely be few. Moreover, since Beqvez is a one-time treatment, that explains the hefty price tag, as repeat sales will not exist.

Cost-Cutting in Colorado

Meanwhile, Pfizer is taking aim at paring back expenses. It’s followed through on its earlier plans to shutter research and development operations in Boulder, Colorado, having announced plans to stage layoffs at the facility back in October. That will take 300 jobs and their accompanying costs off the table. The original plan called for Pfizer to merely “reduce its footprint” in Boulder as opposed to a complete shutdown. However, Pfizer will maintain what it calls a “site presence” for employees who aren’t part of research operations.

Is Pfizer a Buy, Sell, or Hold?

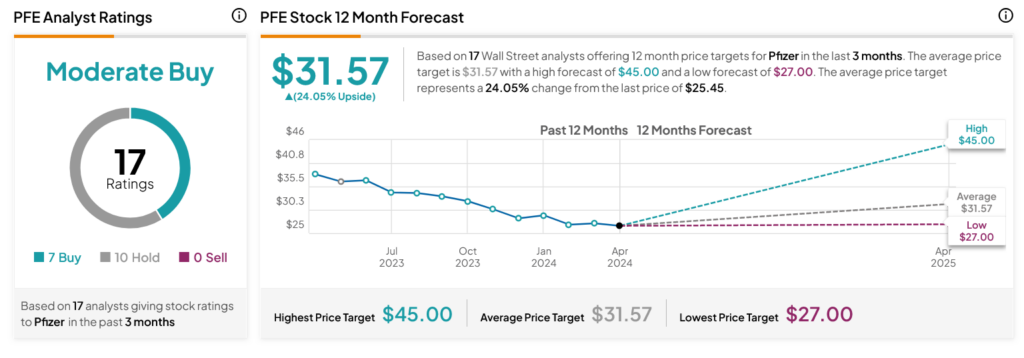

Turning to Wall Street, analysts have a Moderate Buy consensus rating on PFE stock based on seven Buys and 10 Holds assigned in the past three months, as indicated by the graphic below. After a 30.97% loss in its share price over the past year, the average PFE price target of $31.57 per share implies 24.05% upside potential.

Is PFE the Right Stock to Buy for Passive Income?

Before you hurry to invest in PFE, think about the following:

TipRanks’ team has built a Smart Dividend Stock Portfolio for investors, and Pfizer is not included. Our portfolio highlights companies that have been hand-picked for their potential to deliver significant passive income for years to come.

Get a FREE sample of dividend stock insights! >>