Does Consolidated Edison (NYSE:ED) Deserve A Spot On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Consolidated Edison (NYSE:ED), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Consolidated Edison with the means to add long-term value to shareholders.

See our latest analysis for Consolidated Edison

How Quickly Is Consolidated Edison Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. Shareholders will be happy to know that Consolidated Edison's EPS has grown 30% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

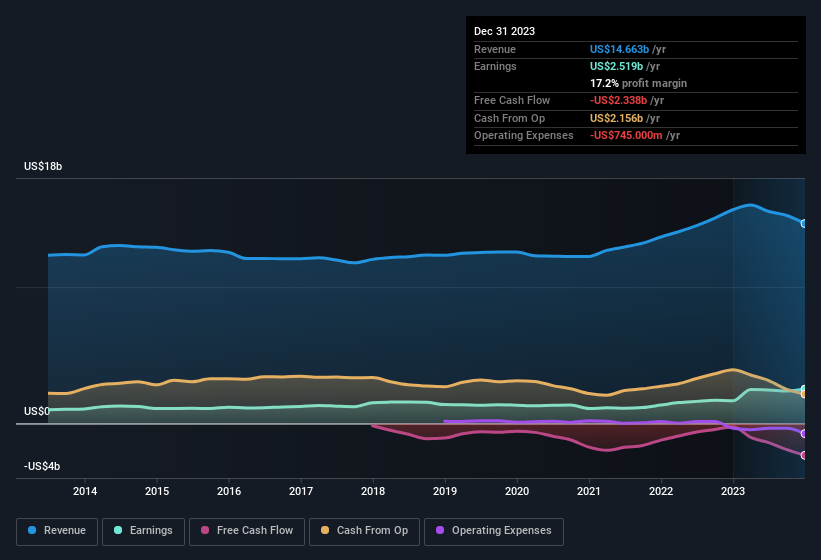

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While Consolidated Edison may have maintained EBIT margins over the last year, revenue has fallen. This does not bode too well for short term growth prospects and so understanding the reasons for these results is of great importance.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Consolidated Edison's forecast profits?

Are Consolidated Edison Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

While Consolidated Edison insiders did net US$9.2k selling stock over the last year, they invested US$251k, a much higher figure. You could argue that level of buying implies genuine confidence in the business. We also note that it was the Senior VP & CFO, Robert Hoglund, who made the biggest single acquisition, paying US$14k for shares at about US$90.81 each.

The good news, alongside the insider buying, for Consolidated Edison bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have US$23m worth of shares. That's a lot of money, and no small incentive to work hard. While their ownership only accounts for 0.07%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Should You Add Consolidated Edison To Your Watchlist?

For growth investors, Consolidated Edison's raw rate of earnings growth is a beacon in the night. Furthermore, company insiders have been adding to their significant stake in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. You should always think about risks though. Case in point, we've spotted 3 warning signs for Consolidated Edison you should be aware of, and 1 of them shouldn't be ignored.

Keen growth investors love to see insider buying. Thankfully, Consolidated Edison isn't the only one. You can see a a curated list of companies which have exhibited consistent growth accompanied by recent insider buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.