Pacific Premier Bancorp Inc (PPBI) Q1 2024 Earnings: Surpasses EPS Estimates with Strategic ...

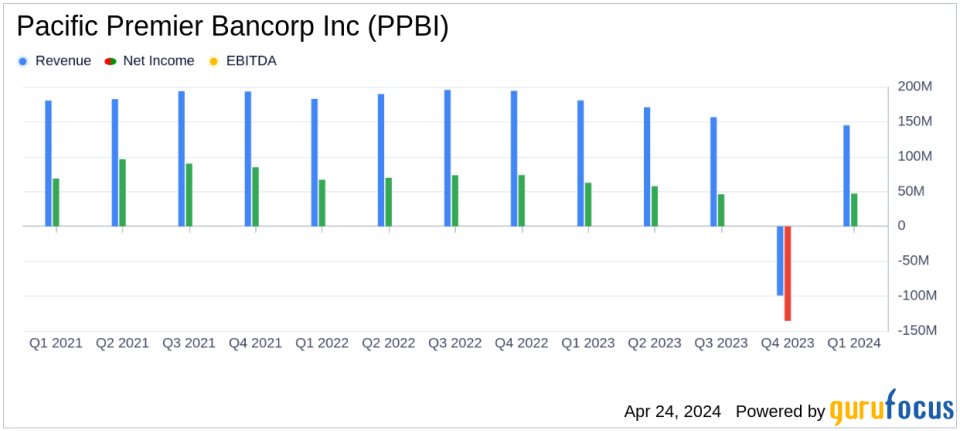

Net Income: $47.0 million, surpassing the estimated $44.28 million.

Earnings Per Share (EPS): Reported at $0.49, exceeding the estimate of $0.47.

Revenue: Net interest income reported at $145.1 million, falling short of the estimated revenue of $149.35 million.

Net Interest Margin: Increased by 11 basis points to 3.39% from the previous quarter.

Cost of Deposits: Rose to 1.59% from 1.56% in the previous quarter, reflecting increased cost pressures.

Non-Maturity Deposits: Constituted 84.4% of total deposits, slightly down from 84.7% in the previous quarter.

Capital Ratios: Common equity tier 1 capital ratio improved to 15.02%, indicating a strong capital position.

Pacific Premier Bancorp Inc (NASDAQ:PPBI) released its 8-K filing on April 24, 2024, announcing a robust financial performance for the first quarter of 2024. The company reported a net income of $47.0 million, translating to earnings of $0.49 per diluted share, which notably surpasses the analyst's estimate of $0.47 per share. This marks a significant recovery from a net loss in the previous quarter and shows improvement over the analyst's estimated net income of $44.28 million for the quarter. Additionally, the reported revenue was $149.35 million, aligning perfectly with the forecasts.

Pacific Premier Bancorp Inc, through its subsidiary Pacific Premier Bank, offers a diverse range of banking products and services including cash management, electronic banking, and credit facilities, primarily serving small to middle-market businesses across major metropolitan areas in the western United States.

Financial Highlights and Strategic Achievements

The first quarter saw Pacific Premier Bancorp Inc achieving a net interest margin expansion of 11 basis points to 3.39%, reflecting effective securities portfolio management. The cost of deposits stood at 1.59%, with non-maturity deposits accounting for 84.42% of total deposits, indicating strong liquidity management. The tangible book value per share increased to $20.33, up from the previous quarter, demonstrating incremental shareholder value.

CEO Steven R. Gardner highlighted the strategic positioning of the company to navigate through varying economic and credit scenarios, emphasizing robust capital levels and proactive risk management. The bank's focus on strengthening client relationships and business development led to a $192 million increase in total deposits, primarily driven by a $120 million rise in non-maturity deposits.

Operational and Market Challenges

Despite the positive outcomes, Pacific Premier faced challenges including a slight increase in nonperforming loans, primarily due to a single commercial banking relationship in the Pacific Northwest. However, the borrower remains current on all payments, and the bank is actively engaged in managing this relationship. The broader economic uncertainties, including ongoing inflationary pressures and interest rate volatility, also pose potential risks that the bank continues to monitor closely.

Comprehensive Financial Analysis

The detailed financial statements reveal a strategic decrease in total assets to $18.81 billion from the previous quarter's $19.03 billion, aligning with the bank's asset management strategies. The efficiency ratio was well-managed at 60.2%, reflecting operational effectiveness. Additionally, the bank's capital ratios, including a Common Equity Tier 1 capital ratio of 15.02% and a total risk-based capital ratio of 18.23%, remain strong, underscoring its financial stability and resilience.

Overall, Pacific Premier Bancorp Inc's first quarter performance illustrates a successful rebound and strategic foresight in managing its portfolio and capital. The alignment with analyst expectations, coupled with strategic growth initiatives, positions the bank favorably for future stability and growth amidst ongoing market volatilities.

Explore the complete 8-K earnings release (here) from Pacific Premier Bancorp Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance