Landstar System Inc Reports Q1 Earnings: A Comparative Analysis with Analyst Estimates

Revenue: Reported $1.171 billion in Q1 2024, falling short of estimates of $1.122 billion.

Earnings Per Share (EPS): Achieved $1.32, surpassing the estimated $1.28.

Net Income: Recorded $47.1 million, exceeding estimates of $45.7 million.

Operating Income: Posted $59.96 million, a decrease from $101.28 million in Q1 2023.

Gross Profit: Declined to $113.9 million from $152.9 million year-over-year.

Dividend: Announced a quarterly dividend of $0.33 per share, payable on May 24, 2024.

Balance Sheet Strength: Reported cash and short-term investments of approximately $530 million as of March 30, 2024.

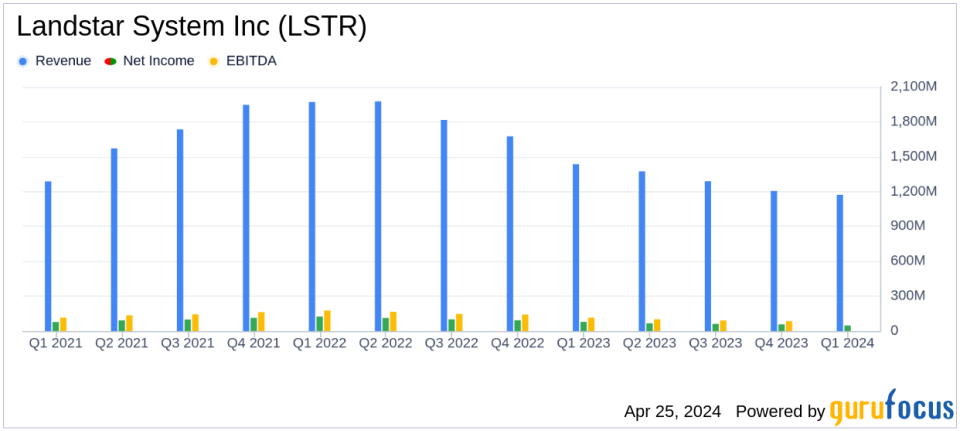

On April 24, 2024, Landstar System Inc (NASDAQ:LSTR) disclosed its financial results for the first quarter of 2024, revealing earnings and revenue that surpassed analyst expectations. The company announced earnings per share (EPS) of $1.32 and total revenue of $1.171 billion, compared to the estimated EPS of $1.28 and revenue forecast of $1122.05 million. For further details, refer to Landstar's 8-K filing.

Landstar System is a prominent player in the logistics and transportation industry, known for its asset-light business model and a network of independent agents and third-party carriers. The company specializes in domestic truck brokerage, which constitutes 90% of its revenue, alongside offerings in intermodal, global air and ocean forwarding, and warehousing services.

Company Performance and Strategic Focus

The first quarter of 2024 saw Landstar navigating a challenging freight environment, yet managing to exceed the upper end of its own guidance for load numbers and revenue per load on truck hauls. This performance underscores the company's resilient operational strategy and effective management execution in a fluctuating market. Landstar's President and CEO, Frank Lonegro, emphasized the company's commitment to supporting its network of small business owners and advancing strategic growth initiatives.

Financial Highlights and Operational Metrics

Despite a 13% decrease in the number of loads hauled and a 7% drop in truck revenue per load compared to the first quarter of 2023, Landstar's financial health remains robust. The company reported a gross profit of $113.9 million and an operating income of $59.96 million for the quarter. These figures represent a decline from the previous year's $152.9 million in gross profit and $101.28 million in operating income, reflecting the ongoing challenges in the freight sector.

Landstar's balance sheet continues to be a pillar of strength with approximately $530 million in cash and short-term investments as of March 30, 2024. The company also boasts a commendable return on average shareholders' equity of 23% and a return on invested capital of 22%.

Outlook and Future Directions

Looking ahead, Landstar is poised to capitalize on improvements in freight fundamentals, backed by a strong balance sheet and strategic investments in technology enhancements. The company plans to discuss its first-quarter earnings in more detail and provide guidance for the second quarter in an upcoming earnings call, which will likely offer further insights into its strategic initiatives and market expectations.

Landstar's performance this quarter illustrates its ability to adapt and thrive despite industry-wide pressures. For investors and stakeholders, the company's focus on enhancing its service offerings and maintaining financial discipline bodes well for its ability to navigate future challenges and leverage opportunities in the logistics and transportation sector.

Conclusion

Landstar System Inc's first-quarter results reflect a strategic resilience that has allowed the company to outperform in a tough market environment. With a clear focus on supporting its network and enhancing operational efficiencies, Landstar is well-positioned for sustained growth. Investors and market watchers will undoubtedly keep a close eye on the company's progress in the coming quarters.

Explore the complete 8-K earnings release (here) from Landstar System Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance