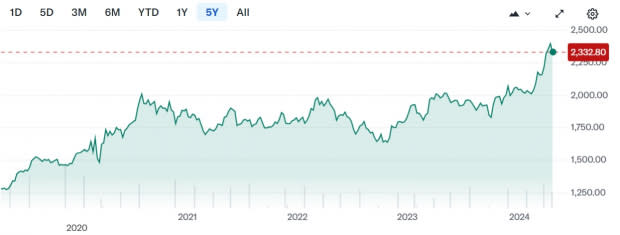

Time to Buy These Top Gold Mining Stocks Amid Recent Market Volatility

With gold traditionally acting as a hedge against inflation, investors may be eying stocks that give exposure to the commodity amid recent market volatility.

Gold often proves to be a safe haven asset during times of market uncertainty as the power of the dollar and other traditional currencies can lose value. Notably, the Zacks Mining-Gold Industry is currently in the top 19% of over 250 Zacks industries and several of these stocks are very attractive.

This comes as the price of gold soared to record highs in March and is still over $2,300 per troy ounce. Of course, gold mining stocks are often sought for defensive safety in the portfolio and many of these companies have intriguing growth prospects as well.

Keeping this scenario in mind, here are a few top-rated Zacks Mining-Gold Industry stocks to consider right now.

Image Source: Yahoo Finance-Gold Prices

AngloGold Ashanti PLC AU

Sporting a Zacks Rank #1 (Strong Buy), AngloGold Ashanti is a gold mining company with operations in Africa, the Americas, and Australia. AngloGold’s flagship Geita project is a significant gold mining operation located in northwestern Tanzania, within the Lake Victoria goldfields and is thought to have over 9 million ounces of gold mineral resources.

Geita is one of five operations owned by AngloGold in Africa and the company’s earnings potential is very lucrative. Fiscal 2024 earnings are expected to skyrocket to $2.84 per share compared to an adjusted loss of -$0.11 a share last year. Even better, AngloGold’s stock trades at just 7.3X forward earnings and FY25 EPS is projected to expand another 37% to $3.89 per share.

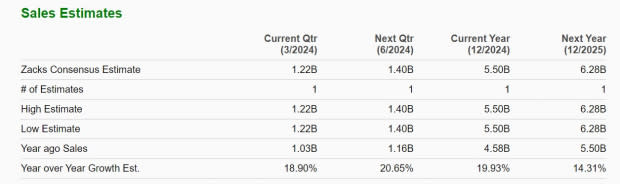

More reassuring is that AngloGold is forecasted to post double-digit top line growth in FY24 and FY25 as well with sales projections well over $5 billion. Year to date, AngloGold’s stock has soared +17% correlating with the surge in gold prices.

Image Source: Zacks Investment Research

Gold Fields Limited GFI

Also boasting a Zacks Rank #1 (Strong Buy) is Gold Fields Limited, which has also seen its stock pop +17% this year as one the world’s largest unhedged gold producers with operating mines in South Africa, Ghana, and Australia.

Despite its presumed market leadership, Gold Fields' stock trades at 11X forward earnings offering a nice discount to the industry average of 18.3X. Plus, annual earnings are expected to soar 64% this year and climb another 70% in FY25 to $2.61 per share. Total sales forecasts call for 32% growth in FY24 and another 24% leap in FY25 to $7.05 billion.

It’s also noteworthy that Gold Fields’ stock still trades under $20 and has a 2.1% annual dividend yield that might peak income investors' attention as well. To that point, Gold Fields has increased its payout seven times in the last five years and has a 52.13% annualized dividend growth rate during this period.

Image Source: Zacks Investment Research

Agnico Eagle Mines AEM

Rounding out the list is Agnico Eagle Mines which sports a Zacks Rank #2 (Buy). Agnico Eagle's stock is up +16% year to date and its steady top and bottom line growth is nothing to sneeze at as a gold producer with operations in Canada, Mexico, and Finland.

Agnico Eagle also has exploration opportunities in the United States and is projected to have 13% EPS growth in FY24 with FY25 earnings expected to jump another 21% to $3.05 per share. Total sales are forecasted to rise 7% in FY24 and slightly increase next year to $7.09 billion. Better still, Agnico Eagle’s stock offers a 2.54% annual dividend which has increased four times in the last five years for an annualized dividend growth rate of 26.88%.

Image Source: Zacks Investment Research

Bottom Line

There are still jitters in the market as rate cuts may be further away than investors have anticipated but earnings estimate revisions for these top gold mining stocks have soared over the last 60 days making now an ideal time to buy.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AngloGold Ashanti PLC (AU) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

Gold Fields Limited (GFI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance