Mr. Cooper Group Inc (COOP) Surpasses Quarterly Net Income Estimates

Net Income: $181 million, surpassing the estimated $135.70 million.

Earnings Per Share (EPS): Diluted EPS at $2.73, exceeding the estimated $2.09.

Revenue: Reported at $564 million, significantly above the estimated $497.06 million.

Servicing Segment Income: Pretax income reported at $313 million, with operational revenue at $577 million.

Originations Segment Performance: Funded approximately $2.9 billion in loans, with a pretax income of $32 million.

Return on Tangible Common Equity (ROTCE): Increased to 14.5%, indicating strong profitability and efficient use of equity.

Quarterly Loan Activities: Funded volume increased by 8% quarter-over-quarter, with a refinance recapture percentage of 70%.

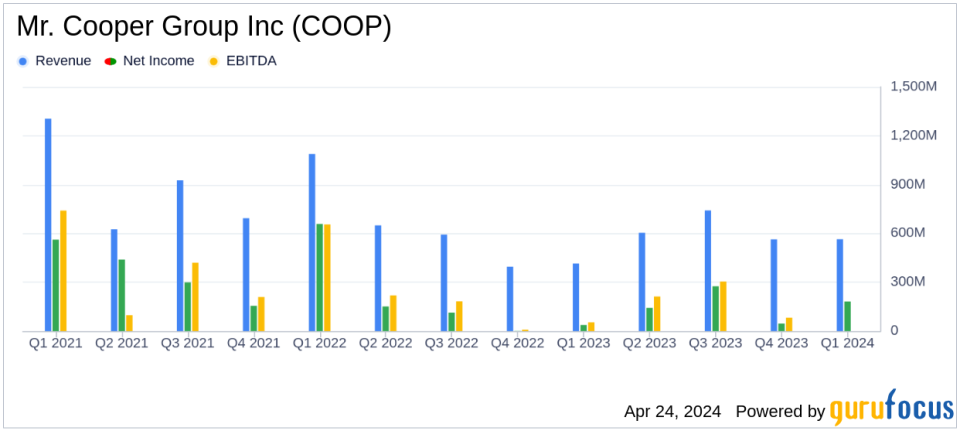

Mr. Cooper Group Inc (NASDAQ:COOP) released its 8-K filing on April 24, 2024, revealing a robust financial performance for the first quarter of the year. The company reported a net income of $181 million, significantly surpassing the analyst's estimate of $135.70 million. This performance underscores the company's effective operational strategies and resilience in a dynamic market environment.

Mr. Cooper Group Inc, a leading home loan servicer, operates through three segments: Servicing, Originations, and Corporate. The Servicing segment, which is the primary revenue generator, focuses on managing operations for mortgage investors including payment collections and customer service. The Originations segment deals with residential mortgage loan creation through direct-to-consumer and correspondent channels.

Financial Highlights and Segment Performance

The Servicing segment reported a pretax income of $313 million, with operational revenue reaching $577 million. This reflects a significant improvement from the previous quarter, highlighting the segment's strong asset performance and efficient service delivery to 5.1 million customers. The Originations segment also showed commendable performance with a pretax income of $32 million, and an 8% increase in funded volume quarter-over-quarter.

Mr. Cooper's strategic focus on technology investment, particularly in AI and cloud services, has been pivotal in enhancing customer service and operational efficiency. According to Chairman and CEO Jay Bray, this technological edge is instrumental in sustaining investor returns and industry reputation.

Analysis of Financial Statements

The consolidated statements of operations indicate a total revenue of $564 million for the quarter ended March 31, 2024, against expenses of $317 million. The balance sheet remains solid with total assets of $14,775 million, supported by a strong cash position and valuable mortgage servicing rights valued at $9,796 million.

The company's earnings per share (EPS) stood at $2.73, diluted, which aligns closely with the estimated EPS of $2.09. This performance is reflective of Mr. Cooper's robust operational framework and its ability to adapt to market dynamics effectively.

Future Outlook and Strategic Moves

Looking ahead, Mr. Cooper Group Inc is well-positioned to leverage its balanced business model to navigate the evolving market landscape. The company's emphasis on enhancing its servicing capabilities and exploring new opportunities in mortgage servicing rights acquisitions are expected to drive future growth and profitability.

As the financial landscape continues to evolve, Mr. Cooper's commitment to innovation and customer service excellence sets a strong foundation for sustained growth and shareholder value enhancement.

For more detailed financial information and future updates, investors and stakeholders are encouraged to refer to the full earnings report and upcoming webcasts on the Mr. Cooper Group Inc website.

Explore the complete 8-K earnings release (here) from Mr. Cooper Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance