Investors with a lot of money to spend have taken a bearish stance on S$Super Micro Computer (SMCI.US)$.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with SMCI, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 60 uncommon options trades for Super Micro Computer.

This isn't normal.

The overall sentiment of these big-money traders is split between 33% bullish and 38%, bearish.

Out of all of the special options we uncovered, 23 are puts, for a total amount of $1,120,802, and 37 are calls, for a total amount of $2,168,152.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $480.0 to $1500.0 for Super Micro Computer over the recent three months.

Volume & Open Interest Trends

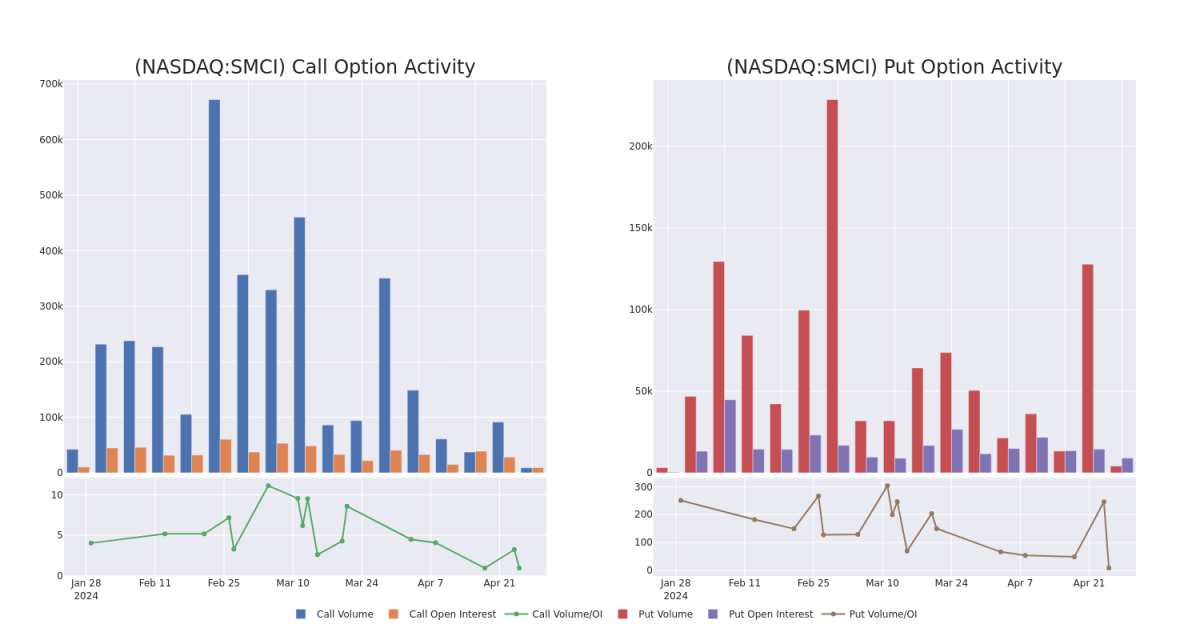

In today's trading context, the average open interest for options of Super Micro Computer stands at 391.81, with a total volume reaching 13,087.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Super Micro Computer, situated within the strike price corridor from $480.0 to $1500.0, throughout the last 30 days.

Super Micro Computer 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

SMCI | PUT | TRADE | NEUTRAL | 04/26/24 | $233.4 | $220.3 | $226.65 | $985.00 | $226.6K | 27 | 2 |

SMCI | CALL | SWEEP | BULLISH | 05/17/24 | $70.4 | $69.0 | $70.4 | $770.00 | $211.2K | 169 | 1 |

SMCI | CALL | TRADE | BULLISH | 05/03/24 | $44.6 | $44.6 | $44.6 | $800.00 | $160.5K | 1.4K | 400 |

SMCI | CALL | TRADE | BEARISH | 05/03/24 | $45.0 | $43.3 | $43.81 | $800.00 | $109.5K | 1.4K | 316 |

SMCI | CALL | SWEEP | BULLISH | 04/26/24 | $18.0 | $17.2 | $18.0 | $760.00 | $109.4K | 584 | 756 |

About Super Micro Computer

Super Micro Computer Inc provides high-performance server technology services to cloud computing, data center, Big Data, high-performance computing, and "Internet of Things" embedded markets. Its solutions include server, storage, blade and workstations to full racks, networking devices, and server management software. The firm follows a modular architectural approach, which provides flexibility to deliver customized solutions. The Company operates in one operating segment that develops and provides high-performance server solutions based upon an innovative, modular and open-standard architecture. More than half of the firm's revenue is generated in the United States, with the rest coming from Europe, Asia, and other regions.

Having examined the options trading patterns of Super Micro Computer, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Super Micro Computer

Trading volume stands at 1,917,663, with SMCI's price up by 1.34%, positioned at $764.81.

RSI indicators show the stock to be may be approaching oversold.

Earnings announcement expected in 5 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Super Micro Computer options trades with real-time alerts from Benzinga Pro.