Bankwell Financial Group Inc. Reports Q1 Earnings: A Comparative Analysis with Analyst Expectations

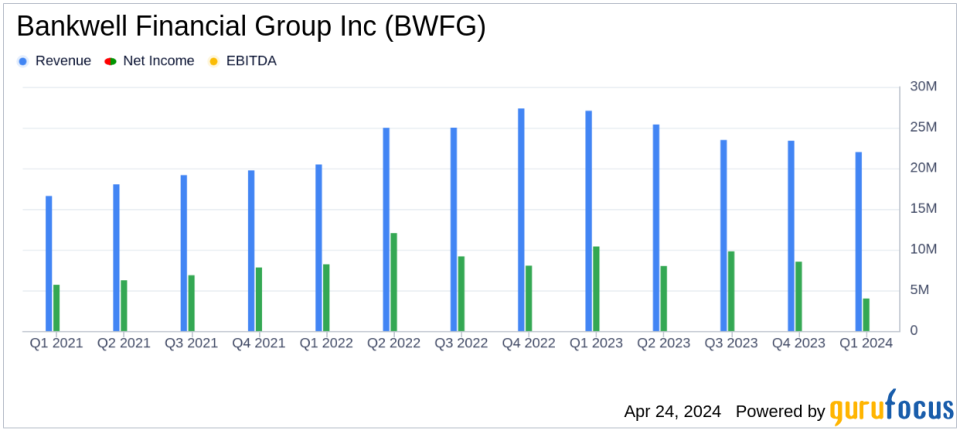

Earnings Per Share (EPS): Reported at $0.48, falling short of the estimated $0.72.

Net Income: Achieved $3.8 million, below the estimated $5.55 million.

Revenue: Totalled $22.1 million for the quarter, surpassing the estimate of $20.76 million.

Net Interest Margin: Declined to 2.71% from 3.24% year-over-year.

Loan Portfolio: Gross loans decreased by 1.4% to $2.7 billion from the previous quarter.

Deposits: Fell by 2.3% to $2.7 billion compared to the end of the previous quarter.

Dividend: A quarterly dividend of $0.20 per share was declared, payable on May 21, 2024.

On April 24, 2024, Bankwell Financial Group Inc. (NASDAQ:BWFG) disclosed its financial results for the first quarter of 2024 through its 8-K filing. The company reported a GAAP net income of $3.8 million, or $0.48 per share, a significant decrease from the $10.4 million, or $1.33 per share, recorded in the same period last year. This performance fell short of analyst expectations which had projected earnings of $0.72 per share and net income of $5.55 million.

Company Profile

Bankwell Financial Group Inc. is a bank holding company primarily engaged in offering a variety of financial products and services. The company focuses on commercial and retail lending, alongside offering depository services. Its lending products range from commercial real estate loans and business loans to residential mortgages and consumer installment loans.

Financial Highlights and Challenges

The first quarter saw Bankwell Financial Group grappling with challenges, notably a $3.7 million charge-off related to non-performing loans, which significantly impacted its net income. Pre-tax, pre-provision net revenue (PPNR) stood at $8.8 million, down from $14.4 million in the prior year's quarter. Total gross loans decreased by 1.4% to $2.7 billion, and deposits fell by 2.3% to the same amount. The company's net interest margin also contracted to 2.71% from 3.24% a year earlier, reflecting rising funding costs.

Strategic Financial Management

Despite the downturn, BWFG has maintained a strategic focus on managing expenses and optimizing its loan portfolio. The bank's efficiency ratio, a measure of noninterest expense to operating revenue, worsened slightly to 60.3% from 46.9% year-over-year, indicating higher costs relative to revenue. However, Bankwell Financial Group continues to uphold a robust capital position, with total shareholders' equity increasing marginally to $268.0 million.

Analysis of Financial Statements

The balance sheet reflects a slight contraction in total assets, which stood at $3.16 billion as of March 31, 2024, down from $3.22 billion at the end of 2023. The decline in deposits and a modest decrease in loan volumes were the primary drivers behind this change. On the income statement, the decrease in net income was primarily attributed to the higher provision for credit losses and increased interest expenses, which offset gains from higher interest income on loans.

Executive Commentary

"Our first quarter earnings were significantly influenced by charge-offs linked to specific non-performing loans," stated Christopher R. Gruseke, President and CEO of Bankwell Financial Group. "Looking ahead, we anticipate our net interest margin to stabilize, benefiting from our disciplined expense management and our efforts to optimize asset yields."

Conclusion

Bankwell Financial Group's first-quarter results were marked by several financial setbacks, primarily due to higher credit costs and increased funding expenses. However, the bank's proactive management strategies and solid capital levels provide a stable foundation as it navigates through the evolving economic landscape. Investors are encouraged to review the detailed financial statements and accompanying investor presentation to gain deeper insights into BWFG's performance and strategic direction.

For further details, please refer to the full 8-K filing by Bankwell Financial Group Inc.

Explore the complete 8-K earnings release (here) from Bankwell Financial Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance