Conmed Corp (CNMD) Q1 2024 Earnings: Surpasses Revenue Estimates, Aligns with EPS Projections

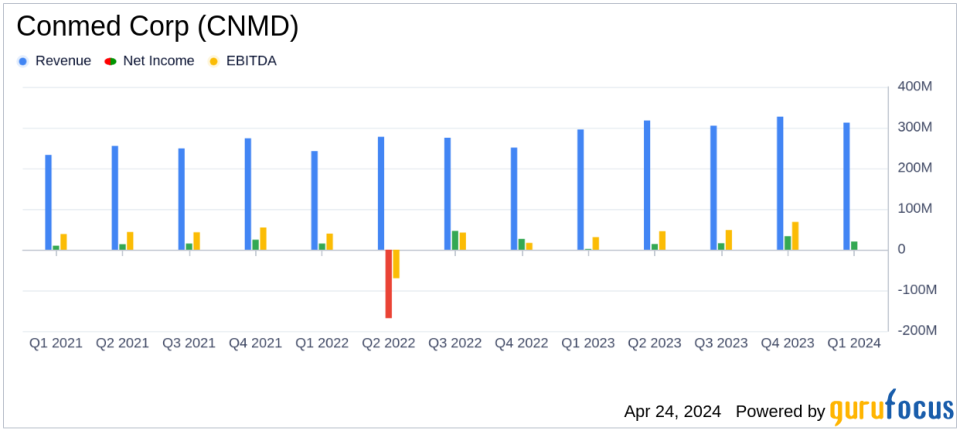

Revenue: Reported at $312.27 million for Q1 2024, up 5.7% year-over-year, surpassing estimates of $306.78 million.

Net Income: Achieved $19.71 million, significantly exceeding the estimated $23.13 million and up from $1.82 million in Q1 2023.

Earnings Per Share (EPS): Diluted EPS at $0.63, below the estimated $0.74, compared to $0.06 in the prior year.

Gross Margin: Increased to 55.1% of sales in Q1 2024 from 52.6% in Q1 2023, indicating improved profitability.

Operating Margin: Expanded to 11.2% of sales, a significant improvement from 4.3% in the same quarter last year.

Full-Year Revenue Outlook: Adjusted to a range of $1.33 billion to $1.355 billion, reflecting potential currency headwinds.

Full-Year EPS Guidance: Adjusted to $4.25 to $4.35, revised down due to forecasted foreign exchange impacts.

On April 24, 2024, Conmed Corp (NYSE:CNMD) disclosed its financial results for the first quarter ended March 31, 2024, through its 8-K filing. The Utica, New York-based medical equipment company reported a net income of $19.7 million and earnings per share (EPS) of $0.63, closely aligning with the analyst estimates of $0.74 EPS and a net income of $23.13 million. However, the company's revenue for the quarter stood at $312.27 million, surpassing the expected $306.78 million.

Conmed Corp, specializing in devices for orthopedic and general surgeries, has shown resilience in a competitive market, particularly in the U.S. which remains its largest market. This quarter's performance highlights significant growth in both domestic and international sales, with notable increases in single-use and capital products.

Company Overview and Market Strategy

Conmed Corp operates primarily through two segments: Orthopedic Surgery and General Surgery. The company has maintained a strong presence in the U.S., while also expanding its footprint in EMEA and APAC regions. This strategic geographical distribution has been pivotal in mitigating risks associated with market volatility in specific regions.

Financial Performance and Operational Highlights

The first quarter results demonstrated a robust gross profit margin of 55.1% compared to 52.6% in the same quarter the previous year. The improvement in margins can be attributed to efficient cost management and an enhanced product mix. Operating income surged to $35.01 million from $12.69 million year-over-year, marking a substantial increase in operational efficiency.

Despite facing foreign currency headwinds, which prompted a slight revision in the full-year revenue and EPS forecasts, Conmed's diverse portfolio and strategic market positioning continue to drive growth. The company now anticipates full-year revenue to be between $1.33 billion and $1.355 billion, with adjusted EPS expected to range from $4.25 to $4.35.

Challenges and Adjustments

Conmed faced several challenges during the quarter, including increased foreign currency headwinds and operational adjustments. These challenges led to revised financial expectations for the year. However, the management's proactive strategies in cost management and market expansion are commendable in offsetting these impacts.

Analysis of Financial Statements

The detailed financial statements reveal a disciplined approach to cost control and innovation-driven growth. Selling and administrative expenses were effectively managed at $123.36 million, down from $130.08 million in the prior year. Research and development expenses saw a modest increase, underscoring the company's commitment to innovation.

Conclusion

Conmed Corp's first quarter of 2024 sets a positive tone for the year, despite the revised forecasts due to external economic factors. The company's ability to exceed revenue expectations and align closely with EPS estimates reflects its operational strength and strategic market positioning. As Conmed continues to navigate through market challenges, its focus on surgical innovation and geographic expansion remains crucial for sustained growth.

For more detailed information and to follow Conmed Corp's progress throughout the year, investors and interested parties are encouraged to visit the company's website and stay tuned for upcoming financial disclosures and analyst updates.

Explore the complete 8-K earnings release (here) from Conmed Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance