NerdWallet Inc (NRDS) Q1 2024 Earnings: Aligns with EPS Projections Amidst Revenue Decline

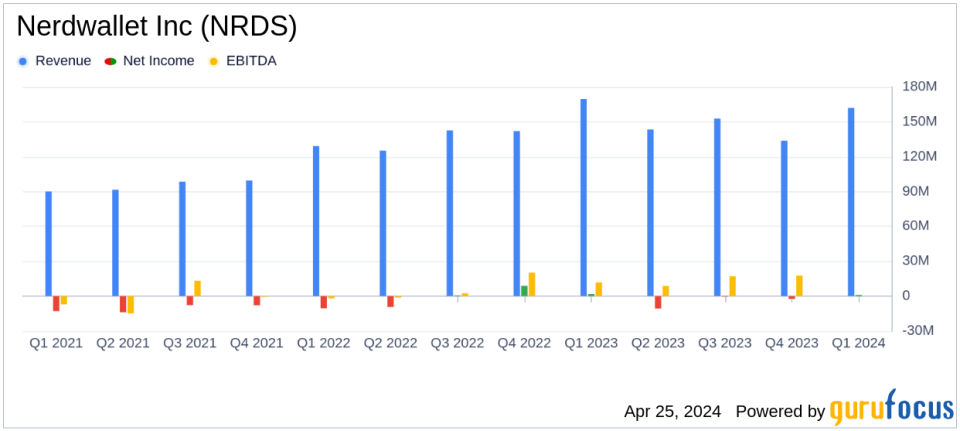

Revenue: Reported at $161.9 million, down 5% year-over-year, falling short of estimates of $157 million.

Net Income: Achieved $1.1 million, exceeding the estimated net loss of $1.03 million.

Earnings Per Share: Met the estimated earnings per share of $0.01.

GAAP Income from Operations: Recorded at $3.7 million, a significant improvement from a loss of $0.8 million in the prior year.

Adjusted EBITDA: Reached $25.5 million, indicating strong profitability metrics.

SMB Products Revenue: Increased by 21% year-over-year to $30.4 million, highlighting growth in this category.

Monthly Unique Users: Grew by 25% year-over-year to 29 million, reflecting expanding consumer engagement.

NerdWallet Inc (NASDAQ:NRDS) disclosed its first-quarter financial results for 2024 on April 25, revealing a mixed financial performance characterized by a revenue decline but alignment with earnings per share (EPS) expectations. The company released its earnings details in an 8-K filing, which showed a year-over-year revenue decrease of 5%, totaling $161.9 million, compared to the analyst estimate of $157 million. Despite the revenue dip, NerdWallet achieved an EPS of $0.01, consistent with market forecasts.

NerdWallet Inc, a San Francisco-based provider of personal finance guidance, faces a challenging economic environment marked by high interest rates and elevated delinquency rates, impacting the lending sector. Despite these headwinds, the company's diversified business model and strong consumer engagement metrics, including a 25% increase in Monthly Unique Users to 29 million, have helped mitigate some negative impacts.

Financial Performance Breakdown

The company's revenue streams showed varied performance, with significant declines in the credit cards segment, which dropped by 19% to $50 million due to reduced partner marketing expenditures. The loans segment also saw a decrease, albeit a smaller one of 3%, amounting to $21.4 million. However, SMB products emerged as a growth area, increasing by 21% to $30.4 million, driven by strong demand for business-related financial products.

Operationally, NerdWallet reported a GAAP net income of $1.1 million, a decrease from the previous year's $1.7 million. The non-GAAP operating income stood at $10.6 million, showing a robust improvement from $3.8 million in the prior year. This was complemented by an adjusted EBITDA of $25.5 million, up 22% year-over-year, highlighting efficient operational management and cost control.

Strategic Insights and Future Outlook

CEO Tim Chen emphasized the company's resilience and adaptability in navigating the current economic cycles, focusing on long-term growth and consumer value proposition enhancement. CFO Lauren StClair expressed optimism for a revenue rebound in Q2, supported by strong brand and traffic metrics that are expected to translate into improved financial performance as macroeconomic conditions stabilize.

For the upcoming quarter, NerdWallet anticipates revenue between $147 million and $152 million, projecting a modest year-over-year growth at the midpoint. The company also expects a GAAP operating loss between $7 million and $4 million, with non-GAAP operating income ranging from a loss of $1.5 million to a gain of $1.5 million.

Overall, NerdWallet's first-quarter performance reflects a company effectively managing through economic turbulence with a clear focus on strategic growth and operational efficiency. While challenges remain, particularly in the lending environment, the company's strong user engagement and diversified revenue streams provide a solid foundation for future recovery and growth.

Explore the complete 8-K earnings release (here) from Nerdwallet Inc for further details.

This article first appeared on GuruFocus.