SouthState Corp (SSB) Q1 2024 Earnings: A Close Match to Analyst Estimates

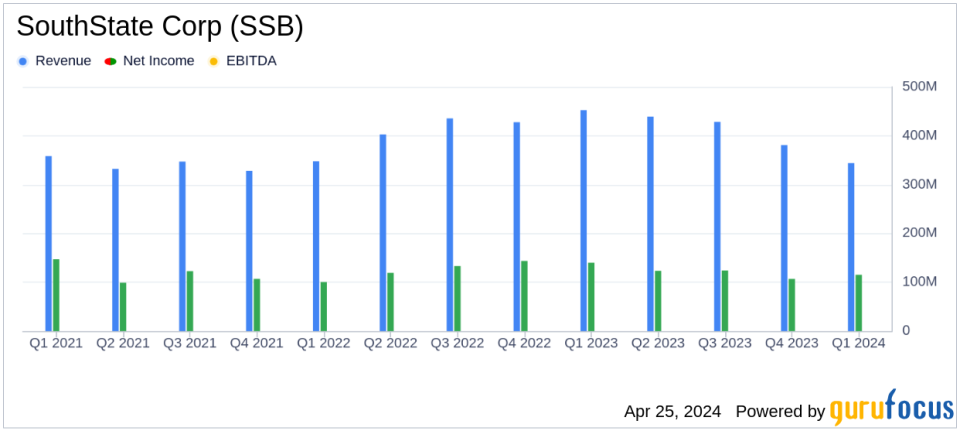

Reported Net Income: $115.06 million for Q1 2024, falling short of the estimated $118.40 million.

Earnings Per Share (EPS): Achieved $1.50 diluted EPS, slightly below the estimated $1.55.

Revenue Performance: Total interest income reached $517.26 million, surpassing the estimated revenue of $414.33 million.

Quarterly Dividend: Declared a consistent quarterly cash dividend of $0.52 per common share.

Asset Quality: Maintained stable asset quality with strong reserves, reflecting resilience in the face of economic transitions.

Loan and Deposit Growth: Reported low-single digit percentage growth in both loans and deposits during the quarter.

Return on Average Assets: Recorded at 1.03% for the quarter, indicating efficient asset management.

On April 25, 2024, SouthState Corp (NYSE:SSB) disclosed its first-quarter results for the year, closely aligning with analyst projections. The detailed earnings report, accessible through the company's 8-K filing, reveals a nuanced picture of stability and modest growth, characteristic of the firm's operational strategy amidst a shifting economic landscape.

SouthState Corp, a prominent bank holding company in the United States, operates through its subsidiary, South State Bank. The bank offers a comprehensive suite of services including retail and commercial banking, mortgage lending, and wealth management across several key Southern states. This regional focus has benefitted from demographic trends favoring the South as a business and residential hub.

Financial Highlights and Performance Metrics

The first quarter saw SouthState achieving a net income of $115.06 million, slightly missing the estimated $118.40 million but presenting a robust picture of the bank's earnings capabilities. Earnings per share (EPS) stood at $1.50, closely aligning with the anticipated $1.55. Total revenue for the quarter was reported at $517.25 million from interest income, which, when combined with noninterest income, aligns with the expected figures.

CEO John C. Corbett emphasized the resilience of the bank's markets and highlighted the growth in loans and deposits, which increased in the low-single digit percentage range. The bank's asset quality remained stable with strong reserves, an essential indicator of financial health in uncertain economic times.

Analysis of Income Statement and Balance Sheet

SouthState's income statement reflects a disciplined approach to cost management and revenue generation. Net interest income after provision for credit losses stood at $331.25 million. The bank's efficiency in operations is evident from its efficiency ratio, which improved to 56.47% on an adjusted basis, indicating better cost management compared to previous quarters.

The balance sheet expanded slightly with total assets reaching $45.14 billion, supported by increases in both loans and deposits. This growth underscores the bank's ability to attract and retain deposits while cautiously expanding its loan portfolio.

Strategic Insights and Future Outlook

The bank's strategic focus on maintaining a strong capital position is evident from its capital ratios, with a Tier 1 leverage ratio of 9.6%. Such metrics not only comply with regulatory requirements but also provide a buffer against potential financial disturbances.

Looking ahead, SouthState appears well-positioned to capitalize on regional economic growth and demographic trends. Its focus on maintaining robust asset quality and efficient operations is likely to support its performance in the upcoming quarters, even as it navigates the challenges posed by an evolving economic environment.

For detailed insights and further information, stakeholders and interested investors are encouraged to refer to the full 8-K filing. Additionally, a conference call scheduled for April 26, 2024, will provide further elaborations on the quarter's results and management's outlook.

Explore the complete 8-K earnings release (here) from SouthState Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance