Ethan Allen Interiors Inc (ETD) Q3 Fiscal 2024 Earnings Analysis: Challenges Amidst Strong ...

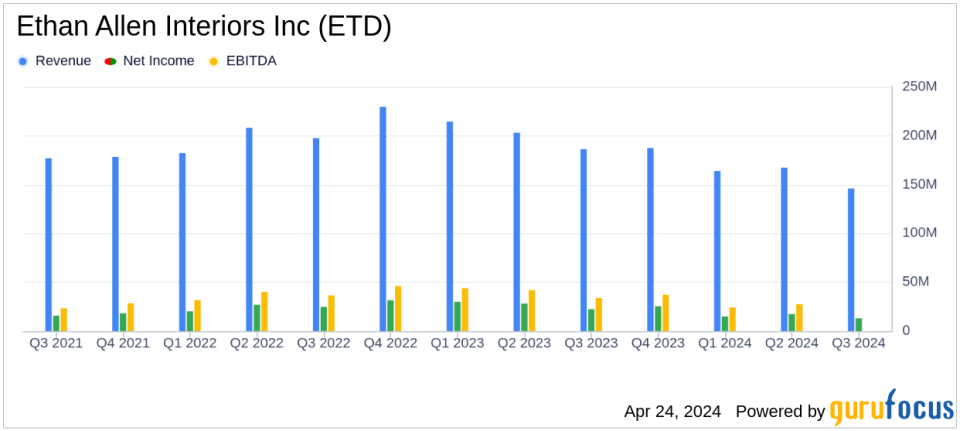

Net Sales: Reported at $146.42 million, a decrease of 21.4% year-over-year, falling short of the estimated $168.15 million.

Gross Profit: Reached $89.82 million, down 19.5% from the previous year, with gross margin improving to 61.3% from 59.9%.

GAAP Net Income: Totaled $12.95 million, a decrease of 42.1% year-over-year, below the estimated $16.40 million.

GAAP Diluted EPS: Recorded at $0.50, a decline of 42.5% compared to the previous year, significantly below the estimated $0.64.

Cash and Investments: Increased to $181.1 million from $172.7 million at the start of the fiscal year, bolstered by strong operating cash flow.

Dividends: Paid a total of $40.3 million in cash dividends, including a special cash dividend, reflecting a commitment to shareholder returns.

Operating Cash Flow: Amounted to $54.0 million for the first nine months of fiscal 2024, despite a decrease from the previous year's $74.4 million.

Ethan Allen Interiors Inc (NYSE:ETD) disclosed its fiscal 2024 third-quarter results on April 24, 2024, revealing a mix of robust strategic initiatives and financial challenges. The detailed earnings can be viewed in their 8-K filing. Despite a downturn in demand reflecting the post-pandemic period, the company showcased a strong balance sheet and continued to return substantial capital to shareholders through dividends.

Company Overview

Ethan Allen Interiors Inc., a prominent name in the home furnishings and interior design market, operates primarily through its subsidiary, Ethan Allen Global, Inc. The company is well-known for its high-quality, U.S.-manufactured products, which represent about 75% of its furniture offerings. With a significant presence in North America, Europe, Asia, and the Middle East, Ethan Allen continues to focus on its retail segment, which is the primary revenue generator.

Financial Performance and Market Challenges

For the quarter ended March 31, 2024, Ethan Allen reported net sales of $146.42 million, a decline of 21.4% from the previous year, underperforming the estimated revenue of $168.15 million. The gross profit stood at $89.82 million with a gross margin of 61.3%, reflecting a decrease from the prior year but an improvement in margin percentage. The GAAP net income was reported at $12.95 million, or $0.50 per diluted share, significantly below the analyst's EPS estimate of $0.64.

The company's adjusted operating margin was noted at 10.0%, demonstrating a strategic enhancement despite the lower demand. The balance sheet remains robust with $181.1 million in cash and investments, bolstered by strategic initiatives such as enhanced interior design services, product introductions, and strong marketing campaigns.

Strategic Initiatives and Shareholder Returns

Under the leadership of Farooq Kathwari, Chairman, President, and CEO, Ethan Allen has launched several key initiatives aimed at reinforcing its market position as a leading interior design destination. These include the strengthening of its talent pool, new product launches, and significant investments in North American manufacturing and logistics. The company's focus on integrating technology with interior design expertise has also been a critical factor in maintaining competitive advantage.

Despite the economic downturn, Ethan Allen has continued its commitment to shareholder returns, paying $137.9 million in dividends during the fiscal years 2021 through 2023, including special cash dividends. The regular quarterly cash dividend saw an 8.3% increase to $0.39 per share, payable in May 2024.

Operational Highlights and Future Outlook

The company's operational strategy includes maintaining a lean inventory aligned with market demand, which stood at $144.5 million, and managing a wholesale backlog that reflects historical norms. With no debt and a cautious but optimistic outlook, Ethan Allen is positioned to navigate current market challenges effectively.

As Ethan Allen navigates through economic uncertainties and shifts in consumer behavior post-pandemic, its strong financial foundation and proactive strategic measures are expected to play vital roles in sustaining its market position. Investors and stakeholders will likely keep a close watch on how these strategies unfold in the coming quarters.

For detailed financial figures and future projections, interested parties can access Ethan Allen's earnings call and supplementary materials on their Investor Relations website.

Explore the complete 8-K earnings release (here) from Ethan Allen Interiors Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance